Oh, what a tangled web we weave when first we practice leverage! BNB, after its November fling with bullish bravado, now finds itself tiptoeing around support levels like a drunk ballerina. Derivatives markets, ever the fickle lover, have shifted to caution, while traders squint at their charts, searching for a sign that this isn’t just another “I told you so” from the bears. 🐻❄️

Open Interest Declines as BNB Pullback Triggers Leverage Reduction

Open Interest (OI), once a sprightly $832 million, now totters at $831 million-a 48-hour decline so dramatic it could make a Shakespearean tragedy blush. Traders, ever the pragmatists, are shedding positions like last season’s fashion. Longs and shorts alike are retreating to the sidelines, clutching their portfolios and whispering, “This is definitely not a phase.” 🤚

On the price chart, BNB pirouettes between $930 and $890-$900, a chaotic tango of whipsaw action. Liquidity? Thinner than a wafer. Volatility? Higher than a toddler on sugar. And yet, derivatives markets remain as uncommitted as a dating app user’s profile. Commitment? What commitment? 🤷♂️

Historically, OI contractions have been the prelude to a fireworks show-either up or down. But for now, BNB is stuck in a consolidation ballroom, dancing with indecision. Reduced OI and neutral positioning scream, “Wait for the music to change!” 🎭

Figures Show BNB Pressured at $899 as Market Sentiment Turns Defensive

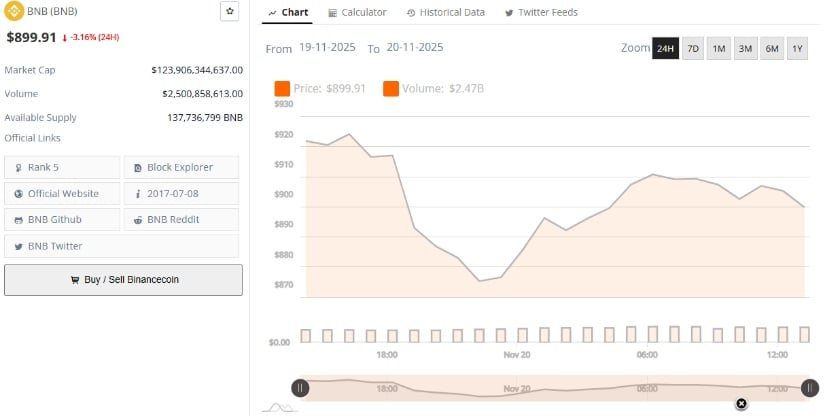

According to BraveNewCoin, BNB now trades at $899.91, a 3.16% drop that makes even the most stoic trader reach for the antacids. Market cap: $123.90 billion. Daily volume: $2.50 billion. It’s a “I’m fine, really!” performance. 🤯

The decline? A post-November high divorce settlement. Profit-taking has left BNB teetering near $900, a psychological fortress now besieged by bears. Will it hold? Only time will tell, but the air is thick with “this is the bottom” whispers. 🕊️

Liquidity remains robust, but sentiment? Defensive as a hedgehog in a salad. Traders, ever the realists, are rotating into safer assets while the altcoin sector softens like overcooked pasta. 🍝

TradingView Indicators Highlight Volatility Spike and Weakening Momentum

TradingView’s daily chart paints a portrait of BNB’s recent drama: a parabolic surge, followed by a sharp reversal that would make a heart monitor weep. The Bollinger Bands now frame BNB like a tragic hero-trapped between the upper highs and lower lows. 🎭

Currently, BNB clings to the lower Bollinger Band, a masochist in oversold territory. Resistance at 1,066.96 USDT looms like a bad ex, while support near 857.10 USDT offers a faint hope. The bears, however, are currently conducting an impromptu conga line of dominance. 🐻

MACD, that fickle indicator, now sports a bearish crossover. Histograms hint at stabilization, but the broader trend? A bear market in bear clothing. Until the MACD decides to moonwalk back above zero, sellers reign supreme. 🚶♀️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- USD GEL PREDICTION

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Silver Rate Forecast

- USD THB PREDICTION

- When Will the Long Traders Finally Give Up? 🤔

2025-11-20 20:00