Behold, the Securities and Exchange Commission’s filings unveil a most peculiar truth: Blackrock’s Ishares Bitcoin Trust (IBIT), that most enigmatic of digital relics, has ascended to the throne of Harvard Management Company’s 13F portfolio, a realm where caution reigns supreme and impulsivity is a sin. 🧠💸

Blackrock’s Spot Bitcoin ETF Tops Harvard Endowment’s Public Portfolio 🧩

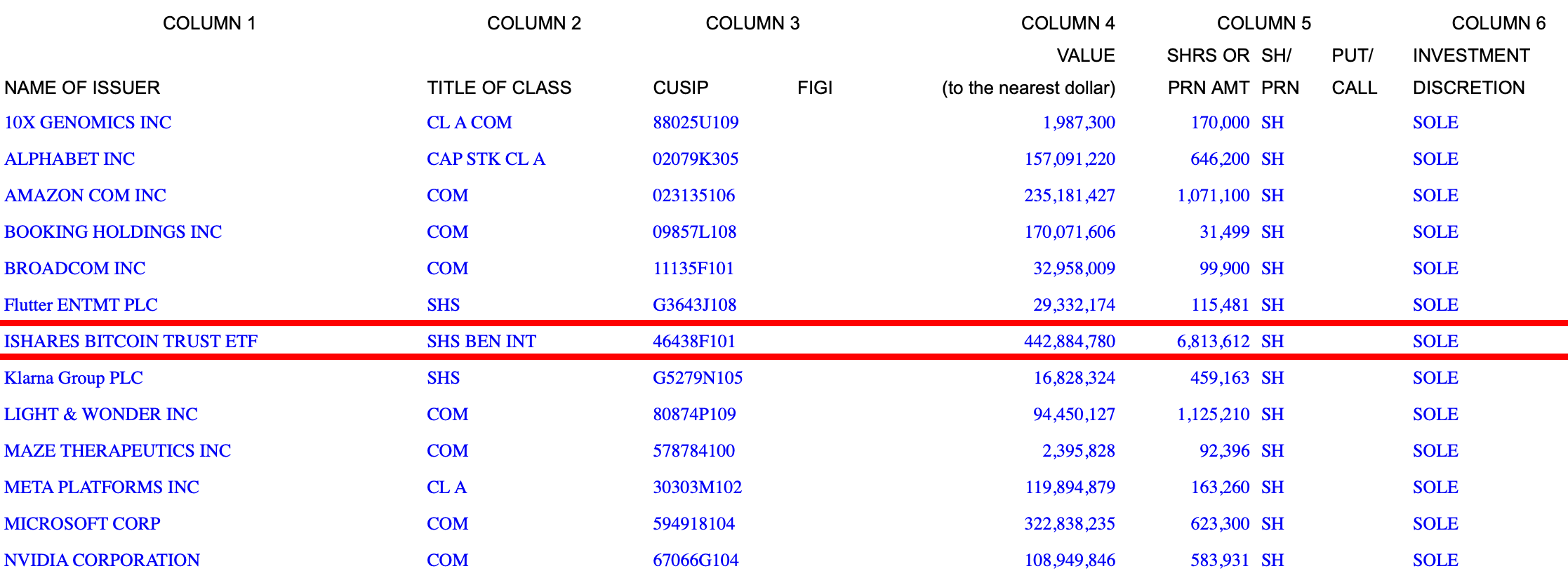

Harvard Management Company, the guardian of a gilded cage housing $56.9 billion, disclosed that IBIT now commands 21.04% of its U.S. public equities portfolio, a sum of 6,813,612 shares valued at $442.9 million. A sum so vast, it would make even the most stoic investor ponder the abyss. 🧨

Bloomberg’s Eric Balchunas, that modern-day prophet of finance, declared: “To see Harvard, a bastion of prudence, embrace an ETF like IBIT is akin to witnessing a monk kneel before a statue of Baal. 🙏⚡” Yet, he quipped, “Half a billion is but a whisper in the endowment’s vast halls-yet it ranks 16th among IBIT holders. A whisper with a megaphone, perhaps?”

This portfolio, a microcosm of 18 holdings, reflects $2.105 billion in securities. Within this conservative realm, IBIT now towers over Microsoft, Amazon, and SPDR Gold Shares-a feat once deemed impossible. Microsoft, in second place, trails with $322.8 million, while Amazon and GLD linger near $235 million. A world turned upside down, where gold bows to code. ⚖️

Harvard’s leap into IBIT was no timid step. The university’s holdings surged 257% QoQ, a $326 million leap that would make even the most audacious speculator blush. To an endowment that views flashy trades as a moral failing, this shift is a thunderclap. ⚡

This bold move, a harbinger of change, elevates IBIT above tech titans and gold, signaling that digital assets have shed their fringe status. For Harvard, a school famed for its cautiousness, this is a declaration: “The future is not what it used to be.” 🚀

The timing, too, is a riddle. HMC’s bet was placed during Q3 2025, when Bitcoin flirted with $119,000. Now, at $95,000, the stake’s value wanes-a reminder that 13F filings capture only a fleeting moment. A snapshot, not a prophecy. 📸

While other universities dabble in Bitcoin ETFs, none have matched Harvard’s audacity. IBIT’s dominance in the filing screams: “This is no mere experiment.” A strategic, deliberate, and seismic shift. 🌍

Harvard’s newfound top holding is a manifesto: the once-taboo notion of Bitcoin in institutional portfolios is no longer a heresy, but a doctrine. 📜

FAQ ❓

- Why did IBIT become Harvard’s largest holding?

In a fit of madness, HMC expanded its IBIT position by 257% in Q3, making it the top-weighted asset in its public portfolio. A decision so audacious it would make even the most jaded investor question their life choices. 🤯 - How much IBIT does Harvard hold?

6.8 million shares, valued at $442.9 million. A sum so vast, it would make a medieval king weep. 💸 - Does this reflect Harvard’s full endowment allocation?

No, the 13F only covers publicly traded securities. The endowment’s true depths remain a mystery, guarded by the veil of secrecy. 🧙♂️ - What does this mean for institutional Bitcoin adoption?

The move signals that even the most conservative institutions are now dancing with the devil-er, digital assets. A slow, deliberate slide into the abyss. 🌀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-11-16 20:28