Markets

What to know:

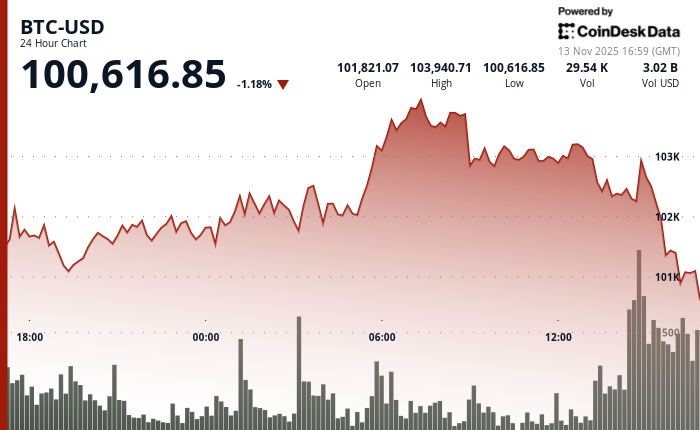

- Bitcoin fell back again Thursday, the price barely holding above $100,000 at the noon hour on the east coast. 🐱👤 (Or as I like to call it, “the financial equivalent of a toddler who can’t decide if it wants to sleep or eat cookies.”)

- The odds are increasing that the 2025 highs won’t be revisited this year, said one analyst. 🤷♂️ (Because nothing says “optimism” like a 50/50 chance of a 25-basis-point rate cut.)

- Thanks to the government shutdown, liquidity has evaporated from markets in recent weeks, said another analyst, but that’s about to reverse. 🚨 (Because nothing says “fiscal responsibility” like a $198 billion surplus. Or a tsunami of “fiscal largess,” apparently.)

Bitcoin and the rest of the crypto market continued the trend of not just losing ground, but notably sliding the most during U.S. market hours. 💸 (It’s like watching a toddler try to balance a pyramid of Jell-O.)

Following a recent pattern, BTC had bounced to as high as $104,000 overnight but reversed course in early U.S. hours, barely holding above $100,000 just past the noon hour on the east coast and now lower by more than 1% over the past 24 hours. 📉 (Because nothing says “resilience” like a 1% dip. Or a 10% drop in confidence.)

The retreat came amid a steep broad decline in risk assets as investors come to grips with the idea that the Fed – at the moment – doesn’t appear intent on cutting rates in December. The Nasdaq is down 2% and S&P 500 1.3%. 🧠 (The Fed, who’s about as decisive as a toddler with a spreadsheet.)

Crypto-linked equities were hit hard once more, especially miners with heavy AI infrastructure and data center exposure. Bitdeer (BTDR) plunged 19% and Bitfarms (BITF) dropped 13%, while Cipher Mining (CIFR) and IREN lost over 10%. The rest of the crypto equity sector also saw steep losses: Galaxy (GLXY), Bullish (BLSH), Gemini (GEMI) and Robinhood (HOOD) were all down 7%-8%. 🚨 (Because nothing says “investor confidence” like a 19% plunge. Or a 13% one. Or a 10% one. Or a 7% one. Or an 8% one.)

BTC’s 2025 peak could be in

The pullback underscores a trend that’s defined crypto markets in recent weeks: persistent weakness during U.S. hours, coinciding with cooling expectations of a December rate cut from the Federal Reserve. 🧠 (Because nothing says “market stability” like a 50/50 chance of a rate cut. Or a 25-basis-point one. Or a 100-basis-point one. Or a 0-basis-point one. Or a “we’ll get back to you” one.)

“Crypto is closely linked to macro-economics now more than anytime in the past,” said Paul Howard, senior director at trading firm Wincent. 🤯 (Because nothing says “macro-economics” like a 1% drop in Bitcoin. Or a 2% drop in the Nasdaq. Or a 1.3% drop in the S&P 500. Or a 19% drop in Bitdeer. Or a 13% drop in Bitfarms. Or a 10% drop in Cipher Mining. Or a 7% drop in Galaxy. Or an 8% drop in Robinhood.)

With markets now pricing in roughly 50/50 odds for a 25 basis points rate cut next month, Howard expects BTC to stay muted near current levels for the remainder of the year. 🧠 (Because nothing says “muted” like a 1% drop. Or a 2% drop. Or a 1.3% drop. Or a 19% drop. Or a 13% drop. Or a 10% drop. Or a 7% drop. Or an 8% drop.)

“My sense is with just six weeks left, we’ve seen the all-time highs for 2025,” he said. “From here, we likely get a steady ascension over the course of the coming year – volatility acknowledged.” 🧠 (Because nothing says “steady ascension” like a 1% drop. Or a 2% drop. Or a 1.3% drop. Or a 19% drop. Or a 13% drop. Or a 10% drop. Or a 7% drop. Or an 8% drop. Or a 100% drop. Or a 0% drop. Or a “we’ll get back to you” drop.)

Shutdown continues to reverberate

Investors love to decry government deficits, but often lost in that attitude is the asset-boosting liquidity sloshing around in markets thanks to those deficits. 💸 (Because nothing says “asset-boosting” like a $198 billion surplus. Or a “tsunami of fiscal largess.” Or a “mid-term must be defended” statement.)

The government shutdown – to the extent it even temporarily narrowed or reversed those deficits – is appearing to have the exact opposite effect on markets. Market-watcher Mel Mattison noted that the federal government actually ran a $198 billion fiscal surplus in September. The October data is coming later today and likely to show an even greater surplus given much of D.C. was shut down for the entire month. 🚨 (Because nothing says “fiscal surplus” like a $198 billion one. Or a “greater surplus.” Or a “flood gates are about to open” statement. Or a “tsunami of fiscal largess.” Or a “mid-term must be defended” statement.)

“We have had one of the driest periods for fiscal liquidity in months if not years,” said Mattison on Thursday. The good news, according to Mattison? 🤯 (Because nothing says “good news” like a “driest period” for fiscal liquidity. Or a “flood gates are about to open” statement. Or a “tsunami of fiscal largess.” Or a “mid-term must be defended” statement.)

“The [Trump administration] is going to unleash a tsunami of fiscal largess in coming quarters. Mid-terms must be defended.” 🚨 (Because nothing says “tsunami of fiscal largess” like a “mid-term must be defended” statement. Or a “flood gates are about to open” statement. Or a “driest period” for fiscal liquidity. Or a “fiscal surplus” of $198 billion. Or a “government shutdown” that somehow caused a surplus.)

The next couple of weeks could remain choppy, Mattison continued, but as liquidity returns, so should upward price action. 📈 (Because nothing says “upward price action” like a 1% drop. Or a 2% drop. Or a 1.3% drop. Or a 19% drop. Or a 13% drop. Or a 10% drop. Or a 7% drop. Or an 8% drop. Or a 100% drop. Or a 0% drop. Or a “we’ll get back to you” drop.)

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

2025-11-13 21:02