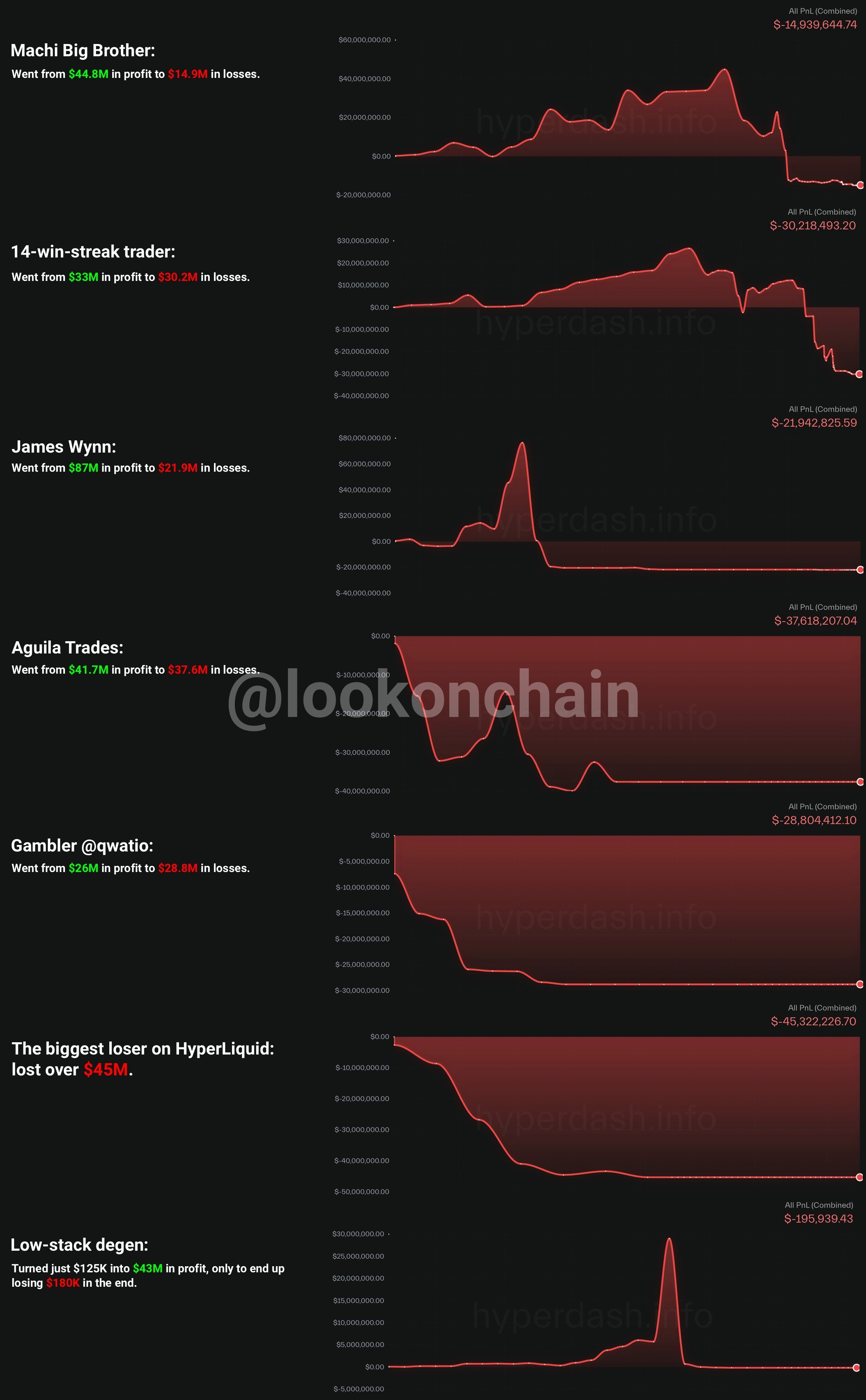

Ah, the seductive allure of high-leverage trading-a tempting shortcut to wealth without the need for pesky skills or years of experience. After all, who wouldn’t want to multiply their gains (and losses) by 50 or 100 times, right? It’s practically the fast lane to financial success, if you ignore the tiny little detail that things can go spectacularly wrong in the blink of an eye. The charts from LookOnChain, however, tell a different tale, one where seven traders who once seemed unstoppable were brought to their knees by the same villain: leverage.

Leverage: The Double-Edged Sword of Trading

Leverage is like that overly ambitious friend who convinces you to try something you’re not ready for. It exaggerates everything: your victories, your failures, your emotional rollercoaster, and your misplaced sense of control. When you use 50x or 100x leverage, you’re essentially betting that you can always be right, forever, in a market that’s about as predictable as a game of Russian roulette. One tiny price fluctuation, and boom-your entire position is liquidated. In the world of cryptocurrency, that’s as common as a Monday morning hangover. It’s the ultimate gamble: risk management, portfolio strategies, and even basic analysis suddenly feel like a game of chance.

The logic behind it is almost disturbingly similar to gambling. It starts innocently enough: you win a few rounds, feel like you’ve cracked the code, and then-bam!-you’re raising your stakes. Your wins are mistaken for skill, when in reality, it’s just the casino’s “bait” doing its job. With every win, your confidence grows, and so does your risk. Eventually, you’re gambling with borrowed money, all while pretending it’s still a game of strategy. This is where things get ugly. And let’s be clear: it’s not the wins that cause the damage-it’s the losses that come when the market decides to give you a lesson in humility.

Even without leverage, trading already shares many psychological flaws with gambling. It’s all about opportunity masquerading as chance, emotional highs overtaking logic, and a sense of invincibility taking root. When leverage enters the scene, however, it’s like throwing gasoline on a fire, turning your human weaknesses into an explosive cocktail of bad decisions.

How Did They Get Burned?

The traders featured in these charts weren’t novices; they weren’t fresh-faced rookies with no clue about market mechanics. These were seasoned players, some with millions in their accounts, and a history of success that would make any investor envious. But here’s the kicker: leverage doesn’t care about your experience. It doesn’t care if you’ve had a string of successful trades or if you’re the Michael Jordan of crypto. If you continue to play with borrowed funds, a single catastrophic event-let’s call it a “black swan”-will wipe everything out. It’s not a question of ‘if’, but ‘when’ it happens. The odds are mathematically stacked against you, no matter how much you fancy yourself a trading genius.

Now, let’s not kid ourselves: HyperLiquid and Binance aren’t the house. They aren’t winning or losing-they’re just there, providing the platform. The real villain here? Volatility. It’s the chaotic force that can turn your carefully calculated profits into dust, if you’re not paying attention. And unfortunately, it’s the only thing that’s truly guaranteed to make you pay the price.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-11-06 15:17