The crypto world just took a gut punch. Bitcoin, the darling of digital gold, slipped below $100,000, dragging almost $2 billion in market value down the drain within a few hours. Panic? You bet. But don’t worry, it’s not the end of the world – it’s just Bitcoin doing its regular ‘heart attack’ routine.

Now, if you’re thinking, “Well, that’s it, the sky is falling,” don’t panic just yet. Financial wizard Shanaka Anslem Perera says this crash might be the prelude to something far more dramatic. Buckle up – he calls it the “$6 trillion endgame.” Yeah, I know, sounds like something straight out of a sci-fi thriller, but stay with me.

A Reset, Not a Collapse

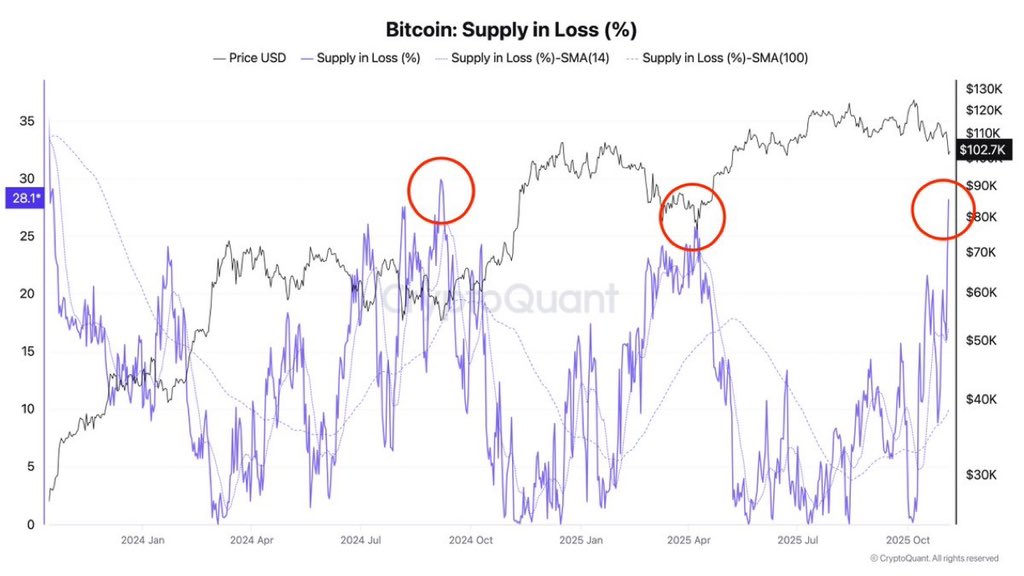

Here’s where things get spicy. According to blockchain data, almost 29% of Bitcoin’s supply is now in the red. Translation: A lot of folks who bought Bitcoin at the moon-high prices are watching their wallets turn green with envy. But hold on to your hats, because this is actually the same thing we’ve seen before – and by “before,” I mean before every single major Bitcoin rally. Think 2017, 2021, and 2024.

Perera’s chart-loving brain tells him this is a “mid-cycle reset.” That means the scared little traders are hitting the sell button, while the seasoned pros are quietly scooping up all the discounted Bitcoin. It’s not a collapse, folks; it’s a cleanup operation before the next big leg up. So, let’s keep the doomsday prepper vibe in check, shall we?

Oh, and before you get too comfy thinking everyone’s making a fortune, let’s talk about wallets. Yes, 97% of wallets look like they’re sitting pretty, but most of those belong to the OGs who bought Bitcoin when it was dirt cheap. That makes the numbers look like everyone’s in profit, when, in reality, a lot of new folks are in the red – and that’s a setup for a massive price spike. See where this is going?

It’s like a game of musical chairs, where only the early birds get to sit down. For the rest of us? Well, just hold tight – it’s about to get interesting.

The “$6 Trillion Endgame”

Now, this is where it gets a bit “end-of-the-world-but-make-it-cool.” Perera predicts that the global financial system, sitting on a bloated $100 trillion in fiat money (that’s cash, bonds, and more), is slowly but surely heading toward Bitcoin – a scarce, hard asset. He calls this inevitable shift the “$6 trillion endgame,” because eventually, he believes, trillions of dollars will pour into Bitcoin and crypto, creating a market cap for Bitcoin that could be huge – we’re talking trillions, baby.

Market Flush: The Panic Seller

Now, let’s talk market flush. Over $19 billion in leveraged positions just got wiped out. Yeah, you read that right. Over $19 billion. The over-leveraged traders are now gone, their panic-induced sell-offs nothing but a bad memory. The market has cooled off, funding rates are nearly zero, and the derivatives market? Pretty much sterilized. No more chain-reaction liquidations. We’re ready for a stable market foundation. A solid one. Like a rock.

Whales and Institutions Are Quietly Buying

As the retail traders scramble for the lifeboats, the big dogs – the whales and institutions – are doing what they do best: quietly stacking up Bitcoin. Long-term holders now control about 70% of Bitcoin’s circulating supply. They’re not selling. Oh no. Meanwhile, ETFs have been quietly gobbling up Bitcoin, with over $149 billion in inflows. That’s a lot of cheddar. Even stablecoins – that’s the ‘dry powder’ of crypto – have swollen by $50 billion since July. There’s money waiting on the sidelines, ready to jump back in.

So, as this all unfolds, Perera sees the next 180 days as the perfect window for Bitcoin’s next bull run. Get ready, folks. The big wave is coming, and it’s going to be one wild ride. Grab your popcorn. 🍿

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-11-06 11:18