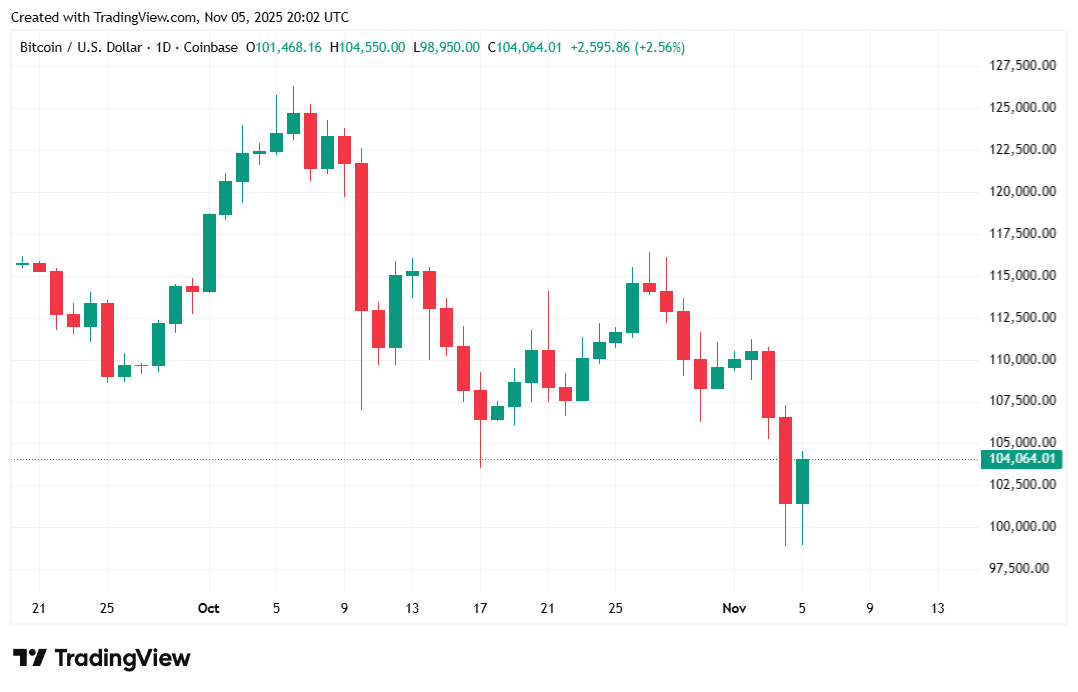

The digital currency nosedived below $100K on Tuesday before clawing its way back to $104K on Wednesday afternoon. 🐦📉

Galaxy Research Revises Bullish Target Down to $120K

Tuesday belonged to the bears. Bitcoin ( BTC) plunged below $100K triggering nearly $500 million in BTC liquidations. It was the first time the cryptocurrency had entered sub-$100K territory since June 2025. Prior to that, analysts had thrown out price predictions ranging anywhere from $150K to $500K. But after Tuesday’s precipitous retreat, crypto research firm Galaxy, which had previously proposed a $185K year-end price, slashed that target to $120K. 🧠💥

“ Bitcoin is trading below $100K for the first time since late June, with other cryptos faring worse,” said Alex Thorn, head of firmwide research at Galaxy, in a Wednesday note to clients. “As a result of this market performance and other factors, we are revising our bullish bitcoin target from $185,000 to $120,000.” 📉💼

There is no one agreed-upon catalyst responsible for bitcoin’s slide. The digital asset recently printed a fresh all-time high of $126K on October 6, almost a month ago to the day. But increasing trade tensions between the U.S. and China, whales taking profits, concerns of an AI bubble on Wall Street, and perhaps more recently, the election of a “Democratic socialist” mayor in the financial capital of the world, all created a perfect storm that kneecapped bitcoin before it could set another price record in 2025. 🌍🌀

“While bitcoin’s structural investment case remains strong, cyclical dynamics have evolved,” Thorn said. “Defined by heavy whale distribution, rotation into competing narratives including AI, gold, and stablecoins, and poor performance of BTC treasury companies.” 🧩💰

Thorn mentions other key factors impacting bitcoin’s performance this year, most notably, the October 10 crash that sparked record liquidations. But the take home message seems to be that BTC has hit a rough patch, but it’s still a bullish long-term bet, as evidenced by the photo below posted by Thorne earlier today. 🧠📈

Overview of Market Metrics

Bitcoin gained 3.67% on Wednesday and was priced at $104,079.23 at the time of writing, according to data from Coinmarketcap. The cryptocurrency has been trading between $98,962.06 and $104,473.83 over the past 24 hours, with weekly data revealing a 6% retreat over seven days. 📈📉

Twenty-four-hour trading volume remained mostly flat at roughly $94 billion and market capitalization inched up to $2.07 trillion. Bitcoin dominance eased slightly since yesterday, dipping 0.43% to 60.53% at the time of reporting. 🌐💰

Total value of bitcoin futures open interest jumped 4.86% to $70.43 billion, Coinglass data shows. Liquidations remained elevated at $237.84 billion with long investors still bearing the bulk of losses at $173.56 million. Short sellers, perhaps increasingly emboldened by Tuesday’s bloodbath, saw a smaller but still noteworthy $64.29 million in liquidated margin. 🧠💸

FAQ ⚡

- Why did Galaxy Research cut its bitcoin forecast?

The firm slashed its year-end target from $185K to $120K after bitcoin’s sharp drop below $100K and weakening market momentum. 🧨📉 - What caused bitcoin’s recent plunge?

Analysts cite whale profit-taking, U.S.-China trade tensions, and Wall Street’s AI bubble fears as key triggers. 🌐🧠 - Is the long-term outlook still positive?

Galaxy says bitcoin’s structural case remains strong despite short-term volatility and heavy whale distribution. 🧠📈 - Where is bitcoin trading now?

BTC rebounded 3.7% to around $104K Wednesday, with a $2.07 trillion market cap and $94 billion in daily volume. 📊💰

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-11-06 01:08