By 11 a.m. Eastern time on Wednesday, the digital gold–Bitcoin-was clinging to life above $103,000 after a brief existential crisis that saw it dip below the sacred $100K threshold just the day before. But of course, the true gladiators aren’t in the spot market. Oh no, they’re fighting it out in the derivatives pits.

From Futures to Options: The Wild Ride Continues in Bitcoin’s Derivatives Arena

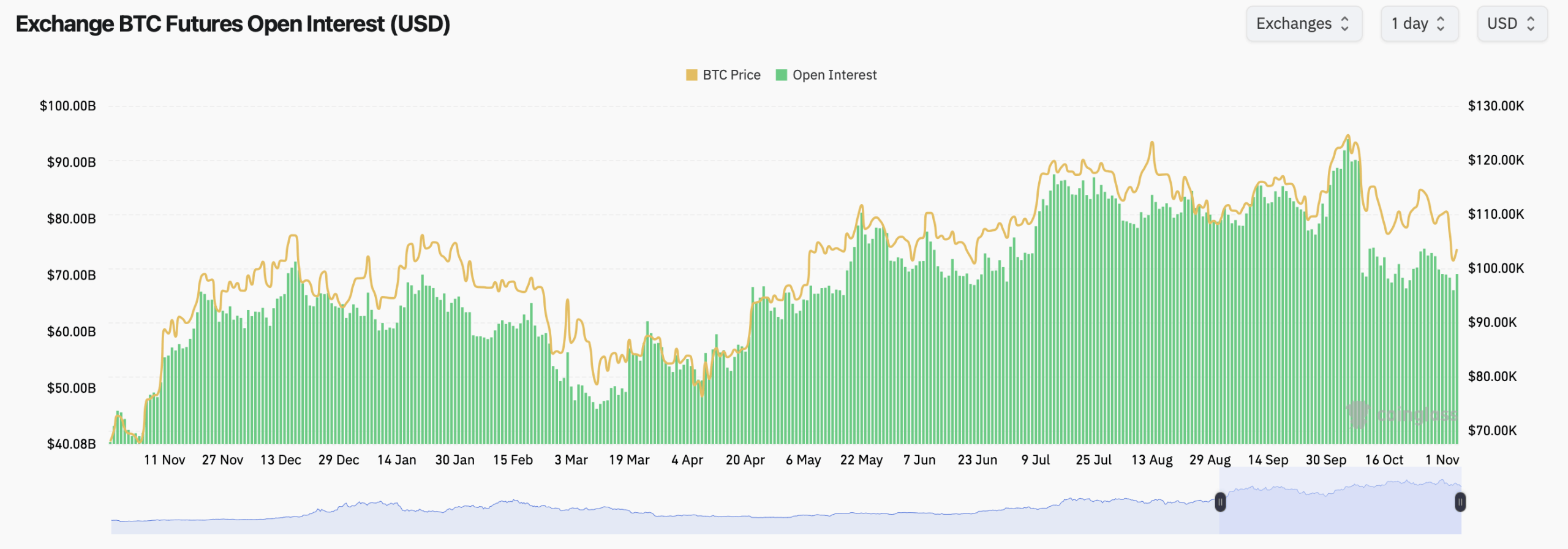

According to the latest whispers from Coinglass, the open interest (OI) in Bitcoin futures stands at a staggering 677,750 BTC-worth a comfortable $70.24 billion. That’s up by 3.47% in just 24 hours. The CME is still flexing with a $14.35 billion lead, though Binance isn’t far behind, with $12.45 billion in OI.

Here’s a fun breakdown: CME controls 20.42% of the futures market while Binance takes 17.72%. But wait-OKX has just made a surprise move, posting a 4.12% jump in OI over the past 24 hours. Meanwhile, Bybit, Gate, and Kucoin are… well, let’s just say they’re taking a nap. Bybit’s OI fell by 2.03%, Gate dropped by 0.42%, and Kucoin, bless its heart, lost 2.97%. Not a great day for them. 😬

MEXC, however, decided to show up to the party, with an explosive 17.45% rise in OI. BingX wasn’t shy either, adding 9.32%. Apparently, smaller exchanges are catching the scent of short-term leverage plays after Bitcoin’s 7% drop in the spot market last week. Nothing like a good old rebound, eh?

Now, let’s talk options. The king of the options game is still Deribit, holding the majority of Bitcoin’s options OI. The total OI in Bitcoin options is chilling at $50 billion, with 61% of that in calls and 39% in puts. Over the past 24 hours, calls made up 60.73% of the volume-because, who wouldn’t want to bet on a rally, even in the midst of chaos?

The big players are eyeing December’s expiration. The hottest trades? Calls targeting $140,000 per coin, with a side order of puts at $85,000, and the occasional moonshot call at $200,000. Translation: traders are betting on both a safe bet and an absolute rocket launch. Why not hedge your bets, right? 🎢

The max pain level on Deribit? It’s chilling at $105,000. Binance, however, is a little more optimistic, with a max pain level around $110,000. These levels are where options writers (those poor souls) hope Bitcoin hovers to maximize the misery of speculators. Oh, the drama of it all! 😏

To sum it up: Bitcoin’s derivatives market is a lively battlefield. CME and Binance lead the futures pack, Deribit controls the options show, and max pain levels suggest volatility will tighten as we inch closer to mid-November. Traders are clearly gearing up for Bitcoin’s next major swing. So, will it surge to $140K, or will it plunge to $85K? Stay tuned. 🍿

FAQ ❓

- What is Bitcoin’s current futures open interest?

Bitcoin futures OI totals $70.24 billion across exchanges, with CME and Binance leading the pack. - What is the call-to-put ratio for BTC options?

Calls make up 61% of options OI, giving a slightly bullish tilt to the market. - What are the key BTC options strikes on Deribit?

The most active strikes are $140,000, $120,000, and $85,000. And yes, there are some crazy folks targeting $200,000. - What’s Bitcoin’s current max pain level?

Around $105,000 on Deribit and roughly $110,000 on Binance. Prepare for some pain.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-11-05 20:34