It is a truth universally acknowledged, that a gentleman in possession of a good fortune, must be in want of… well, a stable cryptocurrency market, it seems! For today, the digital exchanges have presented a most unsettling spectacle – a general decline, a veritable rout, if you will. The total value of these speculative ventures has diminished by 3.2%, settling at a rather less impressive $3.6 trillion. And, alas, some £400 million (or its equivalent, for those of us still clinging to established currency) has been… liquidated in the space of a single day. Bitcoin, ever the bellwether, led the descent, dipping below the significant sum of $107,500, and causing no small distress to over 162,000 hopeful investors. Ethereum, too, suffered a considerable setback.

One cannot help but wonder at the cause of this sudden misfortune. As is often the case with these modern financial contrivances, the reasons are numerous and, frankly, rather convoluted. 🤔

The Roots of This Most Unfortunate Situation

The Actions of Those with Significant Holdings and the Whims of Technical Analysis

Certain gentlemen – or rather, whales, as they are now known – possessing considerable holdings, did not hesitate to act. One such individual transferred a rather astounding 13,000 Bitcoin, valued at $1.48 billion, onto the exchanges. Simultaneously, the ‘futures open interest’ on Ethereum diminished, signalling a lack of confidence. It became a most unfortunate cascade, a downward spiral where falling prices triggered pre-arranged sell orders, leading to yet further decline. A truly disheartening chain of events!

The market’s valuation breached a critical level of support, and the ‘RSI’, a measure of market momentum, remained, alas, dangerously close to a state of ‘oversold’. One fears there remained quite ample room for further losses.

The Plight of the Lesser Coins

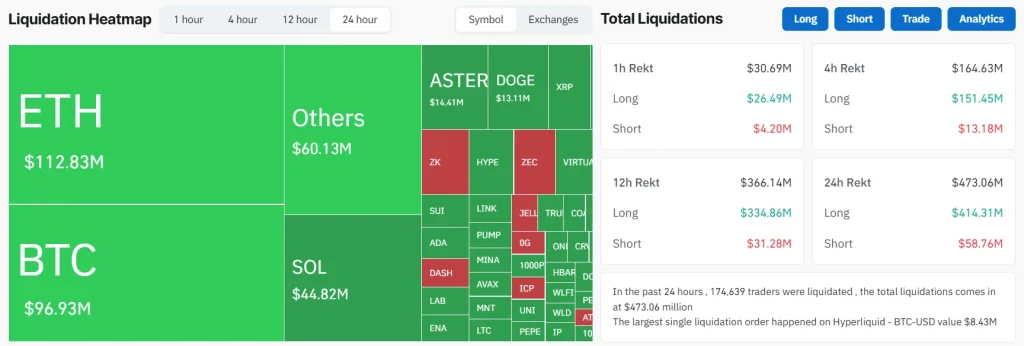

The smaller, more fashionable “altcoins” bore the brunt of this misadventure, as evidenced by a most alarming diagram (see below). The top fifty coins experienced a 4% decline in value, and Bitcoin’s dominance grew considerably. Popular, albeit somewhat frivolous, tokens such as Uniswap and DOGE suffered particularly grave losses. Ethereum liquidations reached $112.8 million, narrowly exceeding Bitcoin’s $96.9 million. Solana, ASTER, and even the ever-optimistic DOGE found themselves swept along by the tide of misfortune. And, naturally, a great deal of anxious speculation circulated amongst those who engage in social media. 🙄

The Federal Reserve and a Lack of Confidence

The pronouncements of that august body, the Federal Reserve, have not been without consequence. After a recent increase in rates, there was a regrettable retraction of any promise of further reductions. This, of course, bolstered the value of the American dollar, to the detriment of these digital currencies. It seems markets have a peculiar fondness for easy credit, and any suggestion of restraint fills them with alarm. The Treasury Secretary, furthermore, indicated limited avenues for further ‘easing’. The likelihood of another rate cut diminished, and the digital markets, predictably, reacted with considerable agitation.

Withdrawals from Investment Funds

To add to the general air of gloom, substantial sums – $1.15 billion, to be precise – have been withdrawn from U.S. Bitcoin spot ETFs, particularly from those managed by BlackRock, ARK Invest, and Fidelity. Such a withdrawal suggests a loss of faith amongst those who are generally considered to be discerning investors, and serves as a cautionary tale for more speculative participants. When Bitcoin could no longer maintain its standing above $110,000, it became clear that those in the know were preparing for further difficulties.

The Opinions of Those Who Claim to Understand

“Over $231.7 million in long positions has evaporated in a mere four hours. Even with the American stock markets opening favorably, these digital currencies are in freefall.”

-Cas Abbé

Frequently Asked Questions

What brought about this latest period of misfortune?

It was a most unfortunate confluence of events: pronouncements from the Federal Reserve, substantial withdrawals from investment funds, and the actions of those with considerable holdings all contributed to a cascading effect as buyers lost interest and prices plummeted.

Which currencies were most affected?

Ethereum and Bitcoin suffered the most substantial losses, though Uniswap and DOGE also experienced significant declines, indicating a general aversion to riskier ventures.

Is there a potential for further losses?

Should Bitcoin fall below $106,000, analysts suggest that the market could suffer an additional $6 billion in forced liquidations. Until then, it appears, fear shall continue to reign supreme. 😱

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Brent Oil Forecast

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

2025-11-03 11:57