And lo, as though guided by the fates, Bitcoin, in its ceaseless journey, has lingered at the spectrum of $109,929 to $110,056 for the past sixty minutes. The market cap looms large at $2.19 trillion, accompanied by a respectable volume of $44.79 billion traded within twenty-four hours. In its heroic dance today, Bitcoin flirted with the volatility of summer storms, casting shadows far and wide yet incapable of summoning the rain. It moved between highs and lows-$108,655 and $110,845-leaning equally towards hope and hesitation, much as a man wavering between courage and fear before proposing.

Chart Outlook for Bitcoin’s Plight

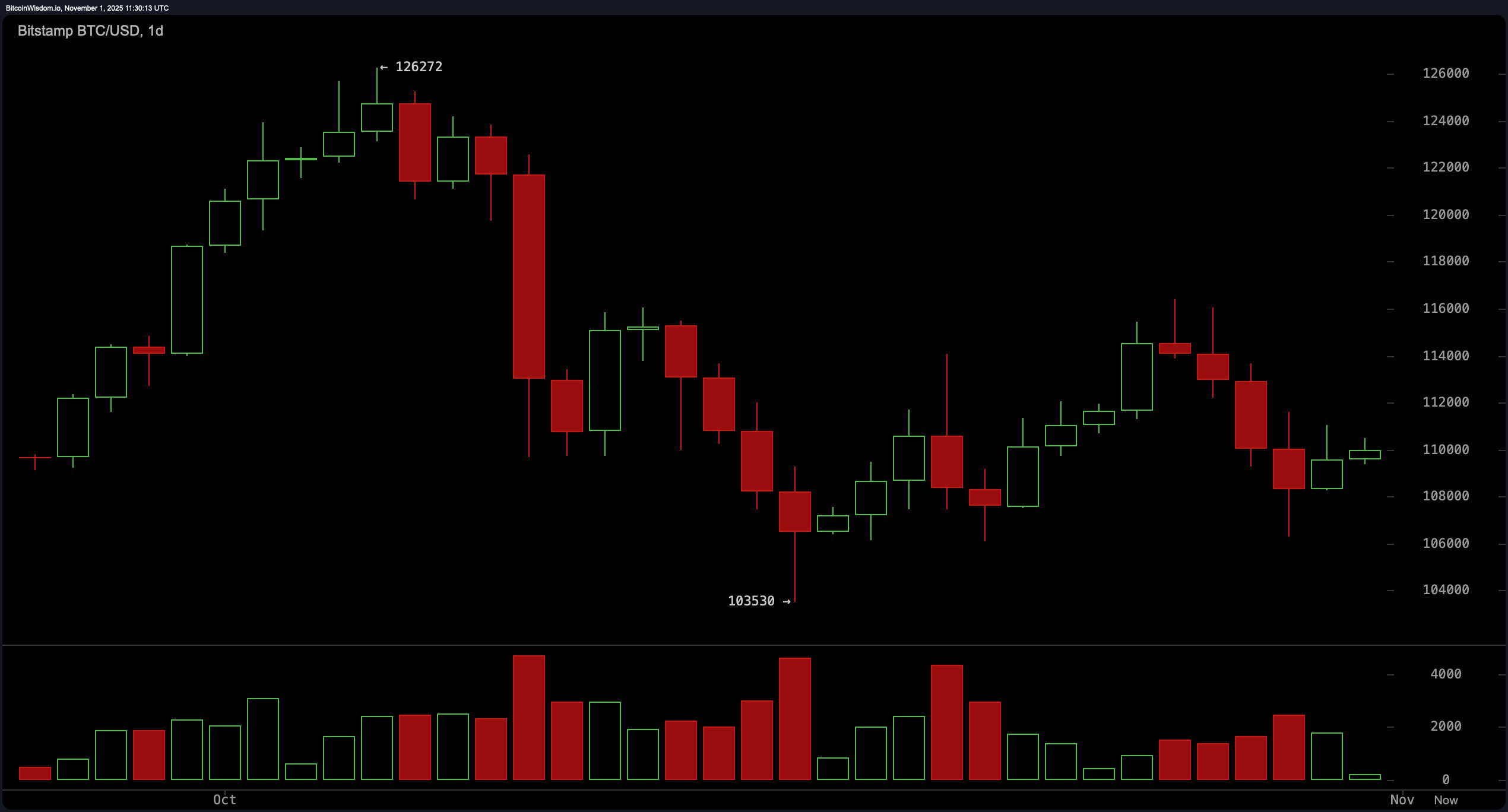

Behold the daily chart: Bitcoin resembles a wanderer returning from a gluttonous spree near its peak of $126,272, now lingering restfully near the resistance of $110,000. From its nadir around $103,530, Bitcoin has indeed attempted a gallant leap, much like a cat on a polished tabletop, seeking the heights again. The initial sell-off bore the weight of a tempest, yet now only faint glimmers of candles remain, their volume whispers dissipating into the air.

This price interlude echoes the uncertainty that befalls all creatures great and small: is it languishing in a post-feast torpor or preparing for the next grand attempt? Key levels of resistance stand at $112,000 and $115,000, with stalwart defenses at support congregating near $103,500 and $108,000.

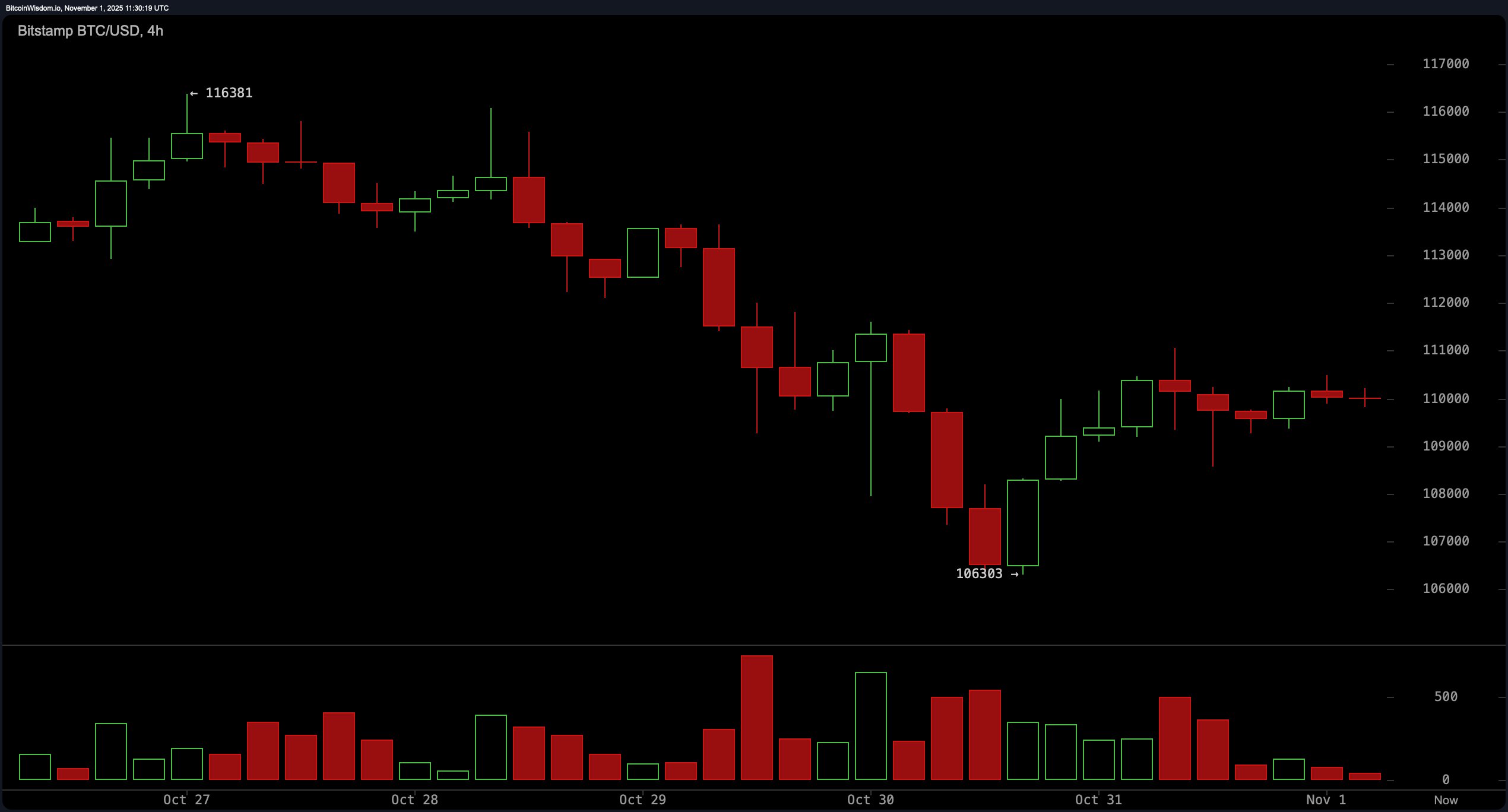

The 4-hour chronicle, akin to its daily sibling, tells a tale of restraint-Bitcoin hovered between the grounds of $106,303 and just above the $111,000 demarcation, as though perched delicately on the edge of decision itself. Small-bodied candles and scant volume bespeak a frail conviction, a fear in breaking free yet a yearning to climb. The $111,000 level refuses admission, rejecting efforts as if lined by velvet gloves at an elite gathering. Until the proud chorus of $112,000 is met with a resonant volume of effort, Bitcoin shall remain in its sideways sojourn, much like a stoic nun pondering life’s unanswered calls.

The more intimate interval of the 1-hour timeline finds Bitcoin ensnared in a standoff, between $109,800 and $111,000. Here the movements are flatter than the surface of a town square once danced upon, turned still by nightfall. Would a push above $111,200 signify a moment of vigor? But the atmosphere is awash with detachment-the volume scant for either bullish or bearish engagement. Thus, the trader’s pursuit lies not in a futile chase of trends unseen, but in the embrace of the steadfast range.

Now let us turn our gaze to oscillators: such indicators seem barely amused. The relative strength index (RSI) nonchalantly perches at a stoic 46, the stochastic oscillator at 36, while the commodity channel index (CCI) sprawls at a noncommittal −21. Even the average directional index (ADX) at 17 suggests a weary traveler with no path to tread. Momentum at 2,403 hints at bullish inklings, yet the moving average convergence divergence (MACD) hovers at −1,081, oddly maintaining an optimistic undertone. It is an array of indicators as indifferent as a man musing over the nonsensical edicts of life.

Equally unenthusiastic are the moving averages. The transient moving averages, extending from the ephemeral 10 to the slightly more enduring 100 period, depict weakness. Bitcoin trails these measures like a departing guest. Only the more enduring 200-period averages offer a sliver of reassurance, above which Bitcoin hovers as though on a perch. The message is clear: the long-range trend retains its warmth, yet the short-term brings but a frosty indifference.

To conclude, Bitcoin’s current state hangs in delicate balance, hovered between rebound and repudiation. It is akin to a heart straining against the remnants of turmoil. The market surges forth, eager to rise, yet clings to its wounds. A passage above $112,000 might rewrite this tale, but absent the pulse of volume, such a triumph would be empty as a faery’s promise. Until such evidence is secured, Bitcoin remains enrolled in a standoff of technical fortitude, where patience and keen observation of the shifting winds shall be the watchwords for the navigator.

Bull’s Perspective:

If Bitcoin should boldly breach the $112,000 threshold with robust volume, the axis of the technical sphere may tilt in favor of continued ascent. The compounding cues from momentum and the MACD suggest a pressure long coiled and now nearing release. This triumph could propel an upward sojourn to the horizon of $115,000-$118,000, buoyed by the market’s enduring inclination to the sunlit lands.

Bear’s Retort:

Yet should Bitcoin falter in reclaiming the $112,000 rung and stumble further from the embrace of $108,000-particularly if accompanied by a chorus of volume-it would herald the extension of a corrective sway. The lack of vigor discerned in the reading of recent exponential and simple averages, alongside oscillators as muted as monastery bells, paints a canvas of waning economic spirit. Thus, the step that beckons appears at the $105,000 haven below.

FAQ ⚙️

- Where does Bitcoin currently find its value?

As of November 1, 2025, at the hour of 8 AM, Bitcoin’s price wavers between $109,929 and $110,056. - What tally does Bitcoin’s market cap stand at today?

The cap of the market for Bitcoin remains grand at $2.19 trillion. - Is Bitcoin ascending or descending?

Bitcoin finds itself in a realm of stagnation, its momentum poised at equilibrium across a spectrum of observation. - What portals are of consequence for Bitcoin’s future path?

Take heed of resistance foundation at $112,000 and the sanctuary of support lingered at $108,000.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Pantera Denies Akio’s $5M Scam! 🚨

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

- Brent Oil Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

2025-11-01 15:35