If David Sedaris had turned his keen eye from embarrassing family stories to the chaos of blockchain technology, we might end up with this:

The A16z crypto “State of Crypto Report 2025” resembles a teenager’s bedroom-a little cluttered, a bit neglected, but brimming with potential. They claim there’s significant growth in digital asset adoption, which I can only assume is the digital equivalent of having more laundry piled up than one can handle. Isn’t the real mystery here whether our current blockchain infrastructure can actually handle what enterprises throw at it without hiccuping?

Metrics of Mainstream Adoption: Because We All Love Stats

The same report-sandwiched between napkin notes and discarded receipts-suggests that blockchain infrastructure is just about ready for prime time. How marvelous! This improvement has attracted millions of new cryptocurrency users, pushing the total old and young-sorry unrecognized adults-to somewhere between 40 and 70 million.

Mobile wallets are thriving in places like Argentina, Colombia, India, and Nigeria. Meanwhile, in the comfy developed countries, people are fueling token-related web traffic, like intellectual voyeurs peeking into transactions they vaguely understand. Banks are also getting in on the action, but inexplicably not enjoying pizza.

Investors now prefer channels like spot cryptocurrency exchange-traded products (ETPs) and digital asset treasuries (DATs). According to the report (which feels a lot like a “Bring In Your Namesake!” class assignment at school), these exciting financial products have the token supplies of Bitcoin and Ethereum almost tied up in knots. Did someone say 10%?

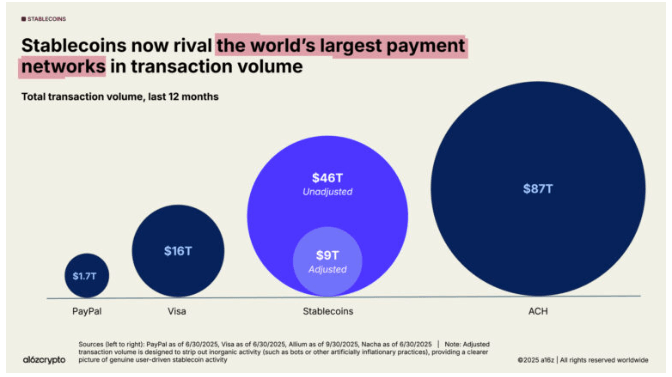

Ah, and stablecoins-blockchain’s answer to that overly enthusiastic pet goldfish that flops around the tank. Their transaction volume soared like a caffeinated hummingbird, reaching $46 trillion. As if banking systems had a long-lost, penniless cousin competing for family inheritance.

The Debate Over Infrastructure Readiness: Back and Forth Like a Grandparent Game of Tennis

Let’s address the things unspoken in polite conversation. Experts can’t seem to agree if blockchain systems are up to snuff for enterprise-level operations. Some argue that we need more speed, like an ill-behaved toddler racing through grocery aisles, while others prioritize the ability for the network to behave in a predictable manner under pressure-something akin to my chihuahua’s Netflix marathon sessions.

Marnix Reckman, sounding rather like a demanding auctioneer, insists that what we really need is speed (up to 65,000 TPS, at peak, of course). Meanwhile, Charles d’Haussy reminds us, with the patience of a saint, that reliability and regulatory compliance are actually more critical than a speedy getaway.

“Whether it shivers under scrutiny or not-that’s the real test,” Charles opines. We might be on the brink of using blockchain for tasks as serious as a surgeon performing major surgery without tools.

The Cost Threshold: Fits and Starts of a Love Affair

Then there’s cost, the old chestnut of debates on who would make a better partner: blockchain or traditional financial frameworks. Wish Wu suggests blockchain is only truly cost-effective at a transfer cost below $0.25-$0.50. Sub-cent transactions are seen as that magical threshold wherein blockchain finally convinces older siblings to let it sit at the adults’ table.

The report coyly mentions that some Layer Two solutions have hit this wallet-friendliness mark. On the other hand, major fintech companies like Stripe and Robinhood are busy building their own blockchains, prompting critics and cyber-skeptics alike to scoff.

Despite the scattered negativity, experts (those people who have the unenviable job of using the most confusing jargon) see this development as a massive thumbs-up for blockchain technology. Vardan Khachatryan argues that these power players are investing in blockchain much like old-timers stashing granola in wooden baskets. Then again, maybe it’s just a way to keep up with the blocks to the left and right.

Wish Wu maintains a balanced view: it’s a vote of confidence, sure, yet a signal that current public infrastructure still feels like the awkward child’s art project that everyone politely praises.

Finally, the A16z crypto report concludes-and none of us are surprised-with predictions that fintechs and traditional banks will fall head over heels for crypto, while new consumer products will usher in the next generation of blockchain brats. We’re all set to witness what could be termed the blockchain renaissance.

FAQ: As Reluctant to Answer as a Child Denied Cookies

- Where is crypto adoption growing fastest? Try Argentina, Colombia, India, and Nigeria. Mobile wallet usage is surging-like my mom when she finds a bargain.

- How are institutions engaging with crypto? They’re dabbling with ETPs and DATs, comfortably clutching a cool 10% of Bitcoin and Ethereum’s supply.

- Are stablecoins becoming mainstream? Nothing short of it; their volume has dizzyingly spun to $46 trillion, giving the top global payment networks a run for their money.

- Is blockchain infrastructure ready for institutions? Experts are at odds. They tout throughput and cost as the hurdles, but who listens to experts these days?

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- Wall Street Whales Abandon Bitcoin for FARTCOIN—You Won’t Believe Their Reason 🤯💨

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

2025-10-29 09:58