Dear Reader, it is with the utmost gravity that we present to you a most intriguing seasonality snapshot, widely circulated among the discerning few. A Coinglass heat map of Bitcoin’s monthly returns, reposted by the esteemed trader Daan Crypto Trades, has captured the attention of all who dare to speculate. The table, spanning 2013-2025, reveals November as a most peculiar month-both for its exorbitant gains and its harrowing drawdowns. One might say it is the Jane Austen of financial calendars: a character of both charm and chaos.

Bitcoin November Preview

“November is Bitcoin’s finest month, by all accounts,” Daan declared on X, his quill trembling with excitement. “An average November change of +46.02% across the dataset! A feat most remarkable, though slightly marred by the infamous November 2013 surge of +449.35%-a single month’s gain so vast, it could make even Mr. Darcy swoon.” He added, with a touch of irony, “The average gain is +46.02%, but this is heavily skewed by that one fateful month.”

The raw data, though unadorned, supports this reputation. Of the 12 Novembers listed (2013-2024), 8 ended in triumph-2013 (+449.35%), 2014 (+12.82%), 2015 (+19.27%), and so forth-while 4 were dismal: 2018 (-36.57%), 2019 (-17.27%), and others. One might say the market’s mood swings are as capricious as a Regency-era debutante’s affections.

The median November change, at +10.82%, is a more modest figure, tempering the 2013 effect. Excluding that year, the average plummets to +9.35%, a reminder that even the most robust statistics can be swayed by a single, overzealous month. 🧠

Context, as ever, is crucial. November’s average outshines all others, surpassing October’s +20.30% and casting a shadow over December’s mixed fortunes. One might liken it to a ballroom where the most dazzling dance is followed by a rather awkward waltz. 🕺

September, that most maligned of months, retains a negative average (-3.08%)-a fate as dreary as a rainy day in Hertfordshire. The 2024 row, meanwhile, captures the year’s tumult: double-digit gains in some months, losses in others, and a dismal December to close the affair. A tale of two halves, if ever there was one. 📉📈

Lessons From Prior Cycles

Daan’s musings extend beyond mere seasonality. “November & December have been the stage for both triumph and tragedy,” he observed, referencing the 2013 mania, the 2017 peak, and the 2022 washouts. “A most eventful period, indeed.” One might say it is the financial world’s version of a dramatic novel-full of twists, turns, and the occasional heartbreak. 📖

The Coinglass grid, though unable to timestamp intramonth highs or lows, aligns with the market’s folklore. November’s clustering of pivots is as inevitable as a well-timed proposal. 💌

The practical takeaway, as Daan so wisely notes, is not bullishness, but caution: “An eventful final two months, whether bullish or bearish.” A sentiment as true as it is unsettling. 🧩

November’s distribution, spanning from +449.35% to -36.57%, is a testament to variance. A two-thirds hit rate for green months, yet a median gain in the low double digits. December, by contrast, is a tale of duality-cycle tops and bottoms, all while maintaining a modest average. A reminder that averages, like society’s expectations, can obscure the true path. 🌀

Seasonality, though not destiny, offers a compelling narrative. As November approaches, Bitcoin’s historical pattern is less about quiet trend continuation and more about variance-the kind that has marked both euphoric blow-offs and capitulation lows. A most unpredictable dance, indeed. 💃

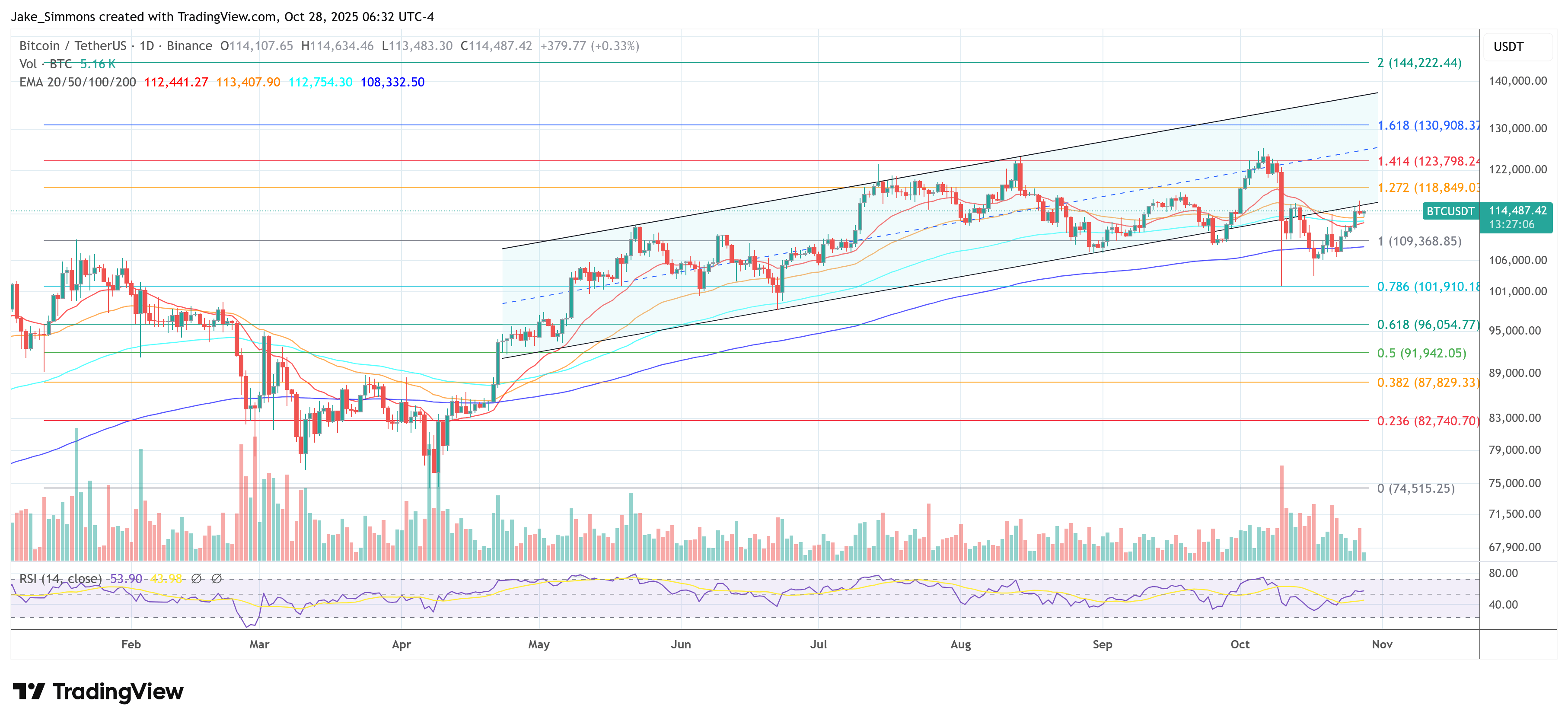

At press time, BTC traded at $114,487-a figure as bewildering as a Mr. Collins’ proposal. 💸

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

- 🤑 Crypto Treasuries Ditch Bitcoin for Wacky Altcoins: Chaos Ensues! 🚀

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

2025-10-28 19:44