Bitcoin, that sly fox, dances between the 100- and 200-day moving averages, its intentions as opaque as a Moscow winter. The $116K barrier, that elusive dream, looms like a gilded gate, while the $109K region, the bullish invalidation threshold, serves as a cruel joke for the optimists.

Until one of these levels is decisively breached-or perhaps, more accurately, until the market’s collective patience snaps like a twig-Bitcoin will continue its tedious waltz, accumulating liquidity like a miser hoarding coins.

Technical Analysis

By Shayan

The Daily Chart

On the daily canvas, Bitcoin has rebounded with the vigor of a caffeinated squirrel, reclaiming key short-term levels after a brief flirtation with the $109K support. The recent upswing has thrust the price into the $114K-$116K resistance zone, a battleground where bulls and bears duel with the fervor of rival poets.

This area, a crucial inflection point, could herald a structural shift if the price dares to close above $116K, potentially charging toward the $120K-$122K supply zone. Yet, the rejection candle near the 100-day MA whispers of lingering selling pressure, as if the market itself is sighing, “Not so fast, dear investor.”

Until Bitcoin escapes the confines of the 100- and 200-day MAs, it will linger in its consolidation phase, a prisoner of its own indecision, building energy for a future surge that may or may not arrive.

The 4-Hour Chart

On the 4-hour timeframe, BTC has broken above a symmetrical triangle, a delicate dance of bulls and bears. The breakout propelled the price into the $114K-$116K supply zone, where early signs of rejection emerge like whispers in a crowded room.

If the price stabilizes above the triangle’s upper boundary ($112K-$113K), the narrative remains constructive, allowing a charge toward $118K-$120K. But a breakdown below $111K would signal a loss of short-term momentum, exposing the $108K demand area like a wounded animal.

This setup, a study in volatility compression, suggests that a directional breakout-either reclaiming $116K or falling below $111K-will soon define Bitcoin’s short-term trajectory. One can only hope the market chooses a side, lest it continue its tedious tango.

Sentiment Analysis

By Shayan

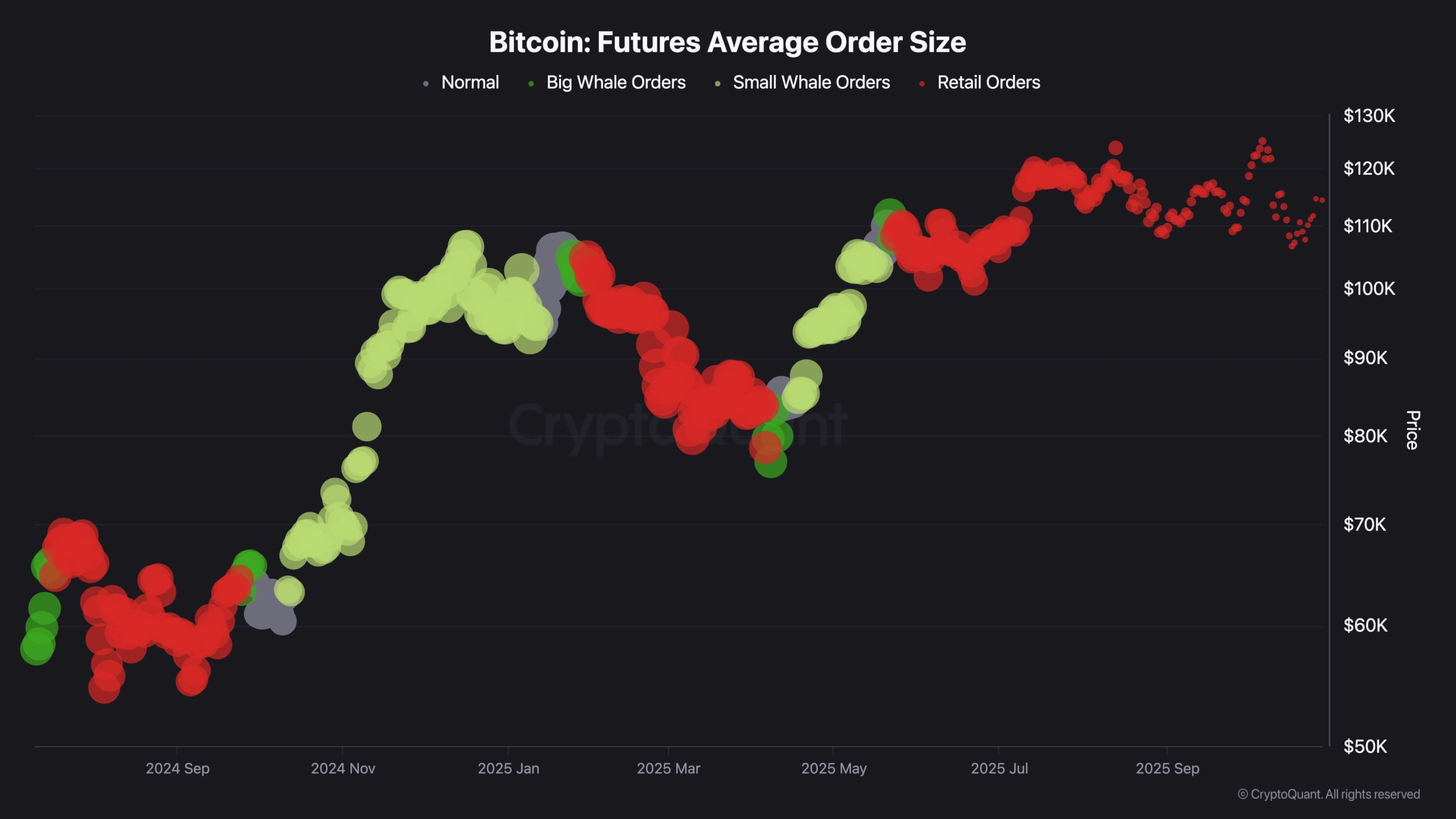

The Futures Average Order Size metric reveals a curious shift in market participation, akin to a crowd swapping champagne for cheap wine. During the recent rebound from the $108K-$109K demand zone, large whale orders (green clusters) have faded like the last light of day, while smaller retail-driven orders (red clusters) bloom like reckless roses.

This transition, reminiscent of a timid cat cautiously exploring a new room, suggests institutional traders are reducing leverage, leaving retail to dominate short-term movements. A common behavior during mid-range consolidations, or the later phases of local recoveries-a game of chicken where the stakes are measured in millions.

Historically, phases of retail dominance often coincide with short-term distribution or range-bound action, as big players wait to reaccumulate liquidity at lower levels. Conversely, periods of sharp whale order expansion, as seen in late 2024, have preceded major rallies driven by institutional positioning-a spectacle akin to a magician pulling rabbits from a hat.

At present, Bitcoin hovers near $114K, its price a pendulum swaying between hope and despair. The contraction in large order size signals a neutral to cautious sentiment among professionals, who watch from the sidelines like spectators at a gladiatorial match.

If a fresh influx of large orders reappears near $109K-$110K, it would signal renewed institutional accumulation-a bullish omen that could propel the price toward $120K-$125K. Until then, Bitcoin remains in a short-term equilibrium, a chess game where the pieces move slower than a snail on a treadmill.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

- 🤑 Crypto Treasuries Ditch Bitcoin for Wacky Altcoins: Chaos Ensues! 🚀

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

2025-10-28 14:01