Hold on to your portfolios, folks. This week is about to get interesting. Multiple US economic events are set to shake things up and possibly make or break your investments.

And if that wasn’t enough, we’re also living through a government shutdown. So, you know, data is now officially a scarce resource. It’s like trying to get your Wi-Fi to work at a coffee shop – it’s all very “fun” until it’s not.

US Economic Data Points to Influence Portfolios This Week

Get ready to clutch your spreadsheets. These are the US economic events you need to track like you’re following the plot of a Netflix thriller.

1. FOMC Interest Rate Decision

This is the big one, folks. The FOMC’s interest rate decision comes on Wednesday. Yes, five days after the September CPI release. Timing is everything, right?

The Federal Open Market Committee (FOMC) is about to announce whether it’ll keep the rates steady or let them slip a little. This could send shockwaves through every market – crypto, stocks, you name it.

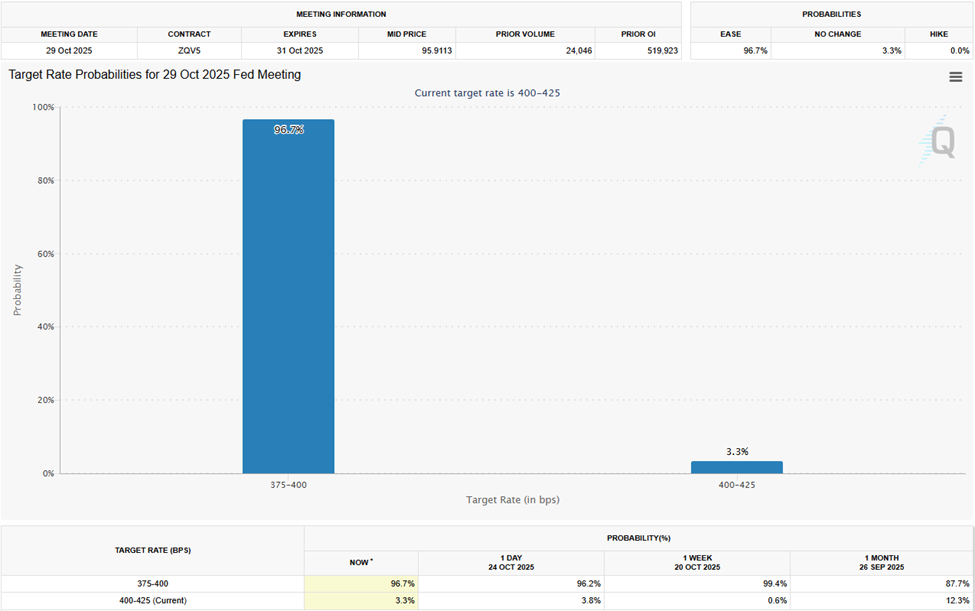

The odds are stacked at a 96.7% chance of a 25-basis point rate cut to 4.00%. But really, anything can happen when the Fed’s involved. It’s like a poker game where everyone’s bluffing, and Jerome Powell’s got the royal flush.

2. Powell’s Press Conference

And the drama doesn’t end there. After the FOMC’s big reveal, we get the post-rate decision press conference. Powell’s about to give us all the tea. This one is like the movie sequel that’s way better than the original.

“[His remarks] will shape 2025 cut expectations (2-3 more priced in), potentially driving mid-week volatility,” said analysts at AlphaBTC.

Markets will be hanging on every word. Will he go full dove or hawk? Investors are already sharpening their pencils, ready to dissect every phrase Powell utters. It’s like a sport. A very nerdy sport.

Also, remember when Powell mentioned that the Fed is nearing the end of its bond-selling spree? Yeah, that happened. The Fed is finally about to stop the balance sheet runoff. That’s if they can stop trying to balance everything, like a toddler with a toy set.

One highlight of the week will definitely be the FOMC decision and Powell press conference, although this one will be a lot less exciting than Sept. Without much new data, no new SEP or dot plot, and with Powell having given an extensive update on the Fed’s thinking (or at least…

– Neil Sethi (@neilksethi) October 27, 2025

3. Initial Jobless Claims

Let’s talk jobless claims. Because when the labor market is throwing tantrums, so are crypto prices. The government shutdown has created a jobless claim spike. It’s the kind of data you don’t want to see but can’t look away from.

Traders will be tracking the number of unemployment filings as if their crypto profits depend on it. And they might. Last week, filings from federal workers soared a ridiculous +121%. Can we just take a moment to appreciate how fast things are crumbling?

The Labor Department’s on strike too, which means state-level data is our only hope. And don’t forget, continuing claims jumped 9% to the highest level in 3.5 years. Yeah, it’s not a pretty sight. 🙄

Brutal. Shutdown pain hits workers and small businesses first. If this drags, expect spillovers around federal hubs.

For investors, stick to your system don’t let emotions override a good plan.– Brian | Calm Money Coach (@CalmMoneyCoach) October 22, 2025

For the record, we’re watching all of this like a hawk because every little data point could have crypto implications. And no, we’re not exaggerating. The US labor market is now a macro factor for Bitcoin. Go ahead, let that sink in.

4. PCE

Last but definitely not least, we’ve got the September PCE (Personal Consumption Expenditure) report. It’s a little less glamorous than the other events, but don’t ignore it. PCE inflation rose at 2.7% in August, which is a tiny bit above expectations. So, yeah, we’re still in inflation territory.

“Why do I think the Fed will keep rates unchanged in October? Inflation is still sticky with PCE 2.7, core 2.9, and median about 3.3, all above target,” one user said in a post.

If you’re wondering what that means for crypto? Well, traditionally, rate hikes mean a cold shower for speculative assets. But rate cuts? Hello, liquidity. Watch out, Bitcoin. 📉📈

As of right now, Bitcoin is chilling at $115,553, up almost 4% in the last 24 hours. Because why not? It’s crypto, anything can happen.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- This Blockchain Bridge Will Make You Say ‘Crypto, Seriously?’ 🚀

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- ETH PREDICTION. ETH cryptocurrency

2025-10-27 11:30