Markets

What to know:

- Oh, look! It’s the same crypto drama again-prices plummeting while gold and silver are showing off their shiny new highs.

- Signs are everywhere-tightening liquidity in the U.S. financial system is squeezing crypto’s lifeblood.

- Banks are tapping into the Fed’s standing repo facility (SRF), making it clear that someone’s sweating it out in the financial world.

And so the familiar saga unfolds-cryptos are slipping down the hill as gold and silver keep climbing to uncharted territory. How quaint. Bitcoin has dropped by around 2% in the past hour, now sitting at a measly $108,800, having lost most of its post-crash bounce from Friday. Meanwhile, the rest of crypto is on a similar path to despair, with Ethereum and Solana suffering even worse declines-around 3% in just the last 60 minutes. Oh, the humanity.

Meanwhile, precious metals? They’re having their moment. Gold has soared by another 2% to a new record just shy of $4,300 per ounce, and silver’s not far behind, up 3.6% to another all-time high. Apparently, they’re having a party while crypto’s in the corner, sulking.

What gives?

You might be sitting there wondering, “What’s with the cryptos getting the cold shoulder after that much-needed clearing of excess leverage last week?” Great question, my friend. The likely culprit is the tightening liquidity that’s making everyone a little more nervous about taking risks. Surprise, surprise.

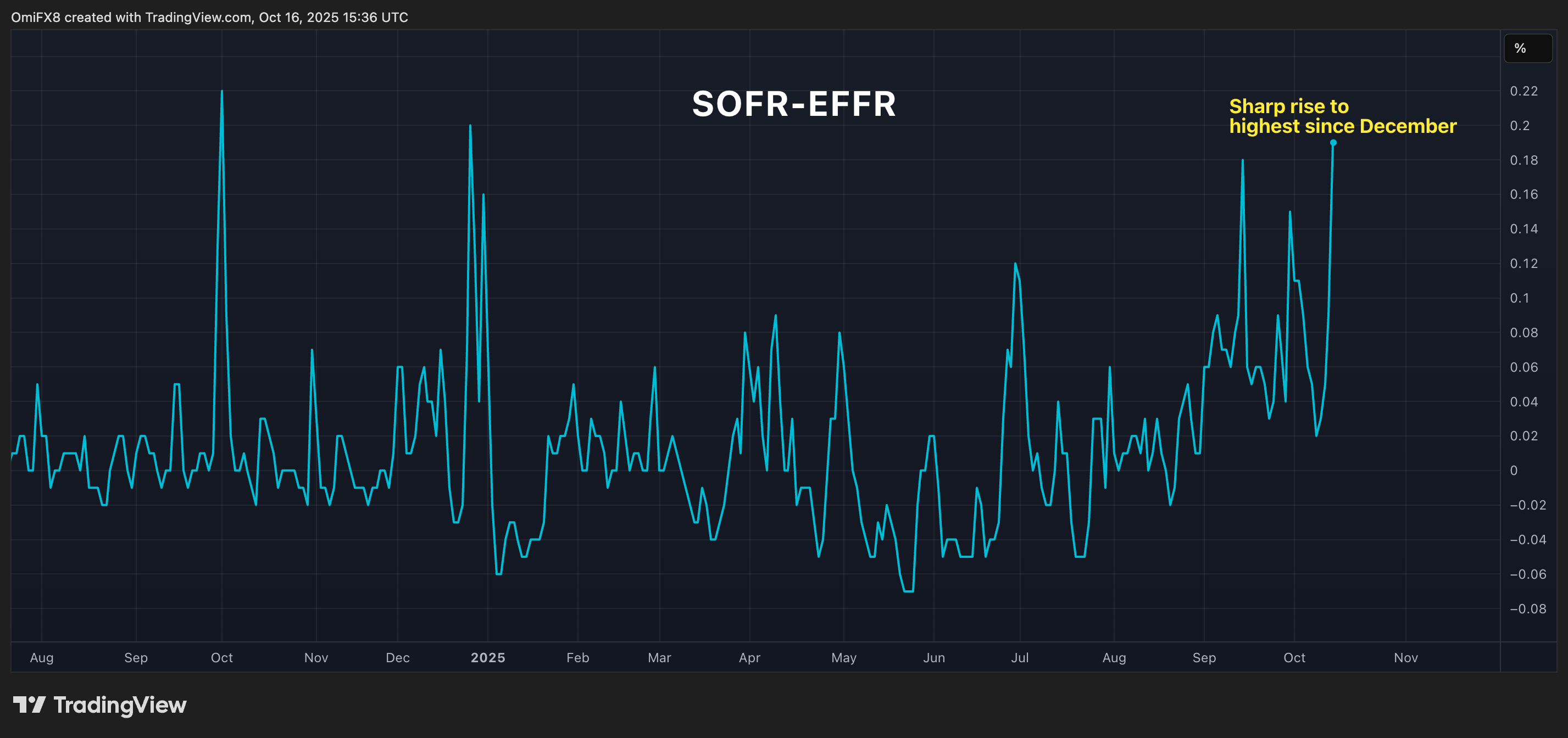

The liquidity situation is clear from the growing gap between the secured overnight financing rate (SOFR) and the effective federal funds rate (EFFR), which has widened from 0.02 to 0.19 in just one week, reaching the highest level since December 2024. (Who’s writing these dramatic plots?)

SOFR, for those of you not living in the financial weeds, is the cost of borrowing cash overnight using U.S. Treasury securities as collateral. Banks and other big players are the usual suspects here. It’s a pretty risk-free rate, considering it’s based on actual transaction data. Meanwhile, the EFFR is the rate at which banks lend to each other overnight in the federal funds market, and it’s more of a free-for-all when it comes to unsecured borrowing.

When SOFR climbs higher than EFFR, it’s a sign that lenders are getting more demanding, even for secured loans. Translation: liquidity is tight, borrowing is more expensive, and the financial system is starting to show its cracks. For those who love drama, it’s like watching a financial soap opera unfold.

This latest spike in the spread could be the very thing capping Bitcoin’s gains, since, let’s be honest, BTC thrives on liquidity like a plant thrives on sunlight. It’s simple biology, really.

Of course, the spread is still a far cry from the 2.95 level seen during the 2019 repo crisis, so let’s not start building bunkers just yet.

But wait, there’s more-other signs of funding stress are popping up, like an unsightly pimple right before prom. On Wednesday, banks drew a hefty $6.75 billion from the standing repo facility (SRF)-the highest amount since the pandemic’s heyday (excluding quarter-end periods, of course).

The SRF, for those who like a little extra detail, was introduced in 2021 to offer liquidity in times of need by providing cash loans in exchange for U.S. Treasuries. It’s like the Fed’s version of a financial lifejacket. And right now, it’s getting quite a workout.

All this liquidity tightening has stirred up some hope in crypto circles. Social media chatter is buzzing with the possibility that central banks might step in, giving the market a much-needed shot in the arm. Maybe that’ll get the bulls back in action. Or, maybe it won’t. Time will tell-and we all know how well “time” treats the crypto market.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Whale of a Time! BTC Bags Billions!

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

2025-10-16 21:15