Oh, darling Binance, you’ve gone and dropped a cool $8 billion from your reserves in just a week – all because of that pesky market crash that’s got everyone clutching their pearls and tweeting doom and gloom. The world’s biggest exchange under the microscope? Shocking, I know. 🙄

Ever since last Friday’s liquidation apocalypse, Binance has been dodging more shade than a vampire at a beach party. Whispers of underreported wipeouts and even wild tales of Uncle Sam pulling the plug? Yeah, the rumor mill is churning faster than a Bitcoin pump-and-dump. But let’s not get ahead of ourselves, loves.

Rumors and Reality: Or, How to Spot a Crypto Conspiracy Theory from a Mile Away

Enter on-chain data, the sober aunt at the family reunion. CryptoQuant’s Julio Moreno, bless him, posts on X (formerly Twitter, for us old souls) that reserves in BTC, ETH, and USDT have indeed dipped by about $8 billion. But wait, he says, don’t panic-buy the drama – just weeks back, they were ballooning by $14 billion. Perspective, people! 📉➡️📈

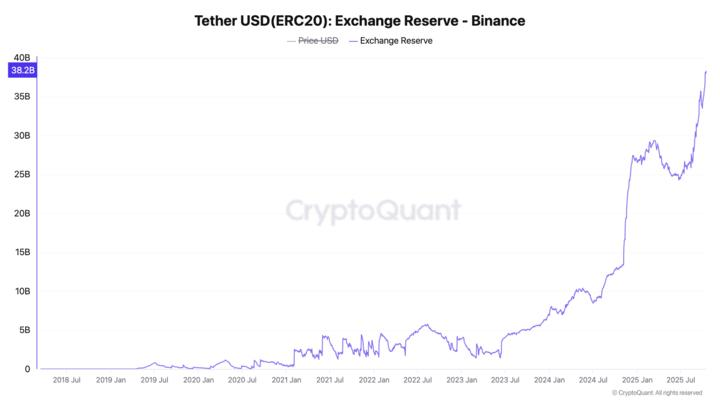

Moreno keeps it real: total reserves are still lounging at all-time highs, around $135 billion in USD for the big hitters. And USDT? New peak at $38.2 billion on ERC20. So, reserves took a tumble, but it’s like spilling your latte – messy, but not the end of the world. ☕💸

That said, the market’s fear-o-meter is off the charts. Coinglass reckons over $30 billion has fled centralized exchanges in seven days, with Binance bleeding $21 billion alone. Everyone’s running for the hills, or at least for their wallets. 🏃♂️💨

Binance in the Hot Seat: Because Who Doesn’t Love a Good Industry Roast?

Timing this speculation circus? About as easy as predicting my next bad date. Amid the outflows, Binance is catching flak from all sides. Hyperliquid’s Jeff Yan calls out centralized exchanges for lowballing liquidations by up to 100x – cheeky, isn’t it? Last Friday’s crash, sparked by US tariff threats on Chinese goods, saw $19 billion liquidated in a day per CoinGlass. Yan hints the real number’s even juicier. Tariffs and crypto? What a pairing. 🇺🇸🇨🇳

In this whirlwind of worry, investors are buzzing about withdrawal halts. That Solana guru @CryptoCurb on X warns, after a decade in the game, this centralized mess won’t just vanish. “REMOVE YOUR FUNDS FROM BINANCE IMMEDIATELY,” he bellows. Dramatic much? But hey, in crypto, better safe than sorry – or broke. 🚨😂

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Riches or Fool’s Gold? 🤑

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Whale of a Time! BTC Bags Billions!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

2025-10-16 15:46