Ah, the crypto market-a theater of the absurd, where fortunes are made and lost in the blink of an eye. Behold, the latest act in this grand tragedy: a crash so colossal, it has left the community reeling, half a billion dollars evaporated into the ether. Smaller altcoins, once the darlings of the speculative masses, now bleed red-a spectacle both pitiful and sublime. Why, you ask? Let us descend into this abyss of greed, fear, and regulatory folly.

- The crypto market, ever the tempestuous lover, continues its downward spiral after the $19 billion debacle on Oct. 10. Liquidations, those cruel harbingers of despair, have surpassed $540 million in the past 24 hours. Major tokens and their lesser brethren alike are drowning in a sea of red, their week-long losses a testament to the fickleness of fate.

- What fuels this bearish inferno? Ah, the usual suspects: regulatory warnings from the G20’s Financial Stability Board, the lingering ghosts of mass leveraged liquidations, and the escalating farce of U.S.-China trade tensions. Truly, a perfect storm of human folly. 🌪️💼

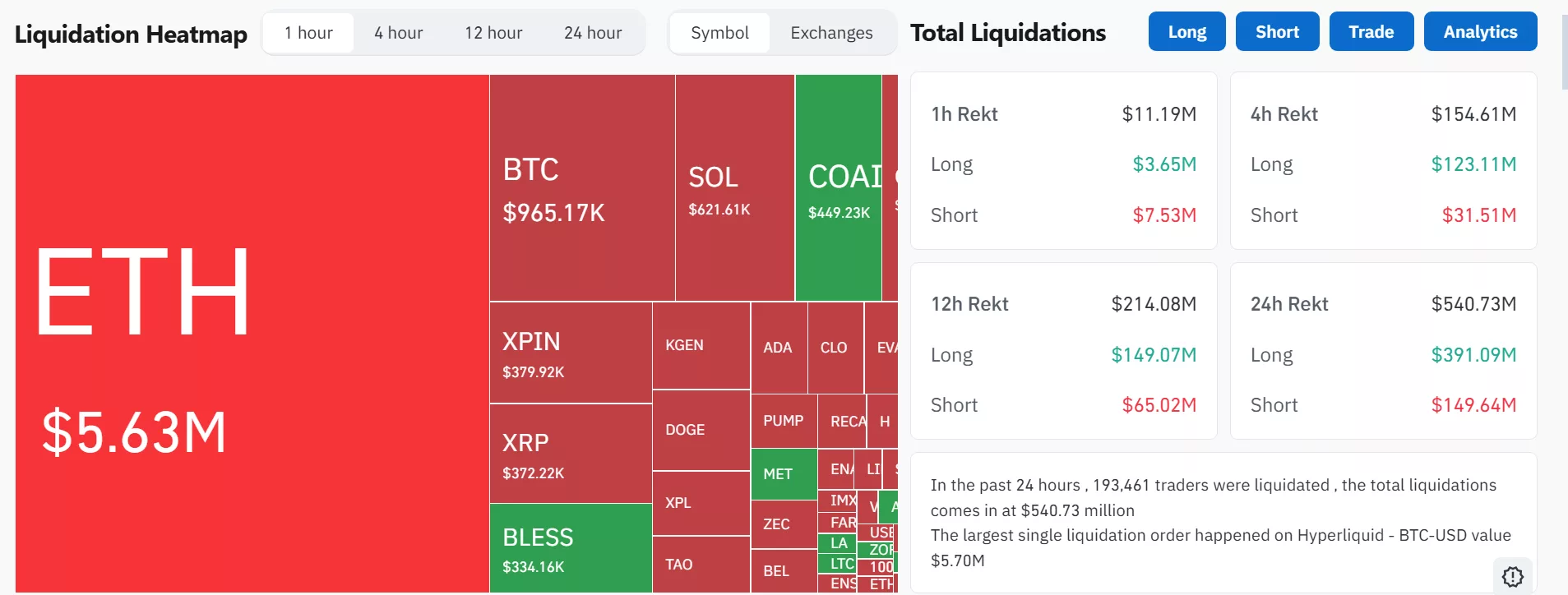

On Oct. 16, the crypto market cap, once a towering giant, stumbled below the $3.9 trillion mark, settling at a mere $3.78 trillion. A 1% drop, you say? Small, perhaps, but enough to trigger a cascade of liquidations totaling $540 million in a single day. And in the past hour alone, $11.2 million has been sacrificed at the altar of volatility. Ethereum, ever the drama queen, leads the charge with $5.63 million in liquidations, while Bitcoin, the stoic patriarch, follows with nearly $1 million. Solana and its altcoin kin have also been gutted, their losses a grim reminder of the market’s merciless nature.

Yet, in this maelstrom of despair, a glimmer of hope-or is it mere delusion? Major tokens like Bitcoin, Ethereum, and XRP have seen modest gains of 0.3% to 1% in the past hour. Smaller altcoins, too, have risen by 1% to 3%. But fear not, for the long-term trend remains resolutely bearish. These tokens, poor souls, have been in freefall since the week began, their plight a continuation of the $19 billion crash on Oct. 10. A tragic farce, indeed. 🎭💔

The smaller altcoins, those hapless dreamers, have borne the brunt of this carnage. ASTER, once a star, has plummeted 12% in the past 24 hours, its week-long plunge reaching a staggering 30%. ZEC, too, has fallen 12%, though it clings to a 25% rise from earlier in the week. LDO, a mirror image of ASTER, has dropped 11.17% in a day and nearly 20% in a week. PENGU, that whimsical creature, has lost 3.8% in a day and 23.5% in a week. Even DOGE, the meme king, has dipped 1.8% in a day, continuing its 19% fall over seven days. A comedy of errors, no? 🤡📉

Major tokens, those stalwart survivors, have fared better-but only just. Bitcoin, the titan, has slipped 0.8% to $111,407, its week-long decline deepening to 8.4%. Ethereum, teetering at the $4,000 precipice, has fallen 1.3% in a day and 6.4% in a week. BNB and XRP, too, have seen their losses deepen, with BNB down 7.9% and XRP down 12.7% over the week. A slow, inexorable march to the abyss. 🕳️💰

Why does this crypto apocalypse persist?

Ah, the eternal question. One culprit is the G20’s Financial Stability Board, that dour watchdog of the global economy. It warns of “significant gaps” in crypto regulations, a declaration that has sent institutional investors scurrying like rats from a sinking ship. According to Reuters, the FSB fears crypto’s integration into financial systems could destabilize the world-though it admits the risk is “limited at present.” A stern warning, indeed, and one that has spooked even the bravest of speculators. 🐀⚠️

Another villain in this tale is the lingering aftermath of the Oct. 10 leveraged liquidations, a massacre that wiped out $19 billion in crypto derivatives. Even now, the market remains on edge, with whales hedging their bets through short positions. And let us not forget the macroeconomic theater: the U.S.-China trade war, with Trump and Xi Jinping locked in a dance of mutual destruction. Investors, ever risk-averse, have fled to the safety of gold and bonds, leaving cryptocurrencies to wither in their absence. 🏃💨

And so, dear reader, we find ourselves at the precipice of this crypto apocalypse. A tale of greed, fear, and folly-a mirror to our own souls. Will the market rise from the ashes, or will it be consigned to the annals of history? Only time will tell. Until then, let us watch this grand spectacle with a mixture of horror and amusement. After all, what is life without a little chaos? 🎢🤯

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Whale of a Time! BTC Bags Billions!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

2025-10-16 15:38