Well, folks, it’s official: XRP took a nosedive that would make a rollercoaster jealous, plummeting over 50% during one of the sharpest crypto market downturns in recent memory. This chaotic tumble triggered a cool $700 million in liquidations, but don’t get too comfy – XRP decided it wasn’t quite done yet, and bounced back with all the grace of a boomerang. Meanwhile, the rumor mill churns with whispers of possible market shenanigans. Cue the conspiracy theories. 😏

Market Impact and Liquidations

In the wake of a particularly brutal cryptocurrency market meltdown, XRP went on a wild ride, dropping by over 50% and wiping out billions of dollars in value. This flash crash, one of the worst we’ve seen lately, saw XRP plummeting to a low of $1.58 on Bitstamp and $1.25 on Binance-its lowest point since November 2024. Ouch. That’s not just a bad day at the office; that’s a full-on disaster. 😱

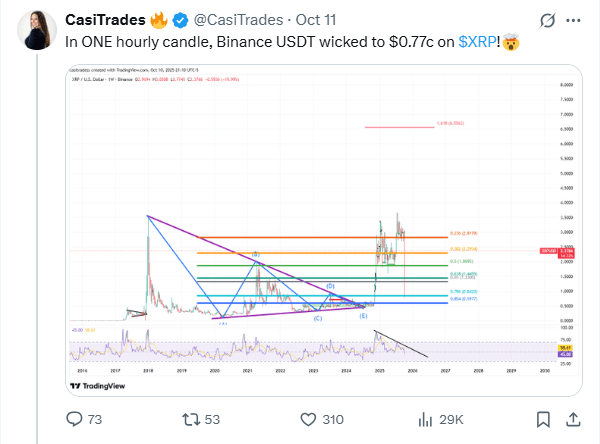

And what does a drop like that do? It doesn’t just hurt wallets; it liquefies them. According to Coinglass, XRP’s sudden plunge alone was responsible for triggering $700 million worth of leveraged position liquidations within a mere 24 hours. That’s an uncomfortable amount of margin calls. Some people on social media even reported the price dipped as low as $0.77 before bouncing back up, though some folks were *unbelievably* prevented from buying the dip. Ah, the joys of centralized exchanges! 🙄

Despite all the chaos, XRP didn’t take the crash lying down. It rebounded with surprising vigor, but, of course, it still has a way to go before reclaiming its previous glory of $2.79. As of 11:00 AM EST on Oct. 12, XRP was trading at a humble $2.44, still licking its wounds but not completely out of the fight.

Some analysts, ever the optimists, claimed that this “slump” didn’t change XRP’s bullish prospects, while others hinted that the whole mess might’ve been the result of some *strategically timed* market manipulation. Conspiracy? Perhaps. But hey, a little drama keeps the crypto world interesting, right? 😉

Crypto trader Casitrades pointed out the “strong bounce” off the $1.25 low as evidence that the bulls are still very much alive. Meanwhile, veteran trader Peter Brandt calmly asserted that XRP’s crash was just a “minor reaction in the bigger scheme of things.” So, all you panic sellers, breathe easy… for now. 😌

The Lesson: Liquidity, Leverage, and Risk

One of the standout lessons from this whole ordeal came from an X user named Protechtor. This sharp observer suggested that the crash was a “master class in liquidity,” pointing out the discrepancies in price drops across exchanges. Translation: Some platforms have stronger liquidity than others, and that can make a world of difference when the market decides to flip upside down.

Protechtor also made a very valid point: When high leverage meets low liquidity, you’ve got a recipe for disaster. It’s like trying to squeeze through a tiny exit door when the place is on fire. The result? Amplified price drops and some very unhappy investors. Moral of the story: stick to the most liquid pairs on the most liquid exchanges, and for the love of all things holy, avoid using leverage on volatile assets. Your sanity will thank you later. 😅

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-10-12 23:45