Markets

Behold, the vicissitudes of fate in the annals of digital coinages:

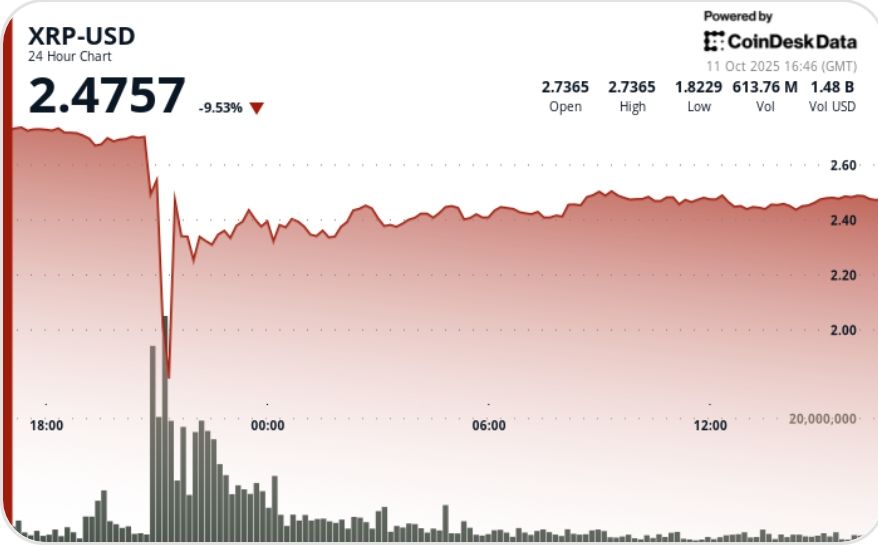

- Ah, XRP, like a wayward soul plucked from the depths of despair, rebounded from its disastrous 41% tumble to ascend above the fateful $2.47 mark, as the mighty institutions, those titans of finance, rebuilt their bids amidst the frenzy of panic-stricken liquidations. 😂

- Over $150 million in XRP futures perished in the crucible of Trump’s 100% tariff decree, igniting a wildfire of cross-asset trepidation, as if the gods themselves had unleashed a tempest upon the markets. 😏

- Yet, key resistance lurks at $3.05, with visions of celestial highs toward $3.65-$4.00, should the momentum of recovery endure like some eternal struggle against entropy. 🚀💸

In the grand tapestry of human folly and ambition, XRP emerged from Friday’s tumultuous fray, clawing back its losses with the ferocity of a peasant uprising against the bourgeoisie, soaring from a 41% abyss to perch gracefully above $2.47, as institutional bids, those steadfast pillars, reconstructed their fortifications after the stampede of frightened liquidations. The session’s $1.14 odyssey-from $2.77 to the nadir of $1.64-was amongst the widest chasms in XRP’s annals of 2025, propelled by macroeconomic tempests and the thunderous liquidation of futures across the vast arenas of trade, a spectacle worthy of Tolstoy himself, reflecting the petty vanities and cosmic misunderstandings of mankind. 🤦♂️

What to Behold in This Comedy of Errors

• From the lofty heights of $2.77, XRP plummeted to the wretched $1.64 between Oct 10 at 16:00 and Oct 11 at 15:00, a 41% intraday catastrophe ere it resurrected to $2.49, proving once more that markets are but mirrors to our restless souls. 😅

• Over $150 million in XRP futures met their doom, as Trump’s 100% tariff proclamation ignited a rebellion of risk aversion among all assets, like a czar’s edict scattering the serfs. 🔥

• Intraday volume surged to a prodigious 817 million-nearly thrice the quotidian averages-a volatile ballet peaking at 41%, as if the universe conspired for theatrical excess. 🎪

• Institutional hoarding transpired between $2.34 and $2.45, where magnates rebuilt their empires upon the bounce, oh the irony of greed’s eternal dance! 💰

• Yet, resistance endures at $3.05, with aspirations toward $3.65-$4.00, contingent on sustained recuperative fervor, much like redemption in the bleak steppes. 🌟

Background of This Epic Saga

The abrupt macroeconomic upheaval-the fresh wounds of U.S.-China tariffs-provoked compelled divestitures across perilous holdings, as XRP descended briefly to $1.64 ere stabilizing through the redemption of volume-weighted bids absorbing frenzied sales. Derivatives lore attested to capitulation: open interest dwindled 6.3% overnight, whilst long liquidations overshadowed shorts by a ratio of 15:1. Analysts, those oracles of modernity, portrayed the revival as “institutional recalibration” rather than the whimsy of retail turbulence, with treasuries augmenting spot holdings in the $2.40 realm amid ETF infusions and ameliorating sentiments toward Ripple‘s fiscal amalgamations. How quaint, the absurdity of tying fortunes to such ephemeral tokens! 🤓

00 to 21:00 UTC, as XRP shed $1.08 amid 817 million volumes-the week’s candle of abject surrender. 💥

• Swift resurgence to $2.34 forged a nascent bastion; thence price ascended methodically to $2.49 by 15:00 UTC.

• The concluding hour (14:58-15:57) witnessed a meager $0.03 oscillation ($2.46-$2.49) with 2.2 million volumes-testimony to accretion, not effusion. 😂

• Market architecture reconstituted with $2.47-$2.48 as transient support, affirming the assimilation of antecedent maelstroms.

Technical Exposition, or the Phrenology of Currencies

• Support-the capitulatory nadir at $1.64; $2.40-$2.45 as the accumulation plateau. 🔒

• Resistance-the breakout harbinger at $3.05; transcendence augurs structural renaissance. 🚪

• Volume-817 million against a 30-day mean of 270 million-turnover of capitulatory grandeur. 📈

• Pattern-a bullish channel of convalescence emerges; momentum sieves incline favorably above $2.47. 🌱

• Trend-RSI liberated from oversold gloom; MACD histogram inclines to equilibrium, intimating nascent reversal, as if the market spirits conspired for levity. 😜

That Which Traders Ponder, in Their Folly

• Whether the $2.47 sanctuary endures as bastion through the weekend’s Oriental vigils. 🌏

• Sustained bids from institutional dens post-liquidatory purge. 🏦

• Fluxes attendant to ETFs, courtesy of 21Shares TDOG’s inaugural ripple. 🐕

• Technical breaches above $2.90-$3.00 to revive bullish predispositions, chasing $3.65+. 🏃♂️

• Macro-discourse-the echo of tariff aggravations and crypto correlative crescendos, a endless farce. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

2025-10-11 21:57