Markets

What to know:

- Aave’s native token, AAVE, had a dramatic 64% drop in a crypto flash crash, only to rebound a staggering 140%. Talk about a rollercoaster ride! 🎢

- The Aave protocol handled a record $180 million in liquidations with zero human intervention. Robots doing the heavy lifting, yet again. 🤖

- Trading volume for AAVE surged. Looks like traders were really glued to their screens during the chaos. 💥

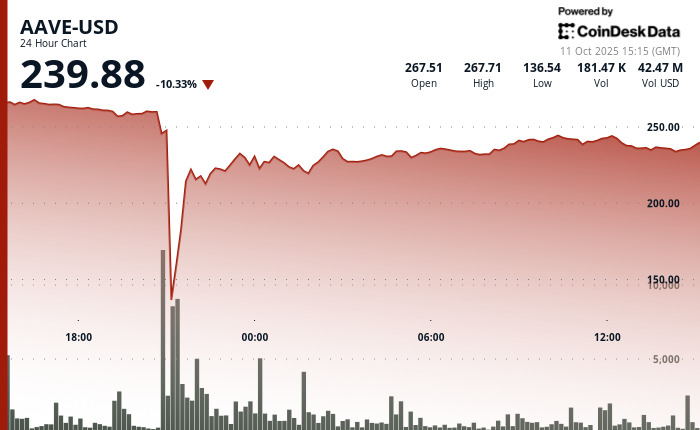

Ah, the wild world of crypto. On Friday, Aave’s native token found itself caught in the middle of one of the more dramatic crypto flash crashes we’ve seen, all while its decentralized lending protocol showed what it’s made of during a historic liquidation cascade.

So, here’s the scene: AAVE, which had been cruising around $270 earlier in the day, plummeted faster than a skydiver with no parachute. It dropped an eye-watering 64%, touching an all-time low of $100.18-its lowest point in 14 months. But, in true crypto style, it then staged a jaw-dropping rebound, climbing back to $240.09. Still down for the day, but hey, that 140% recovery was nothing to sneeze at.

Stani Kulechov, Aave’s founder, boldly declared that this was the “largest stress test” the protocol had ever faced. If you didn’t think the DeFi world was mature enough to handle these kinds of shake-ups, think again. Aave’s $75 billion lending infrastructure had its moment in the spotlight and didn’t falter. Bravo. 👏

Aave, for those of you who don’t know, is one of the largest decentralized lending protocols around. It lets people lend and borrow crypto without the need for traditional banks. (Take that, middlemen!) The platform uses innovative features like flash loans, which allow investors to borrow huge sums of crypto without needing collateral, but don’t get too excited-things can turn south quickly, as Friday’s crash demonstrated. But hey, this is what we call a “learning experience” in the crypto world.

“The protocol operated flawlessly,” Kulechov said in an X post. “We automatically liquidated a record $180M worth of collateral in just one hour, without any human intervention.” Well, that’s one way to flex your DeFi muscles. 💪

Key price action:

- AAVE took a nosedive, dropping 64% from $278.27 to $100.18 before bouncing back to $240.09. Your stomach would’ve dropped too. 😱

- The DeFi protocol flexed its resilience, with AAVE’s token recovering a whopping 140% from the intraday lows, aided by a massive trading volume of 570,838 units. 💰

- After the fireworks, AAVE settled into a consolidation phase, moving within a narrow $237.71-$242.80 range. Probably trying to catch its breath. 😅

Technical Indicators Summary

- Price range of $179.12 represented a massive 64% volatility during the 24-hour period. That’s some wild swings. 🎢

- Volume skyrocketed to 570,838 units, far surpassing the usual 175,000 average. Looks like everyone was in on the action. 📈

- Resistance spotted at $242.80, capping AAVE’s rebound during the consolidation phase. Always a ceiling to smash through, right? 💥

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Whale of a Time! BTC Bags Billions!

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

2025-10-11 20:14