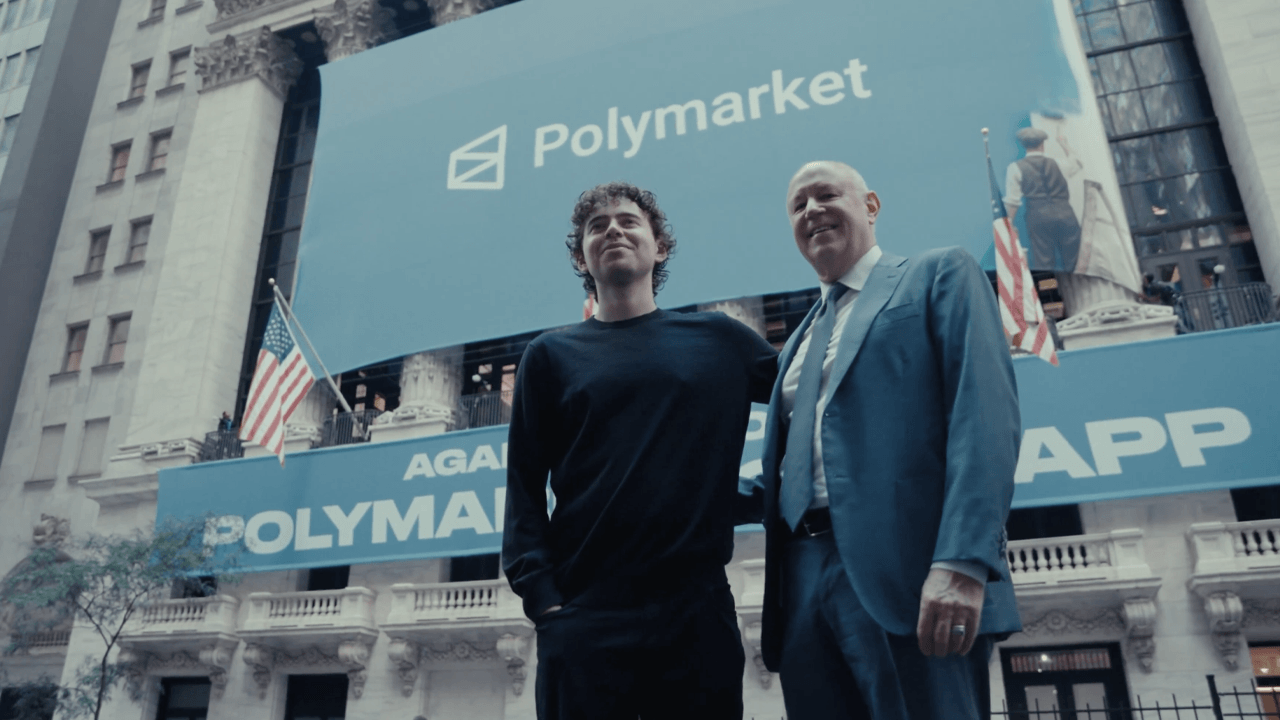

Ah, Polymarket! This sprightly little blockchain-based prediction platform has taken a gigantic leap into the world of high finance with a staggering $2 billion investment from the Intercontinental Exchange (ICE), a name that rings with the melodious chime of Wall Street sophistication. You see, they’ve decided that merging traditional finance (TradFi) with those chaotic decentralized markets is like mixing fine wine with a fizzy soda-unexpected but oh-so-exciting!

Inside ICE’s Polymarket Deal: A Turning Point for Crypto Prediction Platforms

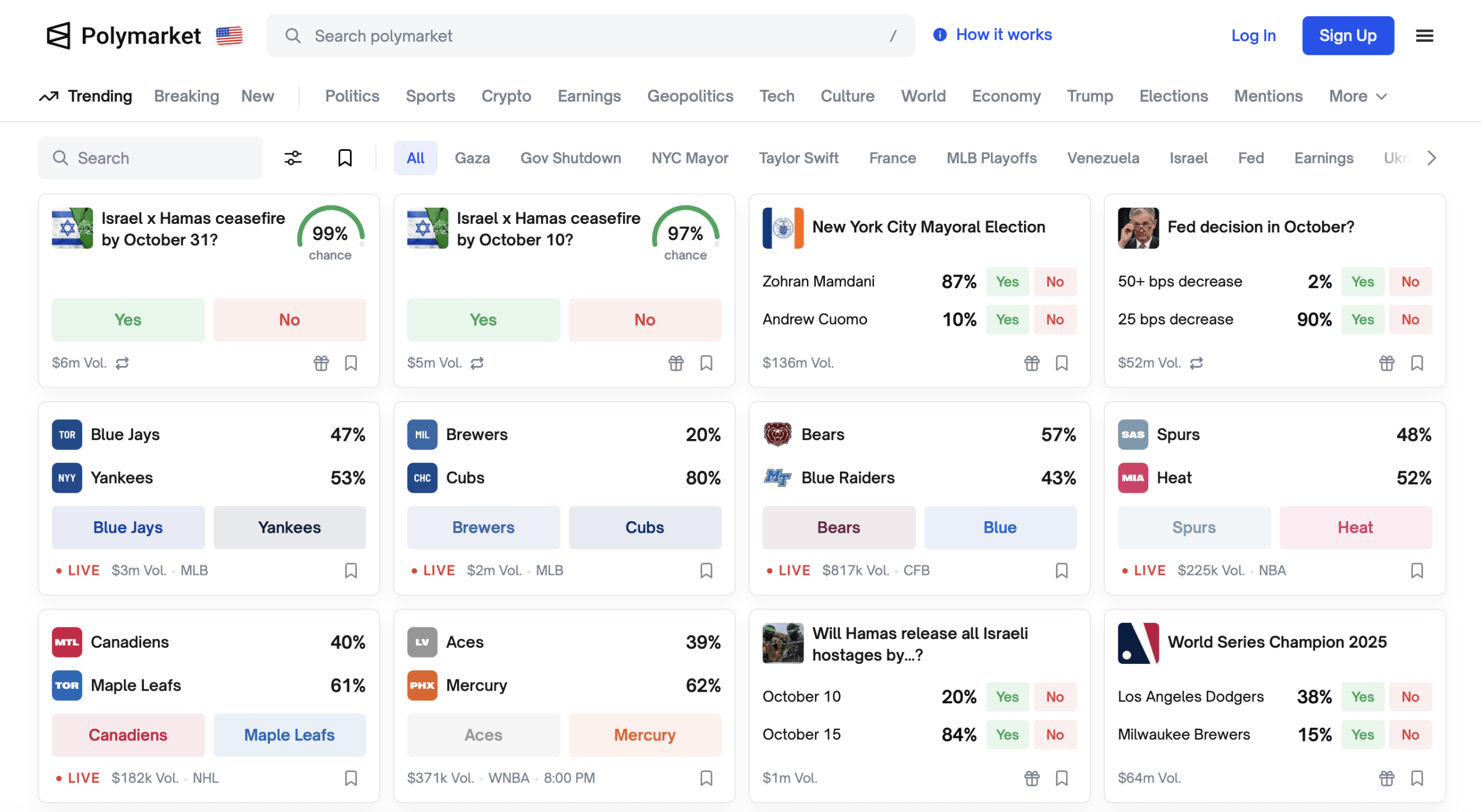

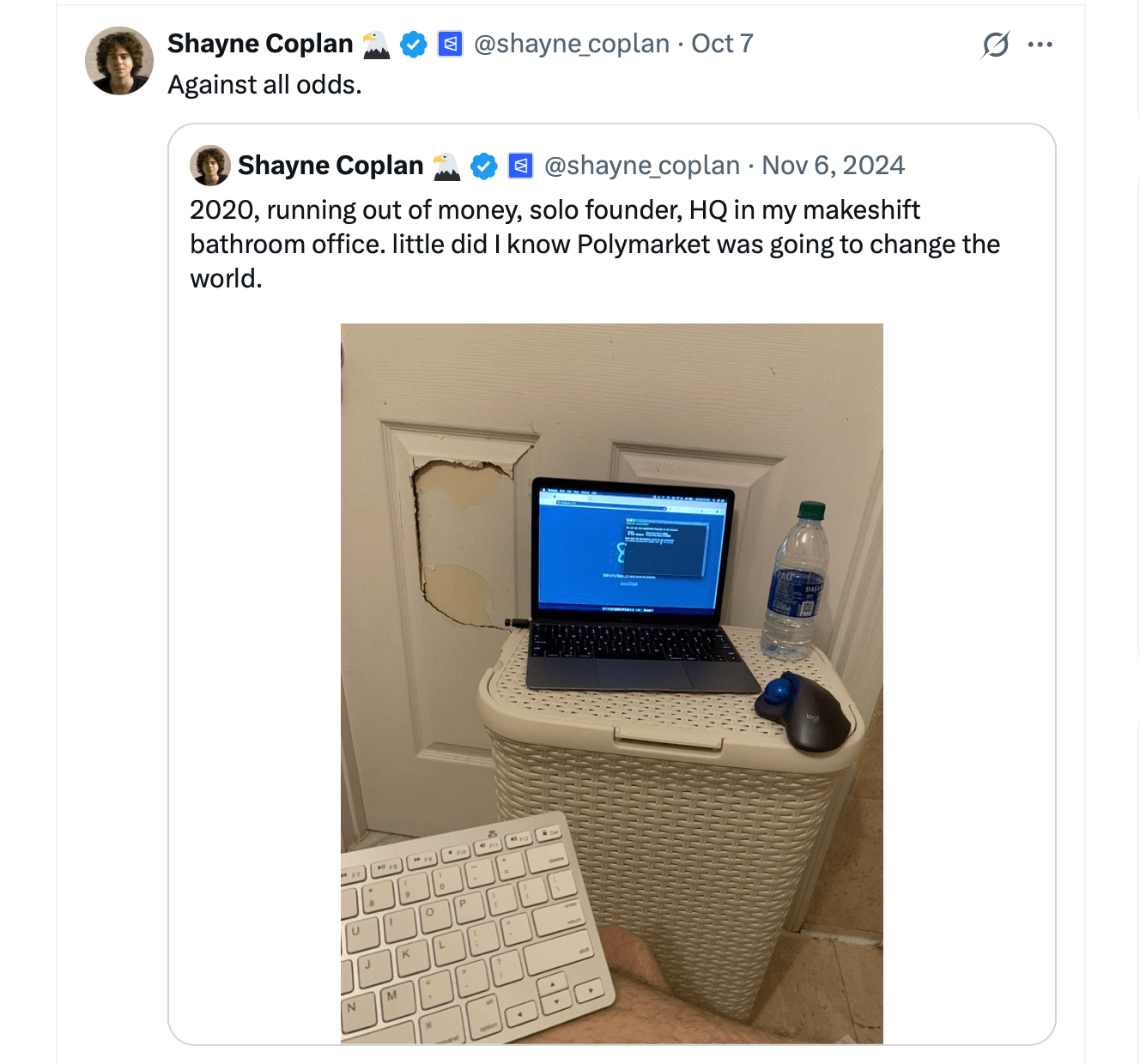

Polymarket, born out of blockchain dreams and a little bit of madness in the Polygon blockchain, has kicked its growth into overdrive thanks to a recently leaked news byte about the $2 billion investment from ICE. Launched back in the wild, freewheeling year of 2020 by none other than the enterprising Shayne Coplan, Polymarket lets users pit their wits against one another by buying and selling shares on an array of real-world events-from the nail-biting suspense of elections to the heart-pounding drama of sports, all while basking in the glow of “yes” or “no” outcomes. You know, the usual high-stakes gambles.

Founded in a time when we thought 2020 couldn’t possibly get any weirder, Polymarket saw its fortunes soar during the 2024 U.S. elections, proving that sometimes decentralized markets possess a far better flair for divination than earnest opinion polls scribbled down on napkins by over-caffeinated analysts.

The ICE investment is like when your quiet uncle unexpectedly shows up at the family reunion with a brand new car-it’s both shocking and thought-provoking! ICE, the powerhouse behind global exchanges and clearinghouses, is apparently intent on smuggling Polymarket’s data and market structures into its own financial ecosystem. CEO Jeffrey Sprecher even said the partnership is a “natural” evolution of ICE’s strategy. Sure, just like opening a bag of chips; it’s only natural to finish them all, right?

And if you thought that was impressive, Polymarket recently snagged QCX, a crypto derivatives exchange, for $112 million in July 2025. A tad cheeky, I must say, given that they had previously incurred the wrath of the Commodity Futures Trading Commission (CFTC) in 2022 and incurred a $1.4 million fine for operating sans registration. But with the DOJ dropping their probe like a hot potato following the Trump administration, it’s safe to say Polymarket is now feeling a little less like a guilty schoolboy in the principal’s office.

Polymarket operates like a peer-to-peer gambling basement where users lay down their cryptocurrency-mostly USDC stablecoins, because who doesn’t want a safe bet?-on event outcomes galore! 🚀 They’re powered by automated market makers (AMMs), those hardworking little elves that ensure your trading experience runs as smoothly as a Ferrari on the Autobahn. It’s all a fast-paced dance from one Ethereum transaction to the next, with Web3 wallets providing the groove.

Just as a cherry on top, ICE’s investment comes at the tail end of Polymarket’s recent move to allow bitcoin (BTC) deposits starting on October 6, 2025. Naturally, this addresses user demand as Bitcoin figures flirt with absurdity at $126,000. Who wouldn’t want to bet their hard-earned assets on the next big event in style?

And hold onto your hats because Polymarket has also decided to buddy up with Chainlink, a tech wizard that connects smart contracts with real-world data. Picture it: a magic wand that helps resolve market disputes faster than you can say “decentralized oracle!” The future is here, folks!

Now, Chainlink’s oracles are incredibly vital for markets based on good old fact-things that need instant verification lest we descend into chaos, like predicting if your neighbor has finally painted their front door a new color. With Chainlink’s wizardry, Polymarket has created a dual-resolution approach that combines decentralization with precision, strengthening the platform’s credibility and appeal to institutional investors who may have instinctively grimaced at anything with the word “crypto” attached to it.

As Polymarket skyrockets in reputation, it illustrates the slow but sure acceptance of prediction markets among investors. No longer confined to the shadows of DeFi curiosity, they’re now attracting attention from hedge funds and data firms eager to tap into alternative forecasting goldmines. ICE’s involvement essentially suggests that these platforms are no longer seen merely as whimsical distractions but as real financial players worthy of attention.

Of course, social media exploded with reactions once the announcement hit the press. Crypto analysts on X (that’s what we call Twitter now, don’t ask) were quick to proclaim it a major win for Web3 adoption, while others raised an eyebrow and contemplated the implications for competitors like Kalshi and DraftKings. One can almost hear the collective sigh of envy echoing through the crypto community!

So, as we look to the future of blockchain and prediction markets, Polymarket is evidently ready to jump on the wave. Blending cutting-edge tech with good old market sentiment, they’re equipped to provide insights on everything from global happenings to future asset prices. And with ICE’s vast experience at their side, full access to the U.S. market might just be a formality, perhaps even pending a rubber stamp from the regulatory wizards.

From humble beginnings as a quirky DeFi experiment to standing at the doorstep of Wall Street’s behemoths, Polymarket showcases just how far blockchain can push the envelope of financial data. With its sturdy embrace of those cheeky bitcoins and friendly oracles like Chainlink, mixed with a sprinkle of ICE’s influence, Polymarket is perfectly poised at the intersection of speculation, information, and finance-a rapidly evolving junction in a world as unpredictable as life itself!

💬 FAQ Section

Q1: What is Polymarket?

Polymarket is a decentralized prediction market that lets users trade on the outcomes of real-world events using blockchain technology and cryptocurrency-basically, it’s the betting pool of the internet age!

Q2: Who invested in Polymarket in 2025?

The Intercontinental Exchange (ICE), proud parent of the New York Stock Exchange (NYSE), showered Polymarket with up to $2 billion in October 2025. Such a generous gesture!

Q3: Why is the ICE investment significant?

It marks one of the largest traditional finance (TradFi) investments in a blockchain platform. In layman’s terms: Wall Street thinks this could actually work!

Q4: What cryptocurrencies does Polymarket now support?

Polymarket happily accepts USDC stablecoins and has recently rolled out the welcome mat for bitcoin ( BTC), creating quite the buzz among traders!

Q5: How does Chainlink enhance Polymarket’s operations?

Chainlink’s oracle network provides verified, tamper-proof data to automate market resolutions, which improves accuracy and efficiency. It’s like having a trustworthy buddy with an encyclopedia in the room!

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- USD IDR PREDICTION

- Brent Oil Forecast

- GBP JPY PREDICTION

- 🚀 Crypto ETFs Bounce Back: BlackRock & Fidelity Save the Day? 🤑

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

2025-10-10 10:41