Bitcoin’s ascent continues with the sly elegance of a promenade in dim moonlight, and one of crypto’s most flamboyant canaries insists the rally could glide on so long as governments keep their money‑printing waltz alive. 😏📈

In his CNBC confessional, Pompliano christens Bitcoin a “savings technology” – a velvet‑clawed coinage – and argues that the prudent reader might tuck a slice of their earnings into BTC to guard against the fiat sun going dim. 🪙✨

Whispers from the price ledger tell of an all‑time high near $126,100, with trades around $122,500 at press time, a backdrop that lends a certain gravity to Pompliano’s remarks. 🧭

JUST IN: Anthony Pompliano tells CNBC Bitcoin will never stop going up.

“They will never stop printing money.”

– Bitcoin Archive (@BTC_Archive) October 7, 2025

Pompliano Frames Bitcoin As Savings Technology

Pompliano told CNBC the kernel is simple: toil, save, and slide a slice of your savings into crypto to preserve value as fiat currencies shed their luster. 💎

He said that as long as governments and central banks keep printing money, demand for a scarce asset like Bitcoin should remain strong. 🧪

Based on his on‑camera remarks, he expects the trend to push adoption higher and to reshape how investors think about storing wealth. 🧠✨

The New ‘Hurdle Rate’

Pompliano went further, describing the top digital asset as the “hurdle rate” of modern finance – a baseline investors must beat before choosing other assets. 🎯

He contrasted Bitcoin’s performance with traditional markets, arguing that the S&P 500 has risen by more than a hundred percent since 2020 in fiat terms but has fallen roughly 90% when priced in BTC, a comparison he used to stress BTC’s long‑term outperformance. This framing explains why he and some others say, “If you can’t beat Bitcoin, buy it.” 💡

Further Gains Ahead

Based on projections, BTC could climb about 20% to $148,500 by the end of the year. The same forecasts sees a jump in market infrastructure: the number of crypto exchange‑traded funds could double to 80, and stablecoin circulation is predicted to reach $500 billion as more money moves onchain. 🔮💹

Those observations realistically bolster an argument that the market is maturing beyond the realm of a short‑term speculation.

Market Size And Stablecoin Liquidity Here To Stay

Market intelligence reveals that the total cryptocurrency market is sizeable at roughly $4.3 trillion, according to CoinGecko. 💰

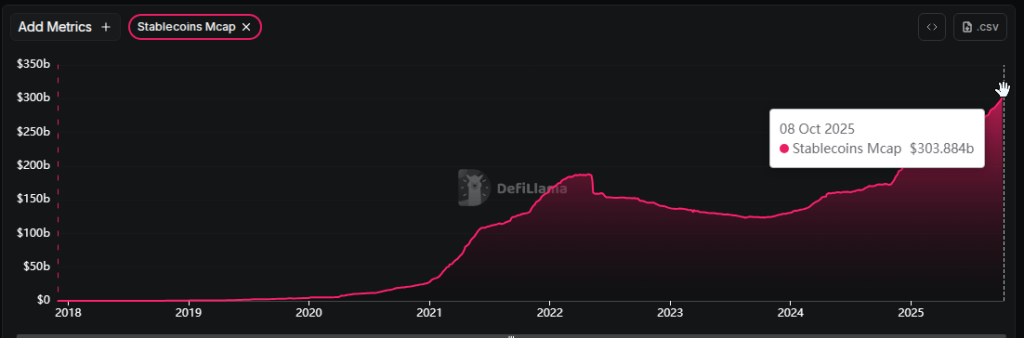

In addition, another market data source, DeFiLlama, reports that the stablecoin supply has exceeded $300 billion as an indication that there is a lot of liquidity onchain and it could flow into risk assets like Bitcoin. 🔄

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Crypto Comes to Shopify! Merchants Rejoice or Panic? 🎉💸

- 🚀 Illuvium’s Wild Ride: 60% Surge or Just a Flirt with Fate? 🌟

- Shiba Inu’s 2024 Rally: A Tale of Resilience and Market Whims 🐶💸

- ETH PREDICTION. ETH cryptocurrency

- France’s Fiendish Plot to Fry Crypto Exchanges in a Pot of Regulation Soup 🧙♂️🔥

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

2025-10-09 08:15