Ah, the marvellous world of Bitcoin! That mischievous little scamp of a currency has gone and done it again, hasn’t it? 🤑 Surging past the $125,000 mark like a greedy Augustus Gloop at the chocolate river, it’s now sitting pretty at $124,980, up a cheeky 2.03% in the last 24 hours. Binance, Bybit, and Coinbase are all in a flutter, with prices bobbing between $125,034 and $125,077. What a spectacle! 🎉

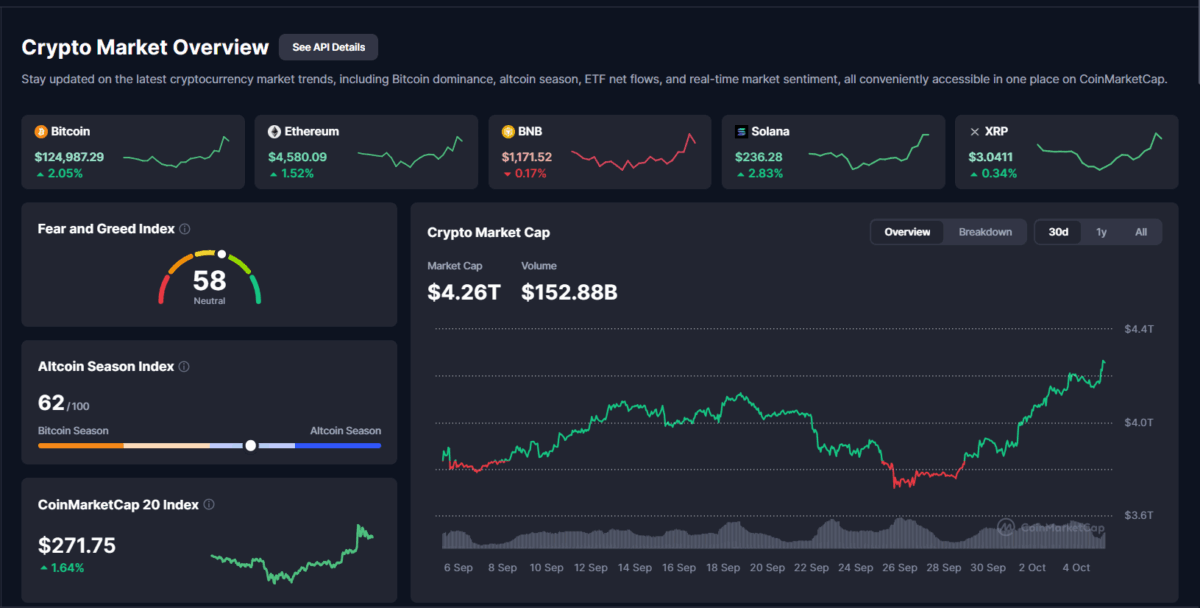

And why, you ask? Well, it seems the grown-ups in suits (institutional adopters, they call themselves) have decided Bitcoin is the new darling of their portfolios. Macroeconomic factors, they mumble, favouring risk assets. Oh, how very fancy! 🥂 Meanwhile, the Crypto Fear and Greed Index is practically doing cartwheels into “greed” territory, as retail investors pile in like children at a candy shop. 🍭

The Great Exchange Circus

Spot markets, derivatives exchanges-they’re all buzzing like a hive of over-caffeinated bees. Liquidity pools are deepening (whatever that means), and open interest is climbing to heights not seen since last year’s pumpkin pie frenzy. 🥧

Market Nonsense (or Context, if You’re Dull)

Bitcoin, they say, is now a “macro hedge” and “digital reserve asset.” Ooh, la-di-dah! Analysts point to ETF inflows, corporate treasuries hoarding BTC like squirrels with acorns, and global liquidity easing. 🌍 But let’s be honest, it’s all just a grand game of “Who’s got the most zeros in their bank account?”

And let’s not forget the central banks, those wise old owls, pivoting toward interest rate cuts. Risk appetite? More like risk feast! 🍽️

What the Wise (or Not-So-Wise) Are Saying

Traders, those eternal optimists, are eyeing $135,000 as the next big hurdle. Glassnode, the oracle of on-chain data, notes that mid-sized BTC holders are accumulating like it’s going out of fashion, while whales are taking a breather. Smaller fish? Neutral, as always. 🐟

“The Trend Accumulation Score highlights a shift in recent days. Mid-sized $BTC holders are accumulating strongly, whale distribution has moderated, and smaller entities remain neutral. This points to fresh structural demand emerging despite continued large holder selling.”

Geoff Kendrick, Standard Chartered’s digital assets guru, predicts Bitcoin could waltz past $135,000 this quarter. And with Bitcoin’s market dominance above 55%, it’s clear who’s wearing the crown in this crypto kingdom. 👑

So, is the moon the next stop, or is this just another chapter in the great crypto circus? Only time will tell. Until then, grab your popcorn and enjoy the show! 🍿

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Silver Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

- Whale of a Time! BTC Bags Billions!

- 50bps Fed Rate Cut Could Spark Massive Crypto Altseason – Are You Ready to Profit?

2025-10-05 10:30