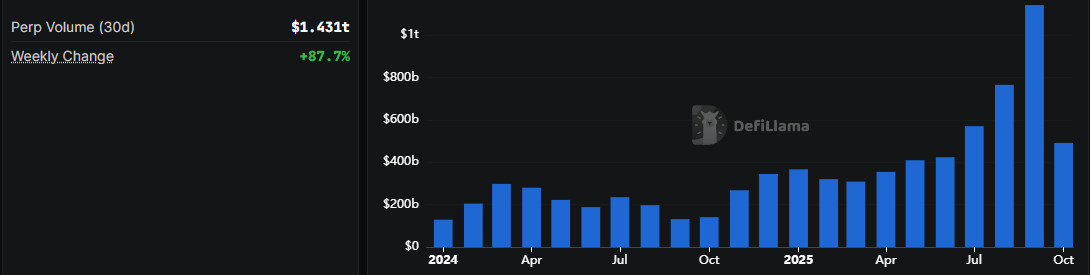

In the month of September, the trading volumes of Perpetual DEXs reached an astonishing $1.43 trillion, a most remarkable 50% increase, which, one must admit, is quite the feat. Aster, the paragon of the realm, led with a staggering $670 billion, while Hyperliquid and Lighter, though modest in comparison, each crossed the $100 billion threshold. 🏆

Perp DEX Volumes Break $1.4 Trillion in September, Led by Aster and Hyperliquid

Perpetual decentralized exchanges (Perp DEXs) achieved a historic milestone in September, with monthly trading volumes surpassing $1 trillion for the first time. According to Defillama, total volume reached $1.43 trillion, marking a nearly 50% increase from the previous month. A most impressive feat, though one wonders if the numbers are as accurate as a gentleman’s promise. 🤡

Three protocols stood out with over $100 billion each in trading activity. Aster led the pack with a staggering $672.43 billion, representing nearly half of all recorded Perp DEX activity. Hyperliquid followed with $281.44 billion, while newcomer Lighter posted $170.12 billion after recently moving its Layer 2 network into public mainnet. A most commendable effort, though one might question the necessity of such complexity. 🧠

EdgeX narrowly missed the $100 billion club with $97.83 billion in trading, while Jupiter came in 11th at $22.15 billion, highlighting the widening gap between top-tier and mid-tier perpetual protocols. A chasm as wide as the English Channel, it seems. 🌊

The surge in volume highlights both retail trader participation and institutional momentum flowing into onchain derivatives. With centralized exchanges still under regulatory scrutiny, DEXs offering perpetual futures are increasingly becoming the venue of choice for leveraged crypto traders. A most curious development, though one might question the wisdom of entrusting such matters to algorithms. 🤖

Industry observers note that the rise of Aster in particular underscores the shift toward specialized, high-frequency trading platforms. Its market share now dwarfs rivals and reflects a growing appetite for decentralized, verifiable alternatives to centralized perpetual venues. A triumph for the bold, though one wonders if the crowd is as discerning as they claim. 🧐

The record-breaking month puts decentralized perpetuals on pace to rival some of the largest centralized derivatives markets, a signal that crypto-native trading infrastructure is entering a new phase of scale and competition. A most thrilling era, though one cannot help but marvel at the sheer audacity of it all. 🌟

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

- Whale of a Time! BTC Bags Billions!

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-10-05 09:57