Mr. Sam Bankman-Fried acknowledges that his most significant error was to have entrusted FTX into the care of the new Chief Executive prior to the calamity of bankruptcy, and that he could not retrieve the moment.

The disgraced founder of FTX, Mr. Sam Bankman-Fried, observes that his gravest mistake consisted in handing the reins of the crypto exchange to the new Chief Executive, Mr. John J. Ray III, ere the company proclaimed its bankruptcy in November of 2022.

Mr. Bankman-Fried learned, with that peculiar sense of tardy fortune, of a possible external investment that might have rescued FTX, a mere few minutes after he had signed away the exchange, and he declared that there was no power in him to reclaim the act.

It was thus revealed in a recent exclusive interview with Mother Jones, casting new light upon the dramatic closing days of the handsome sum of thirty-two billion dollars, as on the eleventh day of November in the year 2022 the entity filed Chapter 11.

Under Mr. Ray’s direction, FTX collapsed with unusual speed, and he summoned Sullivan & Cromwell to furnish legal counsels. The gentleman carries a reputation for wrestling corporate tempests into submission, much like Enron’s own famed affair-oh, the drama! 😂

The fall of FTX was described as an unparalleled failure of governance, wherein ledgers grew chaotic and the practices of management proved lamentably wanting, as the bankruptcy disclosures did reveal.

The bankruptcy disclosed that the company had misused millions of customer funds. The funds of customers were misused by the sister concern Alameda Research, and the company endured billions in trading losses-the dreaded Alameda gap.

In due course, Mr. Bankman-Fried was arrested in the Bahamas and extradited to the United States, where he was sentenced to twenty-five years for his part in the collapse and the fraud. 👨⚖️

FTX Creditors Approach $1.6 Billion Repayment Milestone

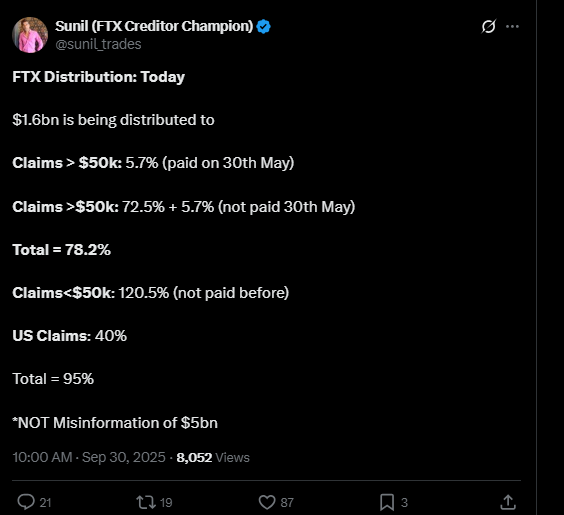

Recently the FTX bankruptcy estate announced it would release 1.6 billion dollars to creditors in the ongoing repayment process. 😅

Source – X

This shall be the third large tranche after prior repayments in February and May 2025.

The repayments are projected to yield high recovery rates for the smaller claimants of more than 120 percent, larger claims surpassing 50,000 U.S. dollars will enjoy approximately sixty percent recovery, and the overall rate hovers near 78.2 percent. 🤔

Such repayments appear to be a measured, albeit gradual, bid to restore creditors’ fortunes after the industry-wide upheaval.

Bankman-Fried and his legal team challenge the conviction, contending that the newly appointed CEO mishandled the billion-dollar bankruptcy. 🧐

The very law firm that hath reaped a handsome reward from these costly suits adds yet another twist to the grand chronicle of FTX’s spectacular collapse. 😏

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- 50bps Fed Rate Cut Could Spark Massive Crypto Altseason – Are You Ready to Profit?

- Whale of a Time! BTC Bags Billions!

- Crypto Chaos: Whales Dump 100B SHIB! Is $0.00001 Next? 🤯💥

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

2025-10-04 23:10