In a bold move that could make even the most seasoned investors raise an eyebrow, Citigroup-one of the towering giants of global finance-has announced that Bitcoin might reach a staggering $231,000 within the next year. Yes, you read that right. A cool $231K! 💰

Now, of course, this is the “bull case,” the shining beacon of hope in their forecast. But, just to be real (and slightly depressing), they also predict a “base case” of $181,000, and-hold your horses-an ominous “bear case” of just $82,000. A little dramatic, don’t you think? Talk about a rollercoaster ride. 🎢

As for the end of this year, Citigroup believes Bitcoin could end its saga at a fresh all-time high of $132,000. The world must be truly spinning in this bizarre crypto universe!🌍

But wait, there’s more! If you thought Ethereum was just hanging out in Bitcoin’s shadow, think again. Citigroup has also revised its forecast for Ethereum, the second-largest digital token, predicting a rise to $7,300 in the most optimistic scenario. Of course, they’ve got a “base case” of $5,400 and a “bear case” of $2,000. But hey, a bear market never stopped anyone, right? 🐻

Looking ahead, the bank expects Ethereum to close the year at a nice, rounded $4,500-up from a previous, somewhat dismal projection of $4,300. You can almost feel the optimism in the air! 😏

Bitcoin remains the bank’s top pick, capturing the lion’s share of the crypto market’s new funds. According to Citigroup analysts, Bitcoin continues to trade well above estimates based on adoption trends, with the “digital gold” narrative still driving the hype train forward. 🚂

Ethereum, on the other hand, is shrouded in more uncertainty due to shifting user behavior. However, despite the confusion, the institution still has its eye on the potential of staking and decentralized finance to boost Ethereum’s position. 👀

Big Money Flows Into Bitcoin

Speaking of Bitcoin, the timing couldn’t be better. As if Bitcoin didn’t have enough momentum, exchange-traded funds (ETFs) are pouring in more money. According to data from SoSoValue, BTC ETFs saw over $1.6 billion in inflows during the first three days of October. Guess the world is really banking on that sweet digital currency! 🤑

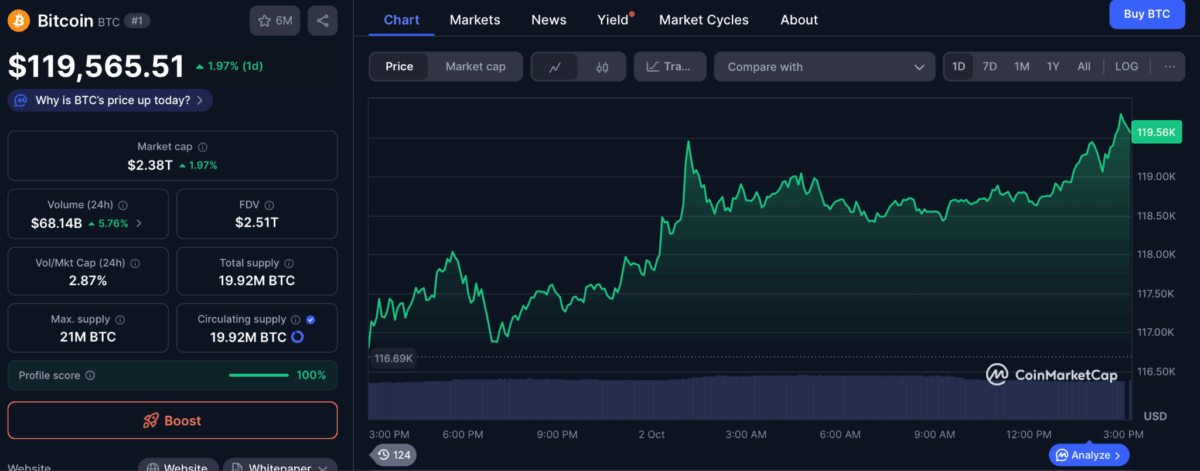

On October 1 alone, the inflows reached $675.81 million-the biggest daily total since early September. Bitcoin responded in kind, surging past $119,000 with a respectable 2% increase since the start of the month. I mean, if it were a human, it’d be flexing in the mirror. 💪

Citigroup also pointed out that favorable economic conditions are supporting crypto prices. The latest ADP jobs report showed a weakening labor market, which boosts the likelihood that the U.S. Federal Reserve might lower interest rates at its October meeting. When the economy stumbles, Bitcoin tends to rise-who would’ve thought? 📉🚀

Historically, October has been one of Bitcoin’s strongest months, with average gains above 20%. Maybe this time around, the predictions won’t just be a wild shot in the dark. Or maybe they will. Who’s to say? 🤷♂️

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- Crypto Institutions Still Relying on the Dinosaur Playbook – Time to Wake Up! 🦖💸

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-10-02 18:09