Ah, the eternal tango between the bullish romantics and the bearish cynics continues, dear reader. Analysts suggest this latest maneuver could be the grand turning point-quite the dramatic twist in our crypto soap opera.

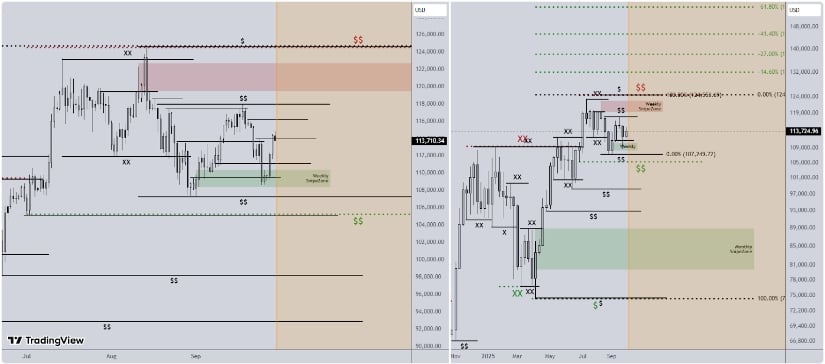

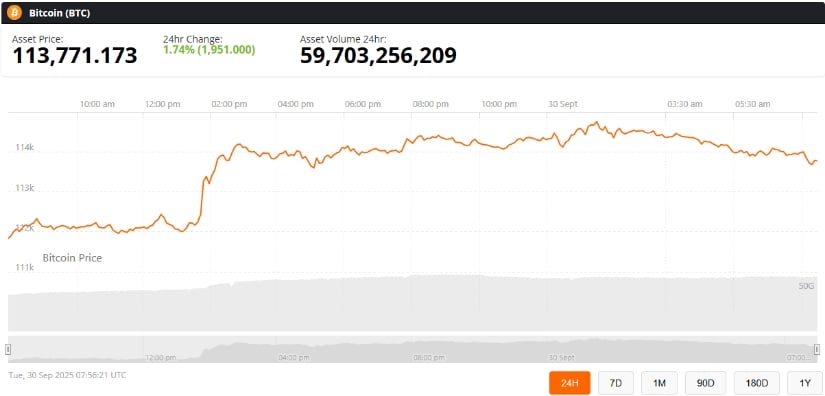

Presently, BTC pirouettes above $114,000, having taken a not-so-delicate leap from September’s rather sorry lows near $106,000, as those diligent Investtech folks report. Market sage @Manofbitcoin proclaimed on X, “A break above the gloomy bearish structure signals the corrective drama may be bowing out,” invoking the mystical Elliott Wave analysis forecasting a breakout with all the gravitas of a Noël Coward wit.

Now, here’s the kicker: Bitcoin’s wave-2 corrections historically adore a polite little lap back to the 61.8% Fibonacci retracement before sashaying upward. Should this pattern hold, we might just toast to the $118,000-$124,000 range, tipping our hats to August’s all-time highs.

Elliott Wave Theory: The Crystal Ball with a Smile

For those who fancy a bit of esoteric melodrama, Elliott Wave theory remains the darling of bitcoin prognosticators. The ABC corrective pattern is apparently nearing its final curtain call, leaving the stage set for a fresh crescendo. A staunch climb beyond the 61.8% retracement would have Bitcoin donning the cape of bullish bravado, possibly ushering in a wave-3 expansion with all the technical poise and macroeconomic aplomb one could hope for.

This optimism isn’t just idle chatter over tea. Rising volumes and sunnier investor moods hint that this recovery could be more than a one-night stand-it might actually last into Q4, fueled by a cocktail of charts and macro trends.

Macro Tailwinds: When Mother Nature and Markets Align

Beyond the technical tiptoeing, broader forces are at play. The Federal Reserve’s September rate cut threw a cold shoulder to the U.S. dollar, sending gold to dizzying heights and breathing new life into Bitcoin’s “digital gold” charade. XWIN Research chimed in: “Capital usually flirts with gold first, then waltzes into Bitcoin when risk appetite perks up. This rebound fits that old tune beautifully.”

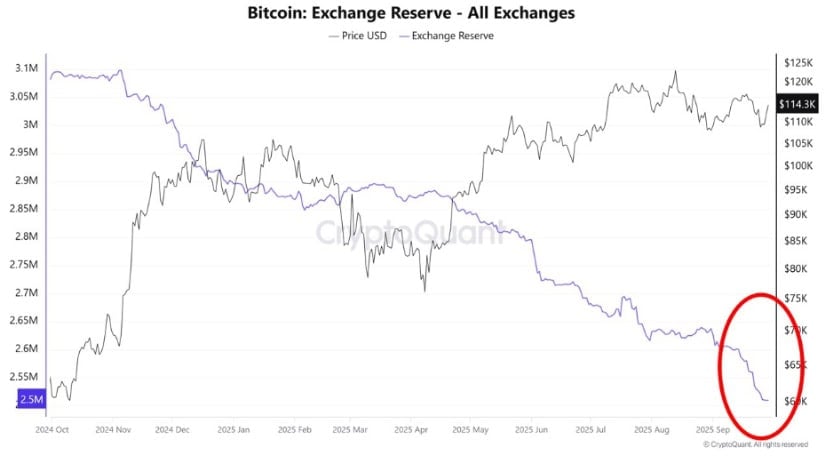

Then there’s the institutional belles of the ball: BlackRock’s IBIT and Fidelity’s FBTC are enticing capital like it’s the last soirée in town. Loosening ETF rules have given the crypto sector a fresh confidence boost. As long-term holders graciously escort coins off exchanges, the sell-pressure choir has quieted considerably. Such vigor supports the case for Bitcoin’s ascent as we flirt with year-end.

Bitcoin’s Eyes Glint Toward $124K and the Oscars

Resistance, that ever-towering wall, stands like a sentinel at $115,000, with the grander guardians at $118,000 and the august $124,000 from August’s limelight. Should Bitcoin cash these invitations, a marquee run might be on the cards-some even fancy a $150,000 to $180,000 encore before 2025’s closing curtain.

On-chain whispers back this bullish overture. Exchange reserves are taking a graceful bow, the MVRV ratio is back on form, and the grand holders are hoarding with the zeal of seasoned collectors. Together, these signs compose a sonnet of rising conviction that Bitcoin’s price might soon pirouette back to its highest heights.

As our insightful commentator Carmelo Alemán mused: “Bitcoin’s in an accumulation waltz. Should liquidity keep swelling, BTC may well set new records before we ring in the new year.”

Final Thoughts: Will the Curtain Rise or Fall?

The latest price caper above stubborn resistance, twinned with Elliott Wave’s endorsement, suggests the bearish villain might just be exiting stage left. Whether BTC sashays past $124K depends on institutional investors staying faithful, macroeconomic stability playing nice, and investor conviction keeping the drama alive.

For now, the fusion of technical derring-do and fundamental charm leaves Bitcoin looking rather bullish-traders watch with bated breath, hoping the world’s most illustrious cryptocurrency is ready for its next dazzling act. After all, one mustn’t miss the next splendid spectacle.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Bitcoin’s on Fire! Institutions Hoarding Like It’s Toilet Paper 2020 🚀💰

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- This Trader Turned Pocket Change Into Millions With LAUNCHCOIN (And You Didn’t!)

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin Apocalypse Imminent?! 😱

2025-09-30 16:39