Behold, Ethereum (ETH)! A creature of contradictions, it tumbles 10% weekly yet draws the attention of institutions like moths to a flame-and retail speculators, those brave souls who trade while clutching their wallets like talismans. Traders squint at resistance levels and technical indicators, as if deciphering the cryptic will of some cosmic stockbroker. One wonders: is this the prelude to glory or a grand farce?

Ethereum’s Price: A Balancing Act Between Despair and Delusion

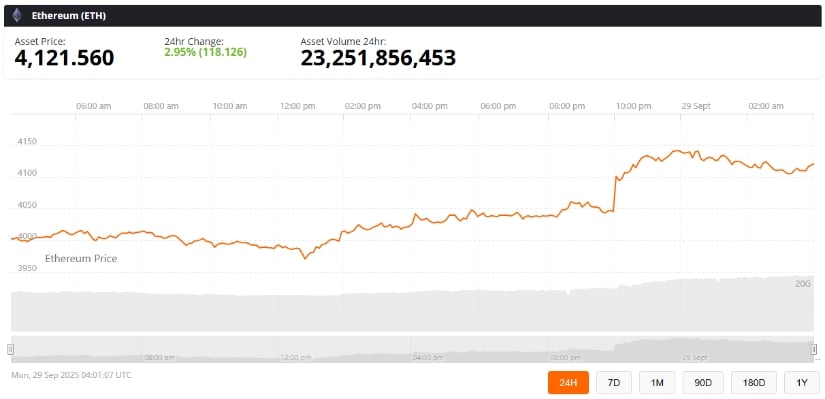

The price of Ethereum now wobbles at $4,121, having mustered a 2.95% rise in 24 hours, per Brave New Coin’s calculations. The market, still reeling from September’s chaos, sways like a drunkard in a tavern. Yet analysts, with the optimism of a man betting on a horse named “Destiny,” insist Ethereum is destined for five-digit glory. One imagines them scribbling graphs while sipping tea, muttering, “Yes, yes, the stars align.”

Trader Ted (@TedPillows), a man whose nickname screams of oversized pajamas, admits the recent drop was inevitable. “ETH’s rebounded 250% from the grave,” he sighs, “so a nap was expected.” He predicts a resumption of bullish antics, with ETH soaring past $10,000. One suspects Ted might also predict rain by looking at his cat’s mood.

The Sacred (and Sinful) Levels of Ethereum

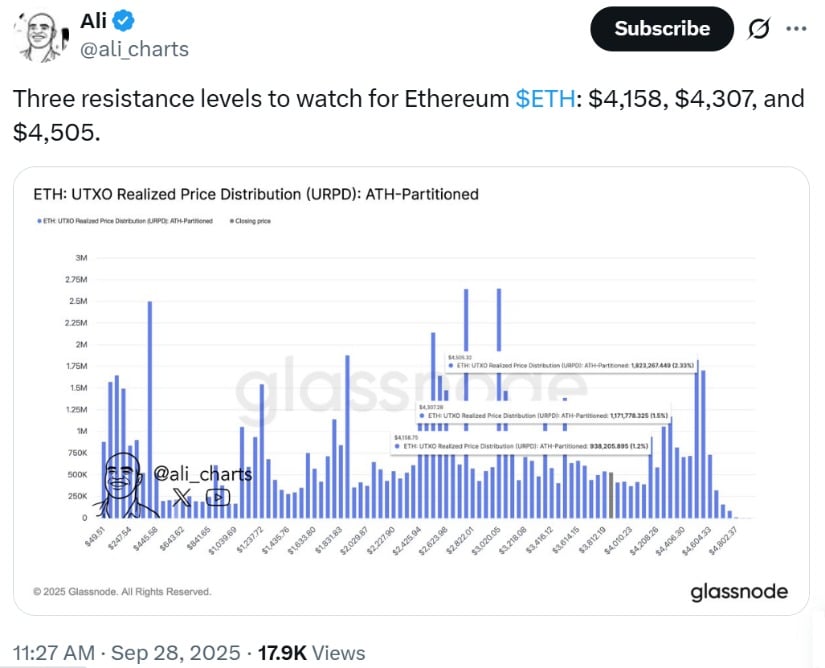

Ethereum now tests zones so sacred, they might as well be guarded by spectral accountants with ledger wands. On the upside, resistance clusters between $4,158 and $4,505, where history whispers of buying frenzies. Yet these levels may summon selling pressure, as investors exit like patrons fleeing a collapsing bridge. A breakout here could send ETH reeling toward its $4,950 high-or perhaps a moonlit sprint to $10,000.

On the downside, support lurks at $3,515, $3,020, and $2,772-price points where buyers might reappear, like villagers emerging from fog to reclaim their fields. ETH briefly dipped to $3,820, a stumble followed by a clumsy recovery. Traders watch, breath held, as if witnessing a bear dance on a tightrope.

Technical Signals: The MACD’s Bullish Waltz

Merlijn The Trader (@MerlijnTrader), a man whose username evokes both mysticism and mild panic, notes Ethereum’s monthly chart has broken free of a descending trendline-a feat akin to escaping a bureaucratic labyrinth. The MACD’s bullish cross? A waltz with destiny, he claims. “ETFs add liquidity!” he declares. One imagines him conducting an orchestra of candlestick charts.

Institutional flows, like a river of gold coins, have funneled $7 billion into ETH ETFs this year. Even temporary outflows of $800 million couldn’t dampen their enthusiasm. Analysts, with the certainty of a man who’s never lost money, insist institutions will keep fueling ETH’s ascent. One suspects they’ve never met a market crash in a tavern.

ETH’s $10K Dream: A Fairy Tale for the Brave

Optimism, that most fragile of currencies, clings to Ethereum. Coinbase analysts link its future to the Pectra upgrade, a solution to scalability and gas fees. They speak of altcoins trailing Bitcoin early in bull markets but overtaking later-like a slow horse gaining speed when the race turns muddy.

Tom Lee, co-founder of Fundstrat, predicts ETH could hit $10,000-$12,000 by year-end. “Price discovery,” he calls it, as if Ethereum is merely choosing a hat for the season. BitMine, now the largest ETH treasury holder, owns 2.41 million ETH worth $10 billion. Their strategy shift? A bold move, or a gamble as reckless as a Cossack charging a dragon?

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Ripple (XRP): Will It Rocket to the Moon or Just Crash and Burn? Analysts in a Frenzy 🚀

2025-09-29 16:20