Traders have practically written in pen a quarter-point cut, daring the U.S. Federal Reserve to prove them wrong at October’s meeting ahead. (Spoiler: They won’t.) 😂

Quarter-Point Trim Leads the Board for October’s Fed Decision 🧠💸

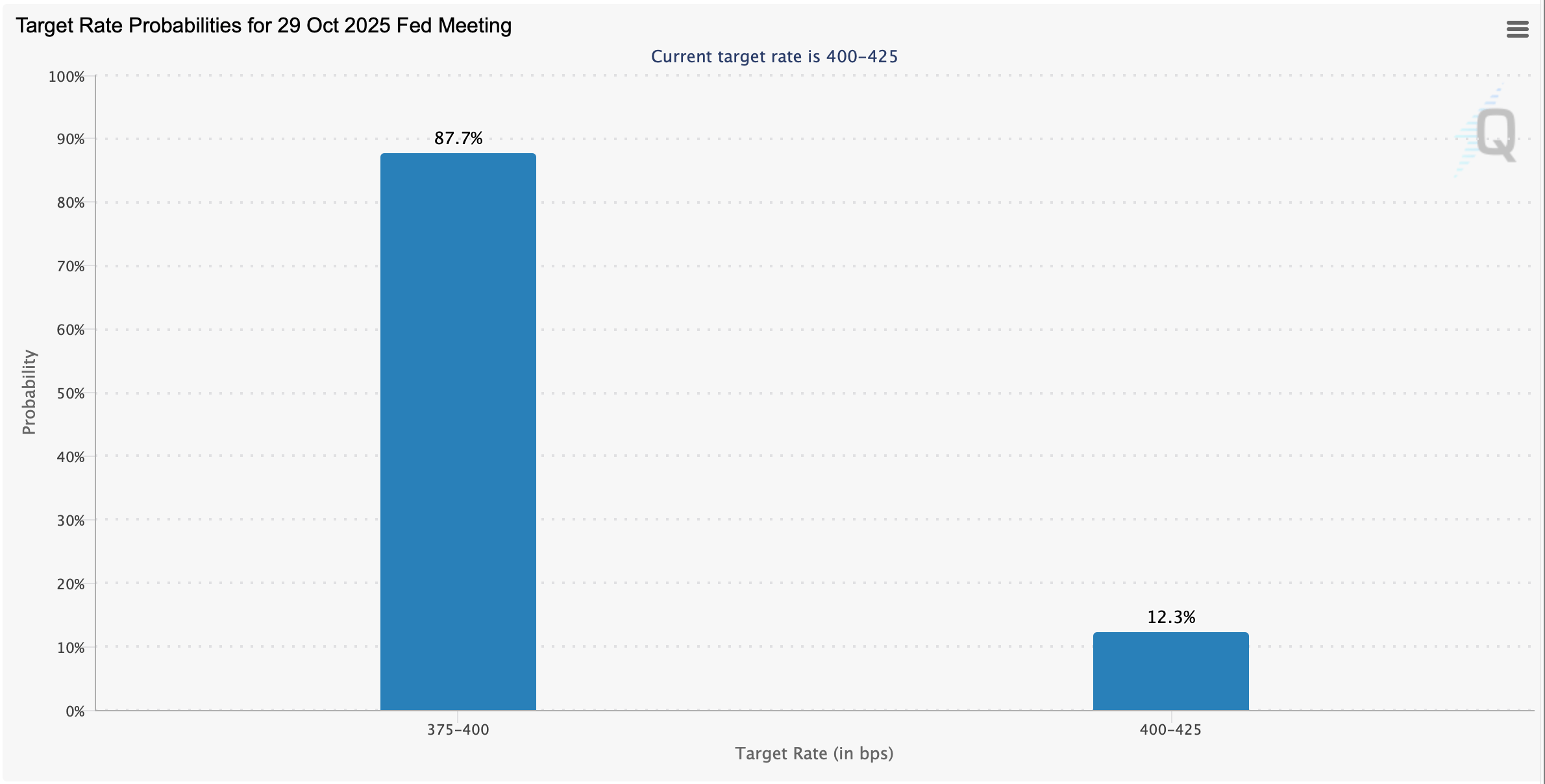

CME’s Fedwatch tool puts numbers to the hunch: with the target currently at 4.00% to 4.25%, the Oct. 29 path most favored is a trim to 3.75% to 4.00%, priced at 87.7%. 🤯

Holding steady at 4.00% to 4.25% sits at 12.3%. Translation: CME futures odds overwhelmingly favor a 25-basis-point cut during the next Federal Open Market Committee (FOMC) gathering. The Fedwatch chart’s two blue bars tell the story at a glance-big bar for a cut, short bar for a hold, nothing else getting airtime. 🚫🔥

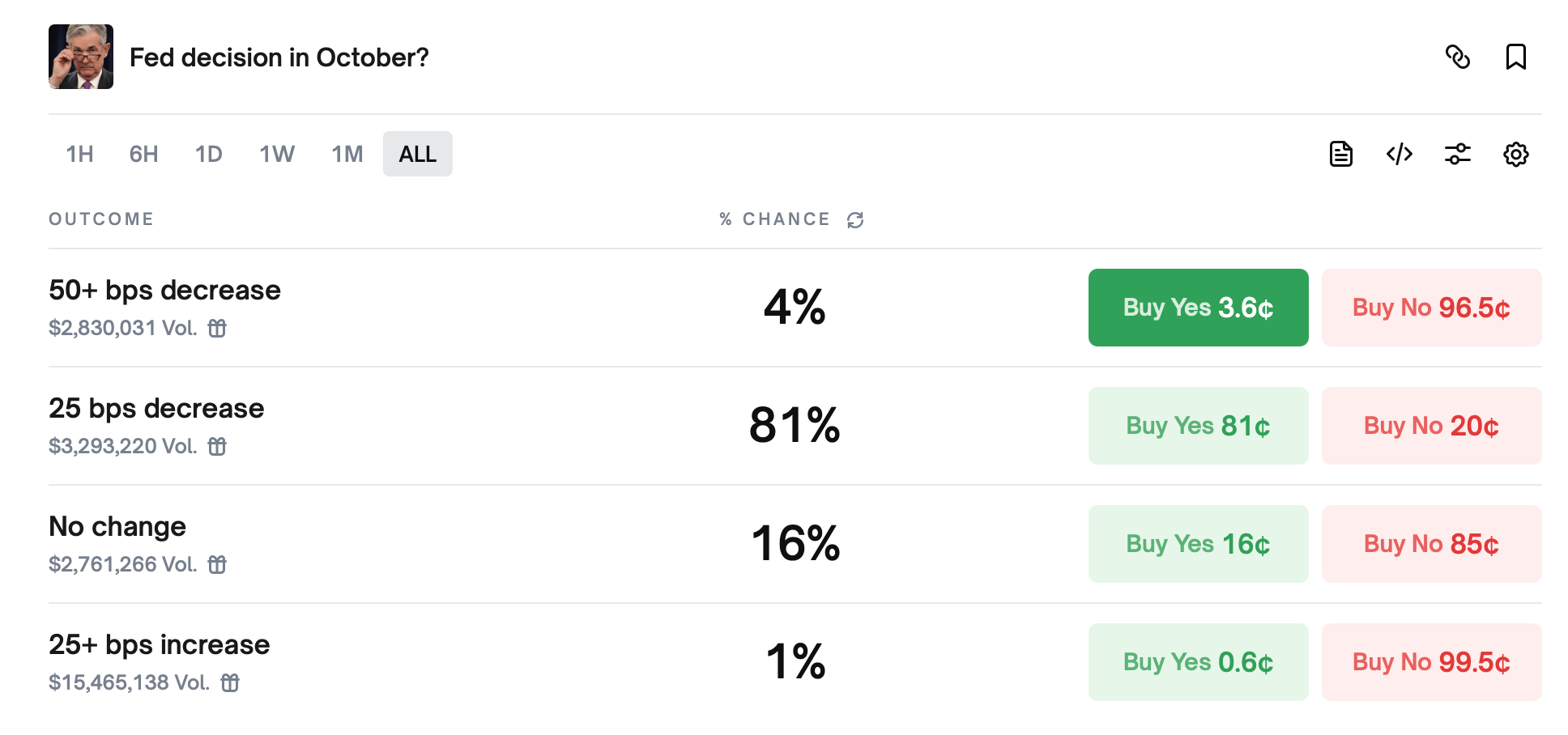

Prediction markets on Sept. 28 rhyme with that view. On Polymarket, traders assign 81% to a 25-basis-point decrease, 16% to no change, 4% to a 50-plus basis-point cut, and 1% to a hike. The market’s vibe: the cut is base case, a larger slice is fringe, and tightening is a museum piece. Yes shares hover near 81¢ for the quarter-point line, a tidy shorthand for crowd conviction. 🧠💸

Kalshi echoes the chorus. Its contract shows 81% for a 25-basis-point cut, 17% for holding the line, and 4% for something deeper than 25. Different venues, different bettors, same punchline: the quarter-point trim owns the stage unless data or guidance torpedoes it. 🚫🔥

For rate-sensitive corners of the market, like bitcoin (BTC), that setup matters. A small cut would ease funding costs at the margin, flatter risk appetite, and keep optionality open for later moves. Still, probabilities are not promises; a hot print or hawkish press conference can flip the board faster than you can say “dot plot.” Liquidity optics aside, forward guidance will likely steer cross-asset moves more than mechanics this time. 🏦💥

Bottom line: positioning heavily favors a gentle step down, but the Fed writes the script on Oct. 29. All eyes in the financial world are fixated on the Fed’s next move. Still, it’s early, and consensus can still be wrong. 🕵️♂️🧐

Read More

- Silver Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

2025-09-28 21:43