In the grand theater of finance, where numbers dance like shadows on the wall of Plato’s cave, the ethereum-liquid staking protocols (LSPs) have witnessed a drama most profound. Lo, for fourteen weeks, they basked in the glow of 690,000 ETH, a bounty that seemed to whisper of eternal prosperity. Yet, as the fickle winds of fortune shifted, 60,000 ETH slipped through their fingers in a mere 27 days, leaving them to ponder the transient nature of wealth. 🌪️✨

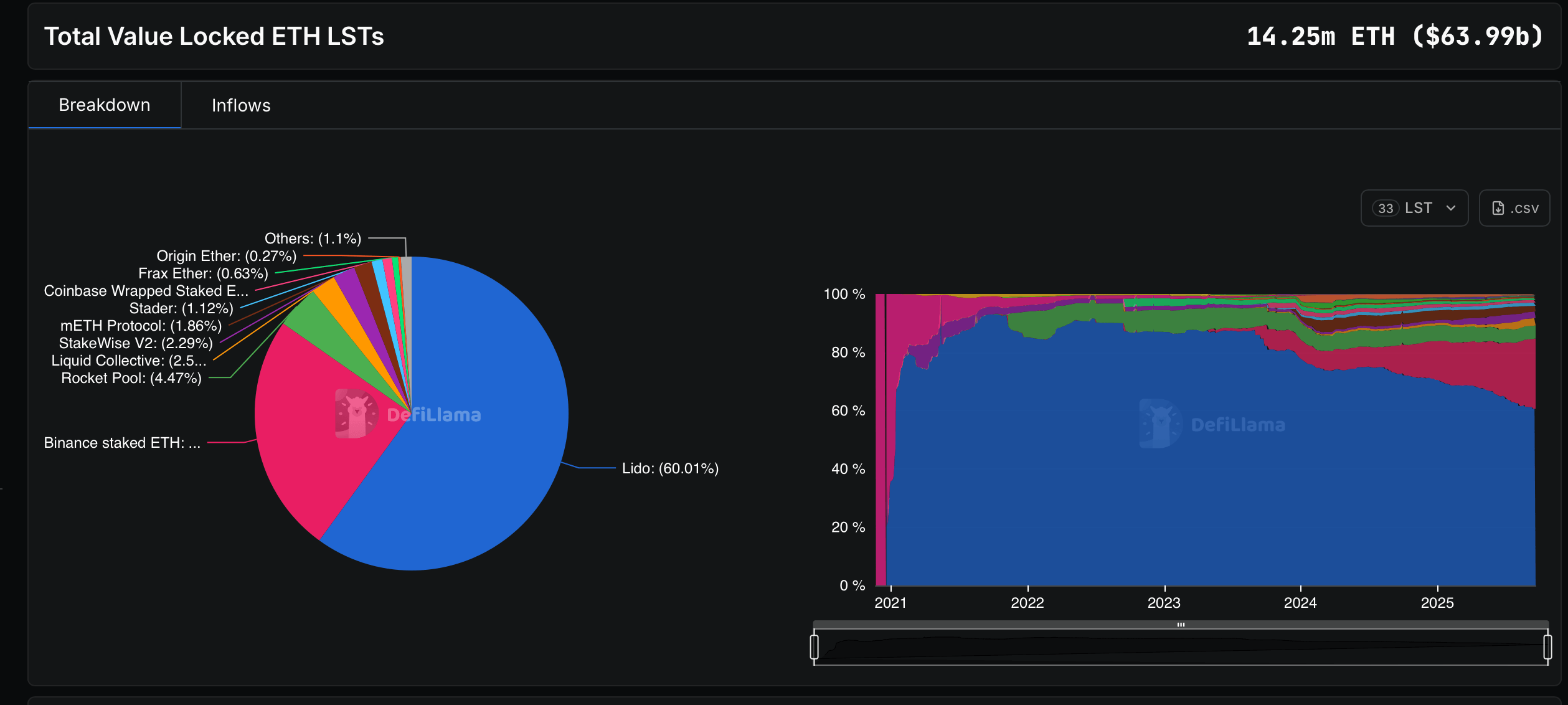

Billions in Flux: Ethereum’s Liquid Staking Reaches $63.99B

The ETH LSPs, once the darlings of the crypto ball, have shed $268.55 million-a sum that would make a tsar blush-since the fateful day of August 24, 2025. Yet, even in their retreat, they command a staggering $63.99 billion of the $87.177 billion locked in liquid staking, a testament to their enduring allure. 🧑🎤💰

Despite the departure of 60,000 ETH, the liquid staking realm remains a spectacle of opulence and intrigue. Lido, the undisputed monarch, reigns with a TVL of $38.524 billion across five chains, its coffers swelling with $21.68 million in fees, though only $2.17 million trickles down as revenue. A kingdom rich in treasure, yet frugal in its distribution. 👑💼

Binance Staked ETH, though smaller in scope, holds its ground with $15.862 billion locked across two chains. Yet, its $8.01 million in fees yields a mere $800,767 in revenue-a tale of grandeur and slender margins. 🚀💸

Rocket Pool, the third in this hierarchy of wealth, holds 636,780 ETH ($2.856 billion TVL), though it has dipped by 0.33% in the past week. Liquid Collective, with 363,138 ETH and $1.629 billion TVL, remains steadfast, barely stirred by a -0.08% shift. Stakewise V2, however, shines brightly, amassing 325,962 ETH worth $1.462 billion, a 1.92% ascent that speaks of ambition and vigor. 🚀✨

The mid-tier players, ever the source of drama, continue their dance. mETH Protocol, with 264,488 ETH ($1.186 billion TVL), bears the week’s deepest wound, an -8.06% drop that leaves it scarred but not broken. Stader, with 160,327 ETH worth $721.88 million, eases by a mere 0.18%. Coinbase Wrapped Staked ETH, however, steals the spotlight with a 10.27% leap to 139,426 ETH ($624.39 million TVL), a performance that demands attention. 🎭💫

Frax Ether, with 90,468 ETH and a $405.82 million TVL, remains nearly flat at -0.12%. Origin Ether clings to 38,039 ETH ($170.63 million TVL), slipping by a mere -0.29%. Crypto.com Liquid Staking, however, flexes its muscles with a +5.68% lift to 36,376 ETH ($162.9 million TVL). Swell Liquid Staking, closing out the top 12, manages 25,327 ETH ($113.6 million TVL), though it contracts by -3.52% since Sept. 13. A tale of rises and falls, of ambition and resilience. 📉📈

In this arena of liquid staking, where billions are wielded like swords and fortunes shift like sands, there is no rest. Lido towers, Binance maneuvers, and the mid-tier players keep the spectacle alive. With inflows turning to outflows, the only certainty is change. Next week’s stats, like the pages of a novel, will tell a new story. 📖🎢

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- BitMine’s 4M ETH Hoard: Stock Valuation Shenanigans 💰💸

- Crypto Riches or Fool’s Gold? 🤑

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Silver Rate Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Brent Oil Forecast

2025-09-21 00:28