So, here we are-Chainlink, the cryptocurrency equivalent of that friend who insists on telling you all about their latest diet while you’re just trying to enjoy your chips and guacamole. Bubbafox has emerged like a robed sage of the financial world, pointing at a long, rounded base (that’s the cup) and a sassy little short handle hovering near the $25 resistance, suggesting a potential rally toward the coveted $30 mark-if, of course, buyers confirm a breakout with a delightful rise in volume. 📊

Now, let’s not forget the 200-day moving average and mid-term trendline, which appear to be the supportive friends in this financial saga, holding their ground and reinforcing bullish momentum above the much-coveted support zone between $21 and $22. Yes, the support zone-the one that everyone talks about but nobody wants to visit on a Saturday night.

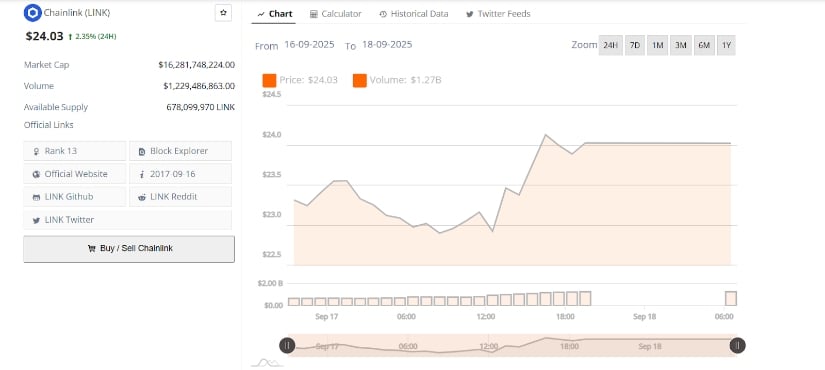

Currently, LINK is lounging around $24.03, up a cheerful 2.35% in the last 24 hours. Its market cap struts around at a breathtaking $16.28 billion, with daily trading volume wearing its best suit at $1.23 billion. The intraday charts are showing buyers valiantly defending the $23.0 to $23.5 support levels. Remember, a decisive close above $23.95 to $24.89 could mean gains galore-if we can just keep that volume up and not let it fizzle out like a bad soda. 🥤

The Cup-and-Handle Drama Unfolds! 🎭

Chainlink is flaunting this grand cup-and-handle pattern, which, if analyst Bubbafox is to be believed, is nearing its climactic conclusion. It’s like a soap opera plot where the cup is the long, rounded base and the handle is just a brief affair with a downward consolidation. Historical market behavior suggests this pattern can lead to an upward price movement, provided the asset manages to clear those pesky key resistance levels. What a plot twist!

Bubbafox identifies the $25 zone as a veritable Mount Olympus of prices to conquer. It seems that a decisive closing above this resistance could pave the way to the $30 paradise or potentially even higher, if buying pressure intensifies. Who knew finance could be so dramatic? 🎬

Support and Trend Indicators: Will They Hold? 🤞

Meanwhile, Chainlink’s chart reveals a sturdy foundation of technical support, like the oversized pillow your grandmother insists you need. The 200-day moving average and a rising mid-term trendline are still there, diligently supporting the broader uptrend. Trading volume is hanging around like that one friend who never leaves the party, maintaining stable levels around that key support range of $21 to $22. We all agree, keeping this zone intact is crucial for the continuation of the cup-and-handle saga.

If the breakout is backed by increasing trading volume, it would almost feel like a fairytale ending. However, Bubbafox warns that if prices drop below the $21-$22 range, our dreams of a breakout might be delayed, much like your last vacation plans. Meanwhile, any resistance-breaking adventures could attract fresh enthusiasm from traders targeting the elusive $30.

Short-Term Resistance and Key Levels: The Waiting Game 🎲

ShardiB2 has also jumped into this financial rollercoaster, laser-focused on the short-time frames. Shardi B notes that the price action is finding itself in a bit of a pickle below $23.95, which is now the short-term resistance level. It’s like trying to peek into a concert that’s sold out-you keep getting rejected every time.

The support near $23.30 appears to be holding up, with buyers doing their best to defend it. However, a close below this level might lead us down the rabbit hole of deeper pullbacks. But, if we get a rebound, we could be back at $23.95, and perhaps even flirting with $24.89. That’d be the financial equivalent of a first date going really well! 🍷

As for hourly momentum indicators like the Relative Strength Index (RSI), they’re dancing between 41 and 58-how scandalous! There’s a mildly bearish tone here, but with no signs of oversold conditions yet. We’d really love to see a strong hourly close above $23.95 to reignite our optimistic spark.

Market Performance and Trading Range: An Upswing Ahead? 🎢

Today, Chainlink is basking in the sunshine at $24, up by an impressive 2.35% over the last 24 hours. Its market cap is strutting around with confidence at $16.28 billion, a daily trading volume of $1.23 billion, and a circulating supply of approximately 678 million tokens. In the previous session, the asset danced from $23.1 to $23.5, dipped briefly to $23.0, only to rebound above $24.0. Quite a pirouette! 💃

The price breakout above $24.0 coincided with some lively trading volume. This frenzy indicates that market participants are eager to keep trying to breach those daunting upper resistance levels, with $24.50 serving as the next psychological barrier-this is not a drill, folks!

The intraday lows near $23.0 are providing immediate support, and traders will be watching this like hawks ready to swoop down on any potential retests. If the buying momentum holds up-fingers crossed-we’re staring down the barrel of a possible journey towards $25 and beyond, as we all watch with bated breath for that grand breakout toward the mythical $30 realm. 🏞️

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- AVAX Soars Again! Is the Crypto World Turning Tides? 🚀

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

2025-09-19 00:55