Ah, Bitcoin! The digital gold that’s been the talk of the town, especially for the corporate high rollers. 2025 has been quite the spectacle, a year of record-breaking moves for Bitcoin treasury companies, but hold on-CryptoQuant’s data suggests the momentum might just be slipping through our fingers like sand.

Bitcoin Treasuries: Slowing Down or Just Taking a Breather?

In the grand theater of corporate finance, the Bitcoin treasury strategy has played its part with much flair, thanks to the ever-dashing Michael Saylor (who, let’s face it, made “buy Bitcoin, hold Bitcoin” a lifestyle). The idea is simple: publicly traded companies stash BTC in their reserves, like a rich uncle hoarding coins in a dusty vault. And what a hit it was! In fact, this strategy was looking like the corporate equivalent of winning the lottery.

During the previous cycle, Bitcoin treasuries were all the rage, but in 2024, things hit full throttle. Take a look at the graph, my friends! In 2023, only 15 companies were game enough to jump in, but in 2024, that number skyrocketed to a whopping 38. Suddenly, it was cool to be the crypto-rich kid in town.

Fast forward to 2025, and we’re at 89 companies, ready to ride the Bitcoin wave to the moon. But… and here’s the twist: just when you think it’s all going up, the plot thickens. CryptoQuant’s latest data reveals a subtle yet telling slowdown. Could it be? Could the Bitcoin treasury dream be facing a mid-life crisis?

Observe, dear reader, how in July, 21 companies were all in. Then, in August? A dramatic drop to 15, and by September’s first half, a mere one new company joined the ranks. Slowdown? It’s like a movie with too many plot twists. CryptoQuant, ever the truth-teller, says, “the slowdown has begun.” Someone hand them an Oscar!

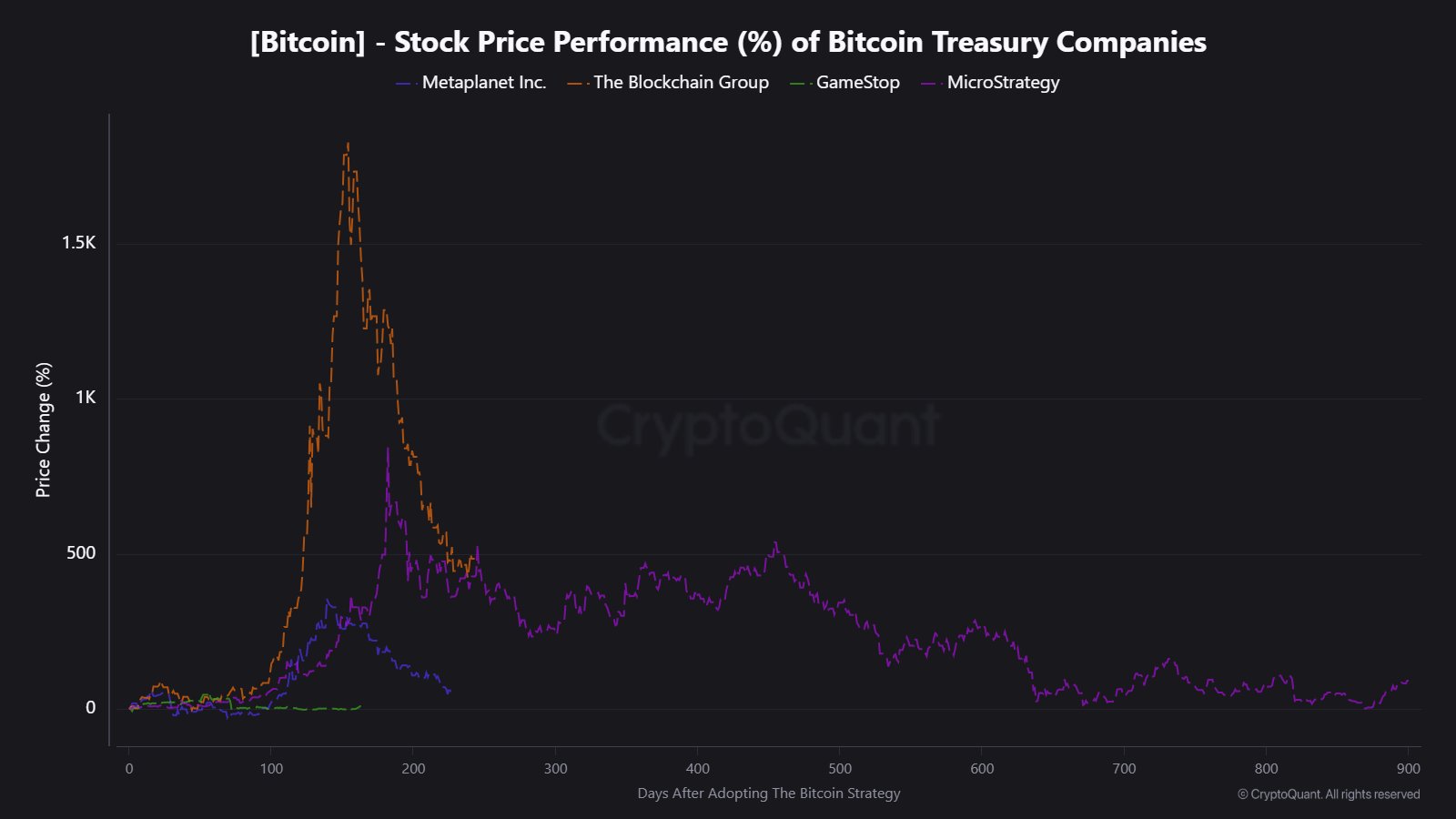

Of course, this is reflected in the stock prices of some of these valiant Bitcoin holders. The Blockchain Group peaked at an astonishing +1,820%, only to tumble down to a modest +443%. Metaplanet too had its highs-peaking at +355% and now languishing at +55%. Reality, as they say, has entered the building!

However, don’t go thinking the corporate Bitcoiners have given up the ghost just yet. Strategy (still the top dog) has gone on a shopping spree this year, adding a cool $19.3 billion to its Bitcoin stash. Metaplanet has joined the party, putting an additional $1.92 billion in the kitty.

All in all, these corporate titans control over 1 million BTC tokens-5% of the total Bitcoin supply. And just so you know, Strategy alone holds a commanding 66% of this stack. If that’s not a power play, I don’t know what is.

BTC Price: Going Up, Up, and Away?

And if you’ve been wondering how Bitcoin is doing on the price front, well, buckle up! The price of Bitcoin has just soared to $116,600, leaving some old-school investors wondering if they’ve missed the boat.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

2025-09-18 01:19