Oh, the whims of fate! The U.S. Federal Reserve, in a fit of bureaucratic benevolence, has deigned to lower its policy rate by a mere 25 basis points-the first such act since the frosty December of 2024. A gesture so grand, yet so fleeting, like a sneeze in a hurricane! 🌪️

Fed’s Scissors Snip, and Bitcoin Takes Flight-But Oh, the Irony! 🚀✂️

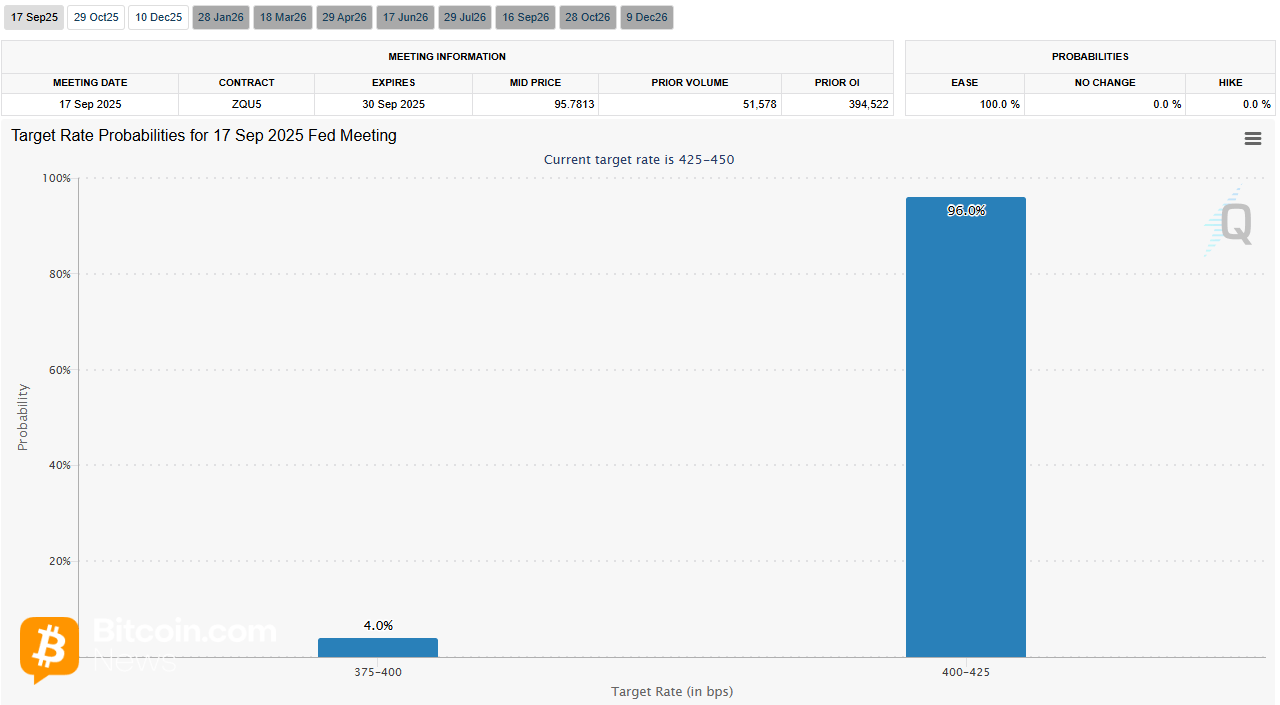

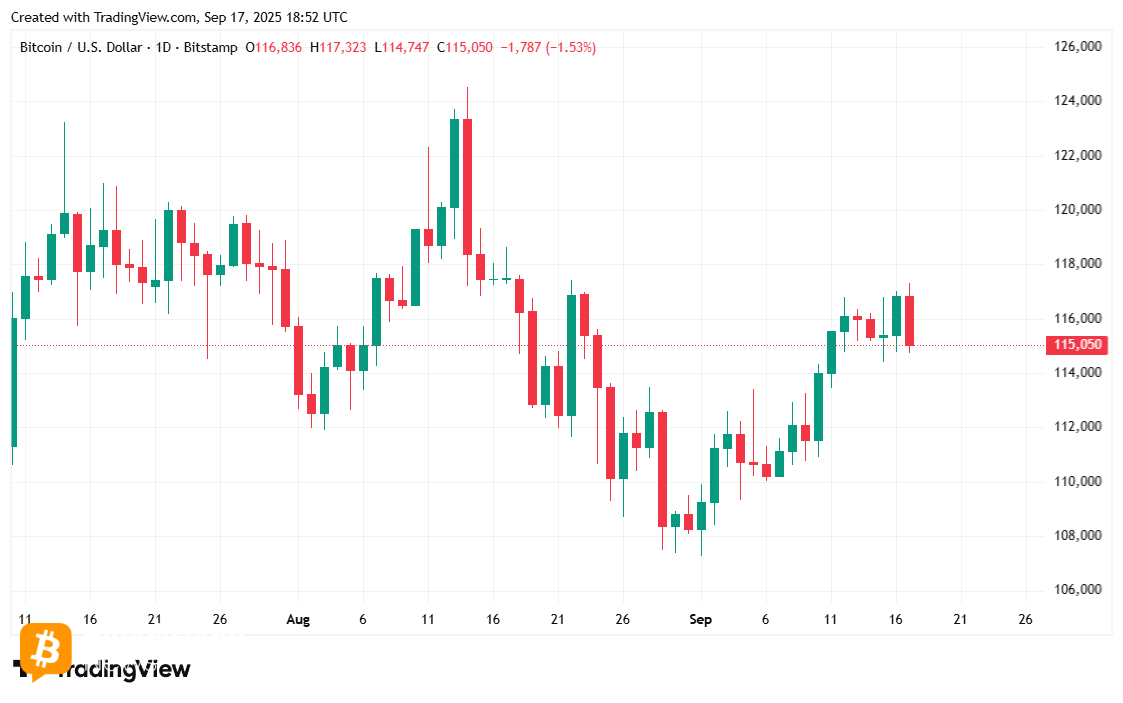

Ah, Wednesday’s rate cut! A spectacle as predictable as a rooster’s crow at dawn. The CME Group’s Fedwatch Tool, that oracle of financial whimsy, had already whispered a 96% chance of this 25-basis-point cut, with a mere 4% chance of a bolder 50-basis-point slash. Yet, the markets, ever the dramatic souls, gasped and fluttered as if witnessing a miracle. Bitcoin ( BTC), that fickle darling, leaped to $116K, only to stumble back to $115K faster than a drunkard on a tightrope. 🕺💸

Last week, the employment data played its part in this farce, startling economists with a surge in unemployment claims-a record, they say! And then, enter Stephen Miran, Trump’s nominee, confirmed as a Federal Reserve Board governor just in time to call for a 50-basis-point cut. A lone voice in the wilderness, crying out for more! Yet, even with this cut, BTC treads water, stuck in its $115K-$116K purgatory. Will October or December bring salvation? Or is this the final act of 2025’s BTC rally? 🎭

“The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen,” proclaimed the Fed in its Wednesday press release. A statement so grand, so filled with bureaucratic poetry, it could make even the most stoic soul weep. “In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4 to 4.25%.” 🧐📜

And what of President Trump, on his state visit to the United Kingdom? Silence. Not a peep. The man who once railed against Fed Chair Jerome Powell, who tried to fire Fed Governor Lisa Cook on allegations of mortgage fraud, and whose nominee, Adriana Kugler, quit amid the drama-he remains mute. A rare moment of peace, perhaps? 🤫🇬🇧

A Glimpse into the Absurdity of Market Metrics

Despite the rate cut, bitcoin remains down 1.00% over 24 hours, lingering at $115,143.95. A price that has danced between $114,803.05 and $117,328.61 since Tuesday-a waltz of numbers, a ballet of uncertainty. 💃📉

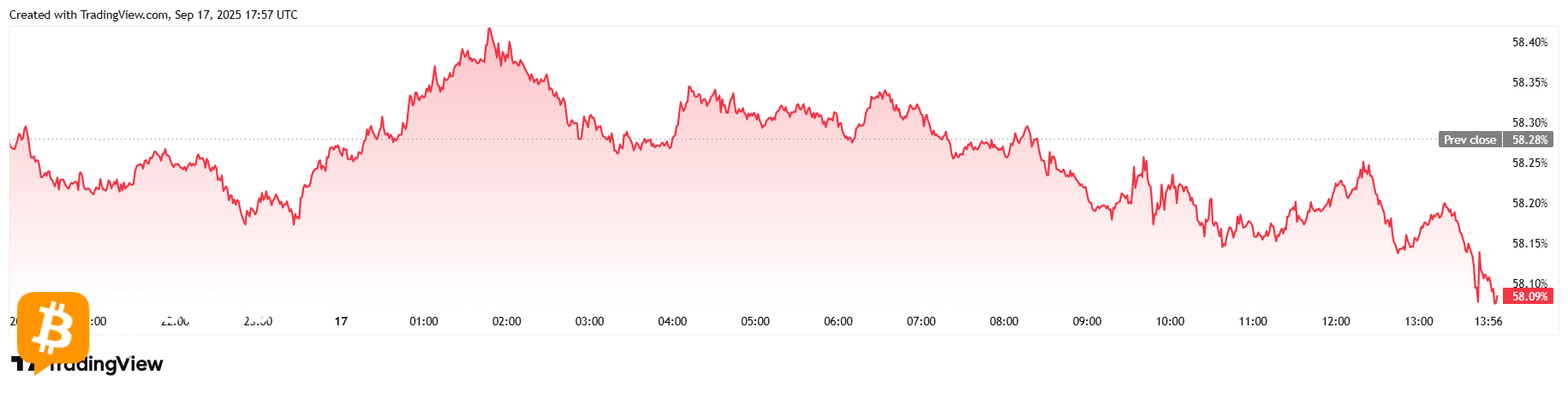

Trading volume, ever the optimist, rose 8.02% to $49.45 billion, while market capitalization, like a deflating balloon, dipped 0.95% to $2.3 trillion. Bitcoin dominance, initially stagnant, eventually fell 0.37% to 58.09%. A tale of rise and fall, of hope and despair. 🎈📊

Total bitcoin futures open interest dipped 0.71% to $83.07 billion, while liquidations reached $25.39 million-a grand total, indeed! Long liquidations of $14.51 million led the charge, with shorts trailing at $10.88 million. A financial tragedy, played out in numbers. 💔💰

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Will BNB’s $600 Wall Finally Crumble? Spoiler: The Hodlers Are Plotting 😉

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

2025-09-17 22:28