As the Federal Reserve convenes today, one might observe-quite amusingly-that crypto aficionados are diligently topping off exchange coffers, perhaps in hopes that a modest 25-basis-point cut will transform their fortunes overnight.

Pre-Fed Positioning

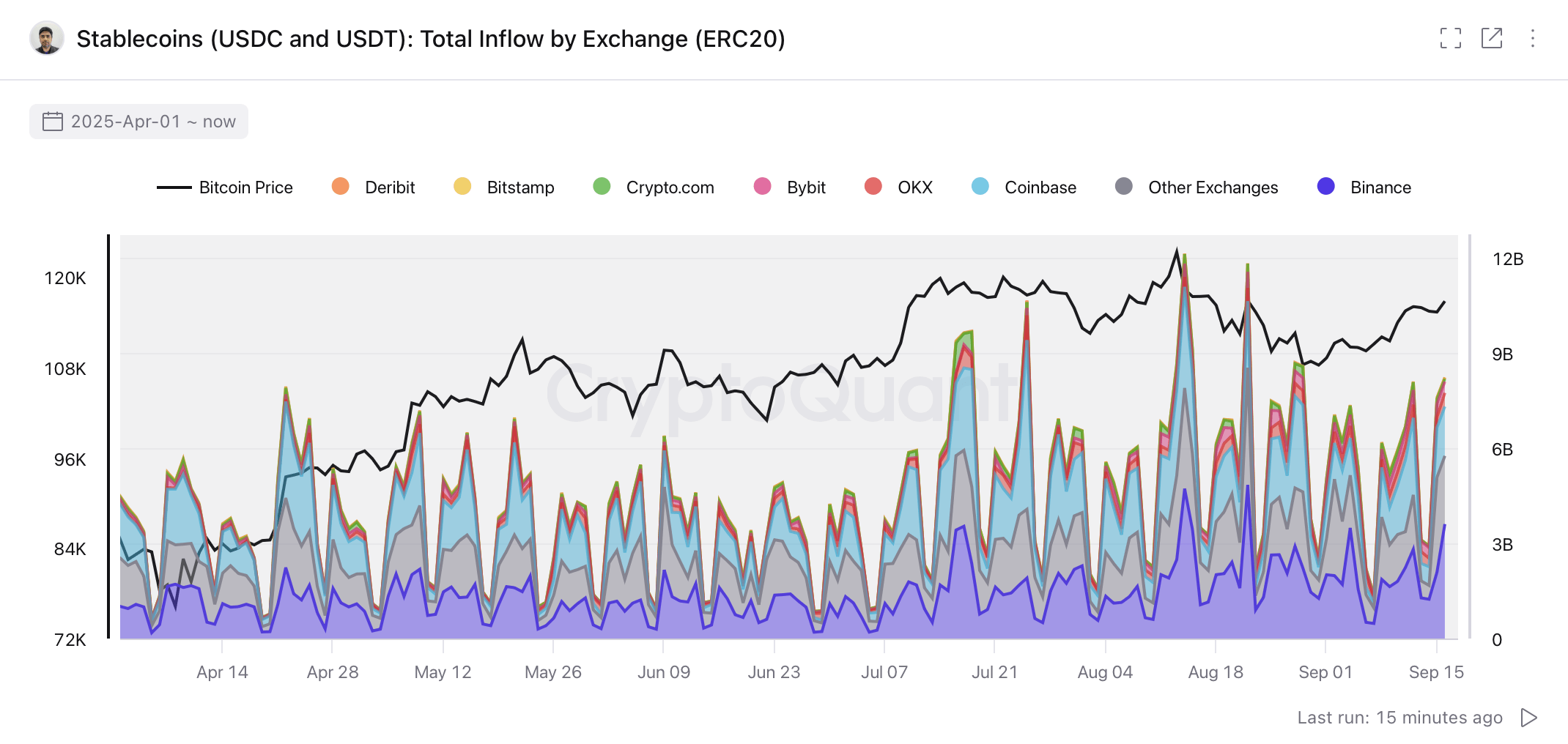

It appears that those ever-reliable stablecoins have taken upon themselves the rather thankless task of bearing the bulk of this capital manoeuvring. The esteemed Cryptoquant reveals a substantial influx-no less than $7.6 billion of fresh USDT and USDC (ERC-20) tokens-striding grandly towards various trading establishments in anticipation of the forthcoming decision. Of this considerable sum, about $2.1 billion found temporary refuge with Binance, another $1.6 billion turned its attentions to Coinbase, whilst the remaining $3.9 billion scattered themselves rather indiscriminately among their lesser-known cousins.

Julio Moreno, the distinguished Head of Research at Cryptoquant, observes that this burgeoning pile indicates capital is thoughtful enough to remain comfortably ensconced within centralized venues whilst traders await the solemn proclamations and theatrical display known as Jerome Powell’s press conference. It is not merely an increase in stablecoins, dear reader-it is an escalation in the size of their wagers; evidently, whales are making quite the splash.

The average USDT deposit has surged impressively, nearly doubling since July-from a modest $63,000 to a rather ostentatious $130,000 presently. Whale-sized transfers, much like those extravagant parties of the ton, prefer the distinguished exchanges of Binance, Bitstamp, and Deribit, where average transaction sizes command $214,000, $181,000, and $166,000 respectively.

Meanwhile, altcoins seem to be packed away as though preparing for a lengthy sojourn-perhaps a genteel retreat. Mr. Moreno articulates that the weekly total of altcoin deposits rose to 55,000 after languishing between 20,000 and 30,000 during the languorous months of May and June.

Further data from Cryptoquant reveals that the majority of these flows grace the halls of Binance (25,000) and Coinbase (6,000), leaving a remainder-about 15,000-to trail among assorted rival platforms. The activity of addresses echoes a similar tale: depositors have spirited themselves away from 23,000 at the commencement of September to 42,000 presently. Such behaviour suggests either a tasteful profit-taking or a prudent pivot to cash, at least until policy pronouncements dustle the scene anew.

Those who frequent derivative desks lean similarly; open interest at exchanges flipped soaringly positive over the past 24 hours, first time since September 13. New longs and short coverings abound, much like guests arriving fashionably late. Binance enthusiastically led this dance with an increase of $166 million, closely followed by OKX at $131 million-an orchestra perfectly poised to amplify any price movements that might dare follow the Fed’s unveiling.

Should the committee graciously deliver the long-anticipated 25 basis-point trimming, rest assured this freshly summoned cash might deploy with all the alacrity of Regency gossip. Yet, a surprising twist could descend into a rather messy reset-chaos, dear reader, cloaked in elegance. While these subtle signals hardly promise a grand rally, they do sketch a market eager to buy dips rather than sell frenzies, provided liquidity and policy compose harmoniously. Such a scene mirrors previous policy weeks when stablecoin inflows climbed like ticks at a summer ball-promising, yet without guarantee of repetition.

The polished analysis and charts from Cryptoquant’s keen-eyed analyst portray a simple narrative: investors are queuing with impatience at the doors of centralized venues, awaiting Powell’s final cue-a moment as eagerly anticipated as the next season of one’s favourite drama.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

- ZK Price: A Comedy of Errors 📉💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

2025-09-17 19:08