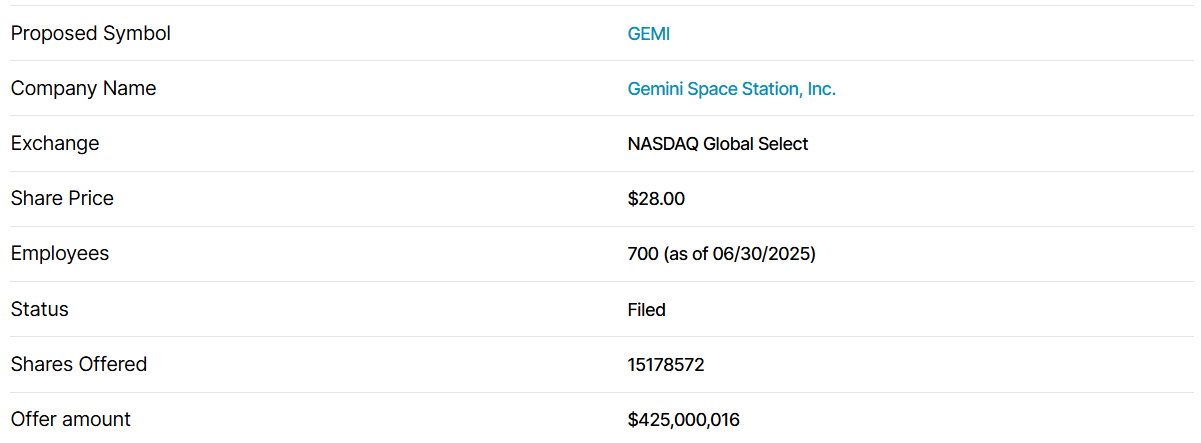

Gemini Space Station, that charming cryptocurrency emporium conjured by the illustrious Winklevoss twins-Cameron and Tyler, no less-has at long last launched itself upon the merciless seas of public markets. Pricing their initial public offering at a sprightly $28 per share, they gallantly sailed beyond mere mortal expectations of $24 to $26. Come September 12, 2025, eager gamblers may seek their fortunes on the Nasdaq, under the magical ticker symbol GEMI. Because if there’s anything Wall Street loves more than acronyms, it’s celestial-sounding ones.

It appears investors, in their infinite wisdom or collective madness, have clamored for a slice of this cosmic pie with such fervour that the offering is oversubscribed by a whopping twentyfold. Gemini has parted with 15.1 million Class A shares, garnering a princely sum of $425 million. Enough, one might hope, to bankroll their next venture-whether that’s a trip to Mars or a more dependable server infrastructure. The passing of the IPO’s banal baton is scheduled for September 15, 2025.

In a move dripping with transparency, a press release states that Gemini and the seller-stockholders have very kindly offered the underwriters a 30-day option to purchase a few hundred thousand additional shares-because why wouldn’t the appetite for more shares be insatiable? Rest assured, Gemini will not see a single penny from the selling stockholders’ sales. Charity begins at home, but apparently, profits do not.

The grand orchestration of this financial ballet is directed by none other than Goldman Sachs & Co., Citigroup, Morgan Stanley, and Cantor-the usual suspects-while a veritable parade of lesser-known banks line up as bookrunners and co-managers. One might imagine a scene less like high finance and more like an episode of Downton Abbey where everyone is jockeying for their cut of the opulent banquet.

A New Chapter for Crypto on Wall Street

Traditional financial mavens, those stodgy paragons of prudence, are not merely lending their genteel approval to crypto ventures, but diving headlong into the murky waters themselves. Nasdaq’s princely $50 million private placement in Gemini serves as the gilded seal of endorsement, proving that even the oldest institutions can catch the crypto bug.

Now, one might raise an eyebrow at Gemini’s prospectus, which reveals a rather alarming net loss-though, Heaven forbid, that should deter a barrage of eager investors gazing starry-eyed into the future. They wager not on short-term profits, but on the tantalizing promise of a digital currency utopia, all wrapped up in Gemini’s boastful cloak of regulation, security, and user-friendly bells and whistles. After all, when one invests in the rapidly evolving crypto markets, one simply must have faith-or a very thick wallet. 🚀💰

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Silver Rate Forecast

2025-09-12 19:17