In just over a week, on September 17, there’s a possibility that the Federal Open Market Committee (FOMC) could lower interest rates by half a percentage point, as suggested by prediction markets. This shift in expectations came after data collected on September 10 hinted at a stronger likelihood for a more significant rate cut, which has sparked optimism among cryptocurrency enthusiasts once again.

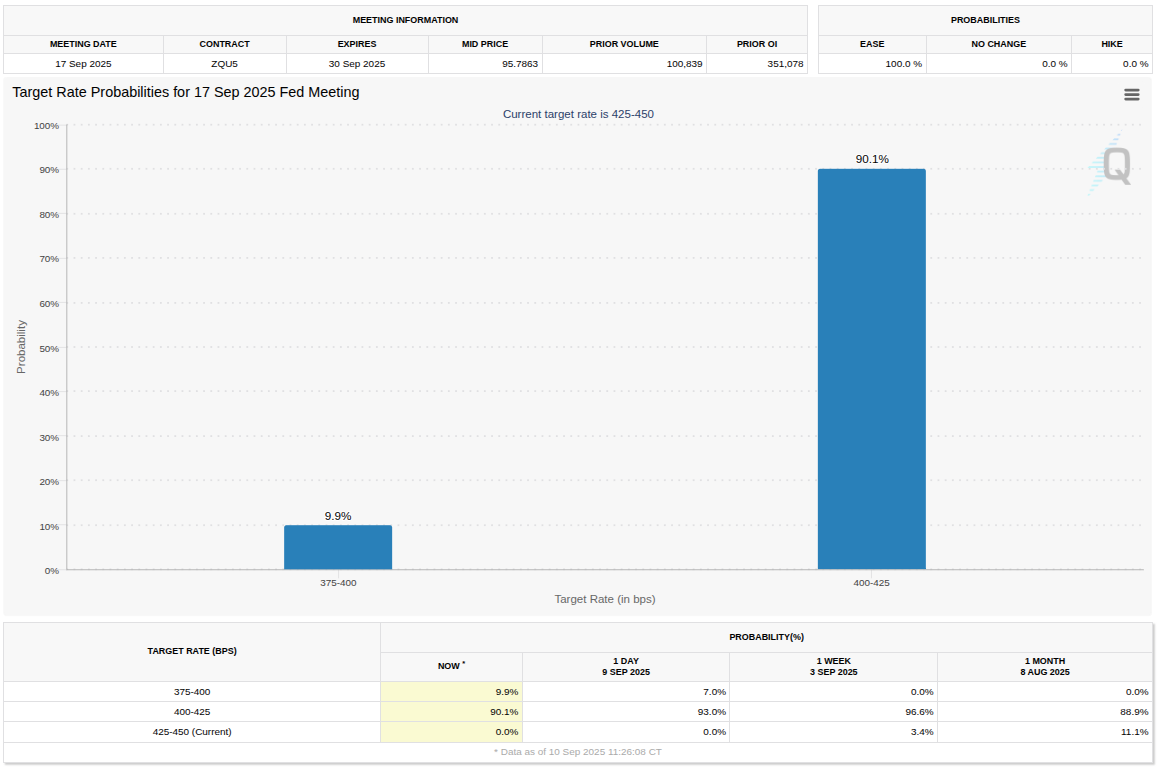

Specifically, the FedWatch tool from the CME Group suggests a roughly 10% likelihood of a new target range for rates between 3.75% and 4% following the meeting, based on data collected from various interest rate traders’ activities. This tool is widely recognized as a reliable predictor for these types of meetings.

Before last Friday, September 5, it wasn’t an option that we were considering, as the market had priced in a nearly guaranteed 25 basis point interest rate reduction to a range of 4% to 4.25%, with only minimal chances of no reductions at all. However, those possibilities have now been entirely ruled out.

FedWatch: Target rate probabilities for 17 Sep 2025 Fed meeting | Source: CME Group

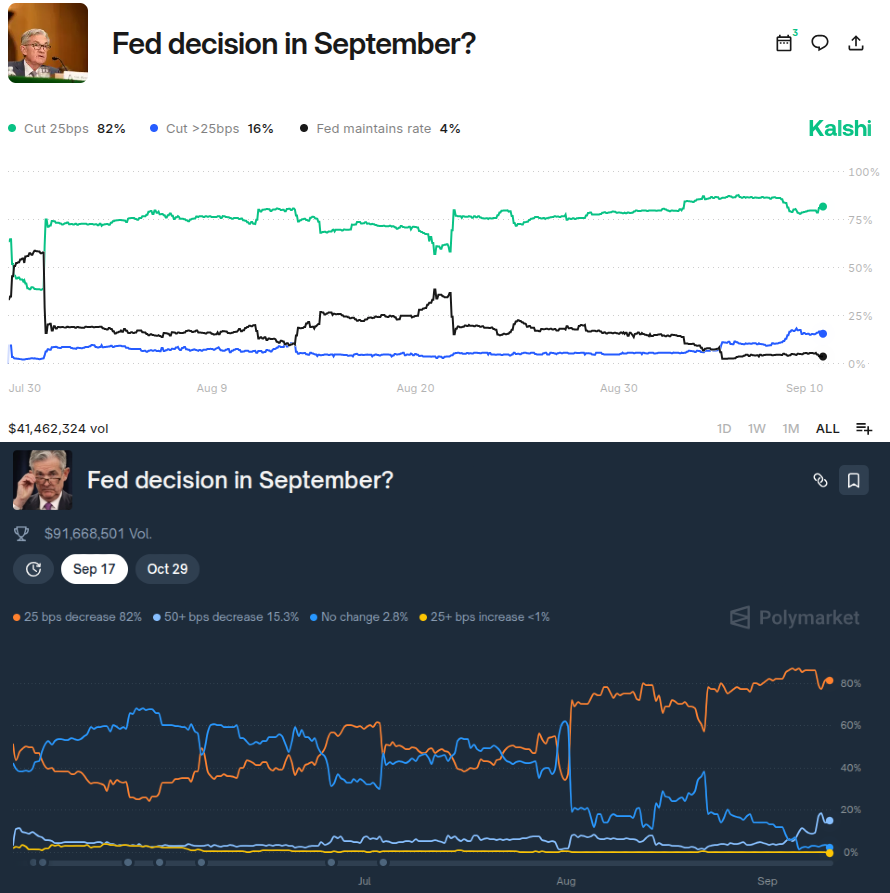

On popular forecasting platforms like Kalshi and Polymarket, you’ll notice a comparable pricing structure, albeit slightly more competitive or aggressive.

Initially, traders on the platform Kalshi predict a 16% likelihood for an interest rate cut that exceeds 0.25 percentage points, with a total volume of over $41 million wagered on this particular outcome. Meanwhile, traders on Polymarket anticipate a slightly higher probability of a 0.5 percentage point cut, with a whopping $91 million in accumulated bets – more than twice the amount on Kalshi.

Prediction market bets: Fed decision in September | Source: Kalshi (top), Polymarket (bottom)

Lowering interest rates generally leads investors to view riskier assets such as cryptocurrencies and stocks more favorably, since the reduced interest rates encourage a shift of substantial funds and liquidity away from safer investments like treasury bonds towards these alternatives that offer higher potential returns despite their increased risk.

During Jerome Powell’s tenure as president of the Federal Reserve, there has been a noticeable hesitance to lower interest rates since December 2024, the last time such a move was made. Recent Producer Price Index (PPI) data coming in at 2.6%, lower than the previous and expected 3.3%, combined with employment reports and other factors, have caused a shift in market predictions.

Bitcoin (BTC) is currently trading at $113,988, showing a 24-hour volatility of 2.2%. Its market capitalization stands at a staggering $2.27 trillion, and in the last 24 hours, it has traded a volume of $51.63 billion. Ethereum (ETH) is also affected by these changes, currently valued at $4,353. It exhibits a more stable volatility of 0.9%, with a market cap of $525.39 billion and a 24-hour trading volume of $33.88 billion. Other cryptocurrencies are also reacting to these fluctuations.

Crypto Index and Bitcoin Price Analysis

Currently, Bitcoin is trading above $113,750, which represents a 2% increase from its closing price on September 8, which was $111,500. The overall value of all cryptocurrencies, as indicated by TradingView’s Crypto Market Cap Index (TOTAL), stands at approximately $3.88 trillion, marking a 1.5% rise from the $3.82 trillion recorded during yesterday’s close on the daily chart.

Crypto market cap index (TOTAL) and Bitcoin (BTC) daily (1D) chart | Source: TradingView

Over the last couple of years, Bitcoin has significantly influenced the overall crypto market index due to its dominant position. However, a shift seems to be happening recently, as the index appears to be slightly separating from Bitcoin, possibly indicating a decline in Bitcoin’s market dominance. Meanwhile, alternative cryptocurrencies, or ‘altcoins’, are gaining more attention and control over the market share.

In simpler terms, experts predict that the separation between major cryptocurrencies (like Bitcoin) and smaller ones (altcoins) will become more pronounced during a bull market, leading to an altcoin surge or “altseason.” This could be initiated by a significant reduction in interest rates by the Federal Reserve on September 17. Additional indicators supporting this prediction include a unique minting of 2 billion USDT by Tether for the first time since December 2024, coinciding with the last rate cut, and movements in the Nasdaq related to the introduction of tokenized securities trading in the U.S.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- XRP’s Quest for $3: A Tale of Volume and Vexation 🏛️💰

- Whale of a Time! BTC Bags Billions!

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-09-11 02:43