Good heavens, what a turn of events! Bitcoin ETFs, those darling darlings of the financial sphere, managed a mere $23 million in net inflows on Tuesday, entirely owing to Blackrock’s IBIT. Meanwhile, ether ETFs, after a most trying six-day ordeal of outflows, rallied with a $44 million inflow, led solely by the indomitable ETHA. 🌈✨

Ether ETFs At Last Break Their Unfortunate Streak, While Bitcoin ETFs Struggle to Maintain Their Composure

At long last, relief has graced the ether exchange-traded funds (ETFs) on Tuesday, September 8th, putting an end to their most lamentable six-day streak of outflows. The modest green close, though hardly a cause for unbridled jubilation, arrives as bitcoin ETFs present a most mixed picture, buoyed by Blackrock yet weighed down by their less fortunate rivals. 😏💼

Bitcoin ETFs, those fickle creatures, recorded a net inflow of $23.05 million, though the day was anything but serene. Blackrock’s IBIT, ever the paragon of institutional favor, delivered a commanding $169.31 million inflow. Yet, selling pressure from other quarters most effectively diluted these gains. 🤑💨

Ark 21Shares’ ARKB, alas, shed $72.29 million, Fidelity’s FBTC lost $55.81 million, and Bitwise’s BITB gave up $18.15 million. Despite these mixed flows, trading activity remained robust, with $3.03 billion in total value traded, while bitcoin ETF net assets settled at a not inconsiderable $144.30 billion. 📈📉

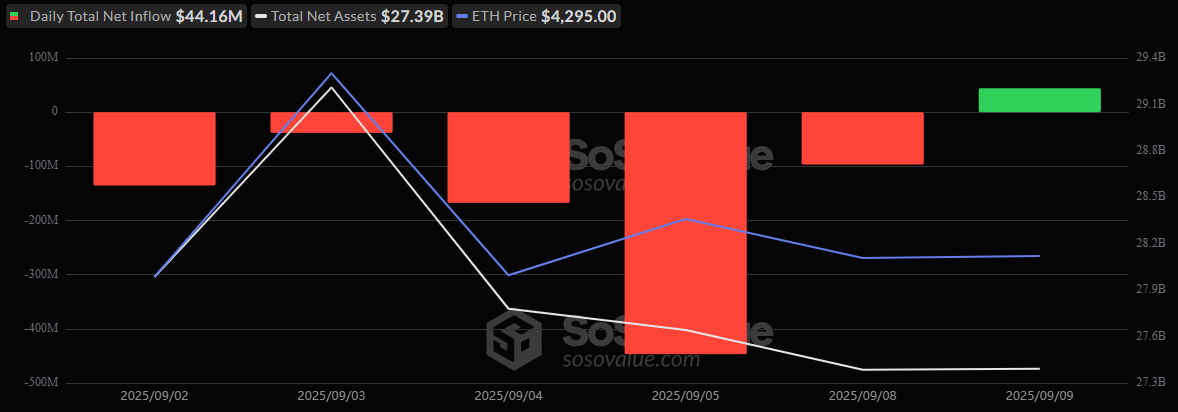

Ether ETFs, those resilient souls, managed to turn the tide. After nearly a week of relentless redemptions, the sector logged a $44.16 million inflow, entirely driven by Blackrock’s ETHA. None of the other funds recorded any flows, but this singular green push was sufficient to end the streak. Daily trading volume stood at $1.28 billion, with net assets steady at $27.39 billion. 💪💚

Tuesday’s flows underscore a most familiar theme: Blackrock continues to anchor both bitcoin and ether ETF demand, while their competitors face sharper redemptions. Whether ether can build upon this fresh momentum or revert to outflows shall be observed with the keenest interest in the days ahead. 🕵️♀️🔮

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Silver Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- 50bps Fed Rate Cut Could Spark Massive Crypto Altseason – Are You Ready to Profit?

- Whale of a Time! BTC Bags Billions!

- 🤑 New Hampshire’s Bitcoin Bond: Revolution or Reckless Gamble? 🤑

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-09-10 21:58