Ah! The mighty halls of Wall Street, where fortunes are tossed about like handkerchiefs at a feverish ball, now find themselves stricken by a curious ailment: a distinct lack of enthusiasm for those parading Bitcoin on their stately ledgers. Such is the lament of the illustrious New York Digital Investment Group.

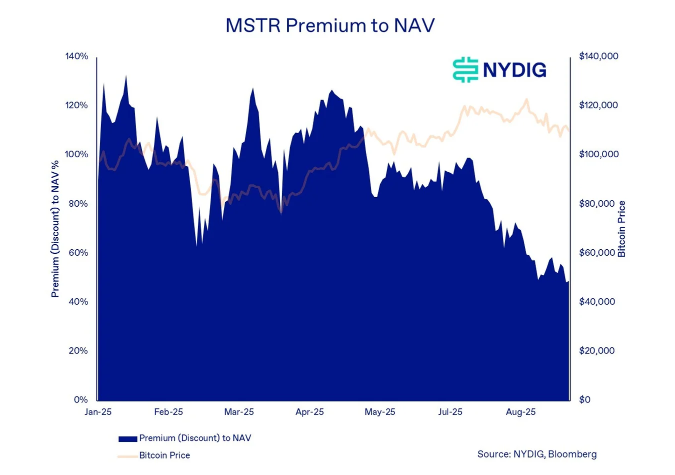

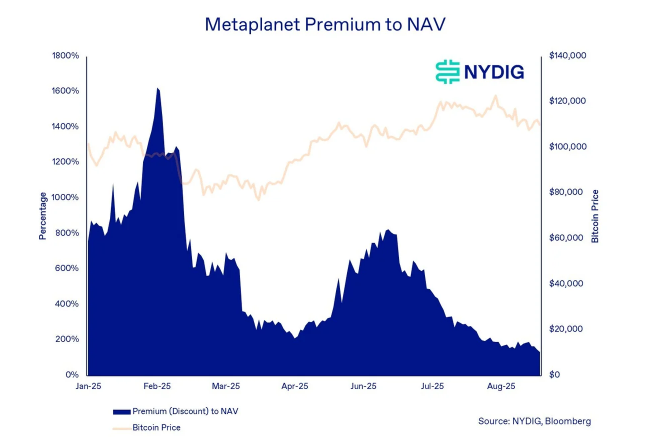

Monsieur Cipolaro, global sage and number-wrangler of the firm, observes-no doubt with a sigh robbed from the heart-that the delicious gap betwixt price and value for these Bitcoin-loving companies has narrowed most ominously, even as the coin itself was recently flaunting new heights like a bold peacock in spring.

“Why this decline?” you cry! The answer, dear reader, is a festival of fiscal follies: supply unlocks lurking about the corner, fresh share confetti raining down upon the masses, and companies indulging in capitalistic whims like a dandy in new shoes. Investors, always ready to snatch profits, now squint at the lack of unique flavors in the Bitcoin soufflés each company offers. Oh, variety, where art thou?

Premiums On The Slide (Cue Dramatic Music)

Worry not if the taste for token unlocks gives you indigestion; it’s a widespread affliction! Cipolaro lists other complaints, too: corporate ambition loses its sparkle, investors cash out with the subtlety of a stage exit, and the cast of Bitcoin-holding players all look uncannily alike-no star performer, alas!

Metaplanet and Strategy-those theatrical proxies for Bitcoin-driven ecstasy-see their gaps shrink faster than the patience of an investor at a late intermission. Stocks once soaked in premium now resemble the coin itself, flatter and not quite the toast of the town.

Buying Activity Faints on Stage

Rejoice, for reports have disclosed a climax: 840,000 BTC stashed away by publicly Bitcoin-besotted companies this year. Strategy, the grand duchess, has snatched a third of the loot, boasting 637,000 BTC, while thirty less ostentatious suitors clutch the remainder.

Alas, the drama sours! Data paints a portrait of waning purchases: Strategy’s bravado plunged from 14,000 BTC in its heyday to a paltry 1,200 in August. The chorus follows suit with an 86% slump. Monthly growth? It tiptoes from a vivacious 40% in 2024 to a meek 5%-as if the last applause is barely audible.

The latest comedy: treasury players now trade at or below their last fundraising spectacle. The plot thickens. Should new shares strut freely onto the market and their owners bolt toward the exit, a stampede may well ensue, sending prices tumbling faster than a jester tripping over his own shoes. 🎭

Ever the oracle, Cipolaro foretells that rough seas may await, with companies wise to fortify their share prices with the sturdy shield of stock buybacks. “Set aside your coin! Buy back those shares!” he cries, imagining the audience roused, even if the corporate treasurers are still fumbling through their lines.

Meanwhile, our beloved Bitcoin suffers its own dizzy spell, its price pirouetting to $111,550-a neat 7% dip from the August peak. Oh, what a tangled web, where treasury firms must dance in step with the coin, yet their stock prices often trip and tumble independently! Cue the laughter-and perhaps a few tears. 😅

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Whale of a Time! BTC Bags Billions!

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

2025-09-08 13:36