Ah, Bitcoin. The digital darling that oscillates between making millionaires and inducing existential crises. Once again, it finds itself at a crossroads, teetering precariously above the $110,000 mark like an over-caffeinated tightrope walker 🤹♂️. Selling pressure is mounting, volatility is playing its usual game of emotional roulette, and investors are clutching their pearls-or perhaps their panic buttons. Analysts, those modern-day augurs, have declared this threshold critical for maintaining the bullish façade. But alas, momentum has shifted faster than one can say “crypto winter.” A deeper correction looms ominously, like an unwanted dinner guest who insists on staying for dessert.

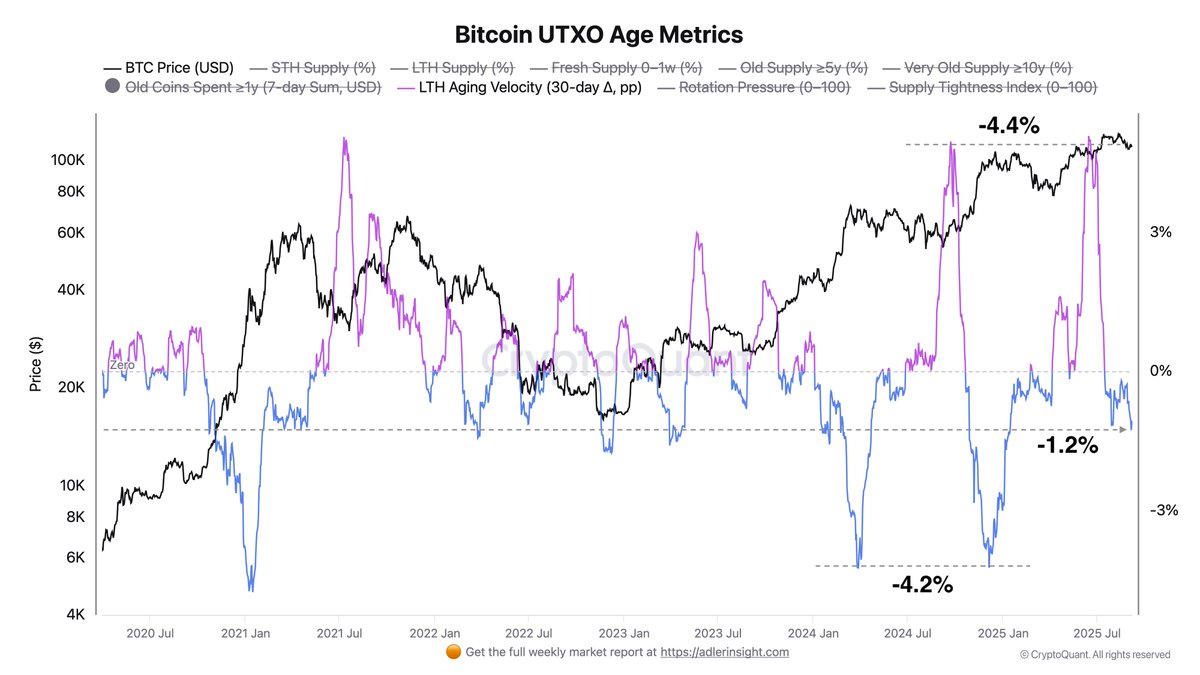

Enter Axel Adler, the Cassandra of crypto metrics, armed with insights from the Bitcoin UTXO Age Metrics. His findings? Long-term holders (LTHs), those venerable sages of the blockchain, are now behaving like teenagers at a garage sale-offloading their prized possessions to anyone foolish enough to buy them 🛒. Historically, such behavior has heralded periods of downside pressure, as the market struggles to absorb the influx of long-held coins. It seems even the most stoic hodlers cannot resist the siren call of profit-taking when prices flirt with all-time highs.

And yet, Bitcoin soldiers on, resilient as ever, though not without cracks showing in its armor. The confluence of distribution signals and investor jitters makes the coming days pivotal. If BTC falters below its current support, it may test not only lower levels but also the fragile conviction of its most ardent supporters. Can demand from ETFs and institutions rise to meet this renewed selling spree? Or will the bulls be left holding the bag-or rather, the empty wallet? 🐂 vs. 🐻: place your bets.

Aging Velocity: The Telltale Metric

Adler directs our attention to the LTH Aging Velocity (30-day), a metric so arcane it might as well come with its own decoder ring. This little gem measures the change in the share of long-term supply over a month, effectively tracking whether coins are being hoarded or sold off. When positive, accumulation reigns supreme; when negative, distribution takes center stage. Currently, the metric stands at -1.2%, meaning long-term holders are relinquishing their grip on the market while short-term holders eagerly scoop up the spoils. How quaint.

The last regime change occurred on July 16th at $118,000-a date etched in the annals of crypto history alongside other moments of fleeting triumph. Adler warns that another 2% of LTH supply could soon enter circulation, equivalent to roughly 300,000 BTC. For context, that’s enough to make even the most seasoned trader break out in a cold sweat 💦. While Bitcoin clings to life above $110,000, the specter of selling pressure lingers, reminding us that no throne is secure forever.

Price Action: Choppy Waters Ahead ⚓️

On the 8-hour chart, Bitcoin languishes at $111,711, consolidating just above the psychologically significant $111K level. The recovery attempt from late August’s dip near $108K offers some solace, but resistance remains a stubborn adversary. Moving averages paint a bleak picture: the 50 SMA (blue) trails behind the 100 SMA (green) and 200 SMA (red), signaling bearish momentum still holds sway. Price action hovers uneasily between these lines, trapped in a purgatory of indecision.

A decisive break above $114K could spark hope for a rally toward $118K, but failure to breach this ceiling risks sending BTC tumbling back to $110K-or worse, $108K. Support at $108K has held firm thus far, but losing it would be akin to dropping your umbrella in a hurricane. A deeper pullback toward $105K becomes increasingly likely, leaving bulls to ponder whether they’ve backed the wrong horse-or perhaps the wrong meme coin 🐴.

In conclusion, dear reader, Bitcoin’s fate hangs precariously in the balance, caught between the forces of accumulation and distribution, fear and greed, hope and despair. Whether you’re a hodler, a trader, or merely a bemused spectator, one thing is certain: the drama unfolding before us is nothing short of Shakespearean-if Shakespeare had written plays about cryptocurrency. Curtain falls. Applaud politely 👏.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Silver Rate Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Riches or Fool’s Gold? 🤑

- Whale of a Time! BTC Bags Billions!

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2025-09-08 12:07