Ah, Bitcoin! That enigmatic digital sorcerer, now oscillating between the realms of triumph and despair like a drunken poet at a wedding. At $110,709, with a market cap of $2.20 trillion, it dances precariously near the edge of its ambitions. Traders, those ever-anxious souls, are glued to their screens, wondering if this is the moment Bitcoin will rise like a phoenix or stumble into the abyss like a clumsy goat. 🐉🐐 The all-time high of Aug. 14, 2025, sits tantalizingly far away, a mere 10.8% above, mocking Bitcoin like an unattainable mirage in the desert of finance.

Bitcoin

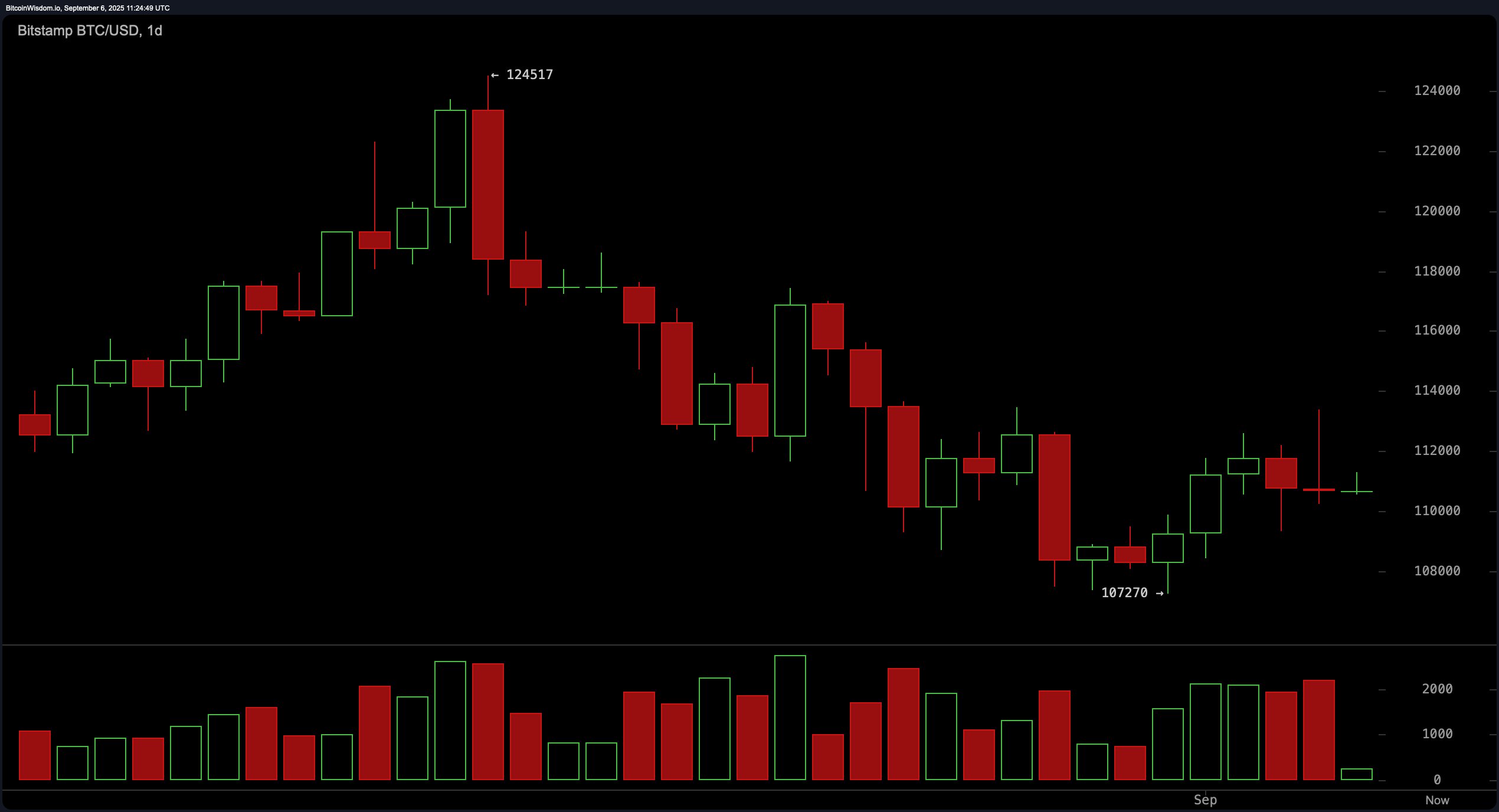

Behold the daily chart, where Bitcoin’s fate is etched in the cryptic language of lower highs and lower lows. A swing high of $124,517 and a swing low of $107,270 frame this tragicomic performance. The recent bounce from $107,270 falters near $112,000, as if the cryptocurrency itself were out of breath after climbing a mountain of expectations. 🏔️📉 The bears whisper sweet nothings into Bitcoin’s ear, while the bulls wait for a miracle-a convincing break above $112,500-$113,000 on strong volume-to ignite their hopes anew.

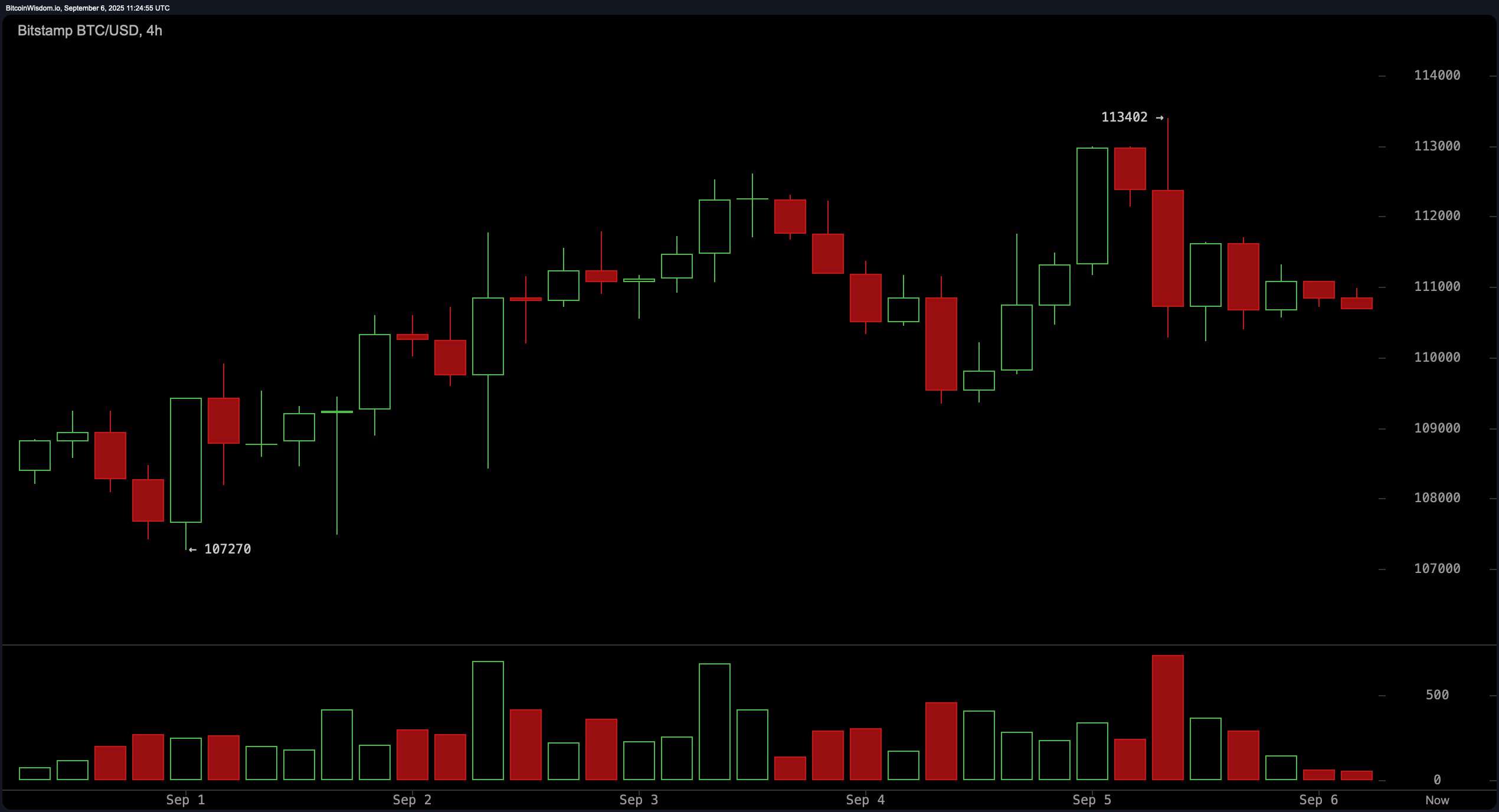

The 4-hour chart paints a picture of stubborn resistance and weary support. At $107,270, Bitcoin clings to life like a cat refusing to let go of a tree branch. 🐾 Yet, every attempt to scale the heights of $113,402 ends in failure, as if an invisible hand pushes it back down. A large red candle looms ominously, signaling that the bears are not yet ready to surrender their dominion. The key resistance band of $112,000-$113,400 stands firm, daring anyone to challenge its authority.

And now, the 1-hour chart, where Bitcoin’s struggles become almost comical. It slumps, chops sideways, and occasionally flirts with bullishness, only to retreat like a shy suitor. A descending triangle forms, hinting at further decline. Should Bitcoin fall below $110,000, the path to $107,270 opens wide, inviting sellers to feast upon its carcass like vultures circling a battlefield. 🦅⚰️

The oscillators, those mysterious oracles of the market, offer little clarity. Neutral readings abound, save for a few faint whispers of bullishness from momentum (MOM) and moving average convergence divergence (MACD). It’s as if the universe itself cannot decide whether Bitcoin deserves redemption or ruin. 🌌✨

Moving averages, however, lean decidedly bearish. From the EMA (10) at $110,877.5 to the SMA (200) at $101,689.8, they form a chorus of dissent, urging caution. Only the long-term averages provide solace, suggesting that Bitcoin may yet find refuge in the arms of its 200-day moving averages. But alas, hope is a fragile thing. 💔📈

Bull Verdict:

If Bitcoin can reclaim $113,000 with the vigor of a knight storming a castle, the bulls might rally behind it, dreaming of retesting the all-time high. The 200-day moving averages stand ready to lend support, like loyal squires awaiting their hero’s return. But beware, dear reader, for such dreams often dissolve like mist under the morning sun. ☀️⚔️

Bear Verdict:

Should Bitcoin falter at $113,000-$113,400, the bears shall rejoice, their claws sharpened and ready. A breakdown below $110,000 could send Bitcoin spiraling back to $107,270, where the daily trend and moving averages conspire against it. Oh, what a cruel mistress the market is, teasing us with promises of riches before snatching them away! 🐻📉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Brace for the $74K Liquidation Tsunami! 🚨

- A Dozen New Defendants Charged in Alleged RICO Conspiracy Tied to $263,000,000 Crypto Theft

- Is Bitcoin About to Make a Dramatic Exit? 🥂

- XRP Skyrockets! ETF Incoming? 🚀

- Kraken Turns Wall Street Into a Crypto Carnival: Stocks, ETFs, and Sarcasm Included

- Bitcoin to $50 Million? Crypto CEO’s Wild Math Will Make Your Jaw Drop 😳

- Is Chainlink’s Hope Dying? Find Out Before It Hits Rock Bottom! 🚨

- Brent Oil Forecast

2025-09-06 15:46