So, Ethereum (ETH) is taking a well-deserved breather-because even crypto needs a coffee break now and then-before it decides to sprint again. Miraculously, what was once a pesky resistance level at $4,250 has done a complete 180 and morphed into a sturdy support. Bulls have been guarding this number like a mother hen for two weeks straight, fending off the seller horde.🐔🛡️

Ethereum (ETH) price: Support at $4,250 looks strong

Ethereum, that lovable second fiddle to Bitcoin but arguably the cooler blockchain kid on the block, has barely budged-down a negligible 0.2% in 24 hours. Apparently, when all the other cryptos act like they’re stuck in a bad Wi-Fi zone, ETH decides to join the meh club too.

Right now, the price sits comfortably at $4,419, with the 24-hour trading volume dwindling to a mere $36.15 billion. (Yes, “mere” in crypto-world means what most people’s annual incomes aren’t.)

Over the past fortnight, Ethereum’s bullish fans have fought tooth and nail to keep $4,250 as a no-fly zone for sellers since August 22, 2025. Spoiler alert: they’re winning.

This mystical $4,250 line has withstood not one, not two, but seven hardcore stress tests in just 14 days. It’s like the cryptocurrency equivalent of a bodyguard with a bad attitude-intimidating and absolutely reliable. Rule of thumb: if support holds after seven trials, it’s either destined for greatness or everybody just really likes it.

And hey, Ethereum even celebrated a shiny new all-time high on August 24, 2025, soaring to $4,953. That’s right, just shy of $5,000-because every milestone deserves a little tease before the big party.

Ether outspeeding Bitcoin on trading volume after seven years? What sorcery is this?

In a plot twist worthy of a Netflix drama, Ethereum stole the spotlight from Bitcoin in August by clocking a higher trading volume-yes, ETH outtraded BTC for the first time in seven years. Imagine that: the underdog finally nudging past the ever-so-proud dog in the park. 🐕🦺🚀

Ethereum racked up a staggering $408 billion in trading volume for August 2025, while Bitcoin lagged behind at a comparatively humble $400 billion. Not too shabby for the world’s “biggest programmable blockchain.”

What’s behind this cryptic trading war? It seems the “altcoin season” buzz has traders and investors flocking from Bitcoin to Ethereum like moths to a flamethrower-except the flames are metaphorical and, hopefully, less painful.

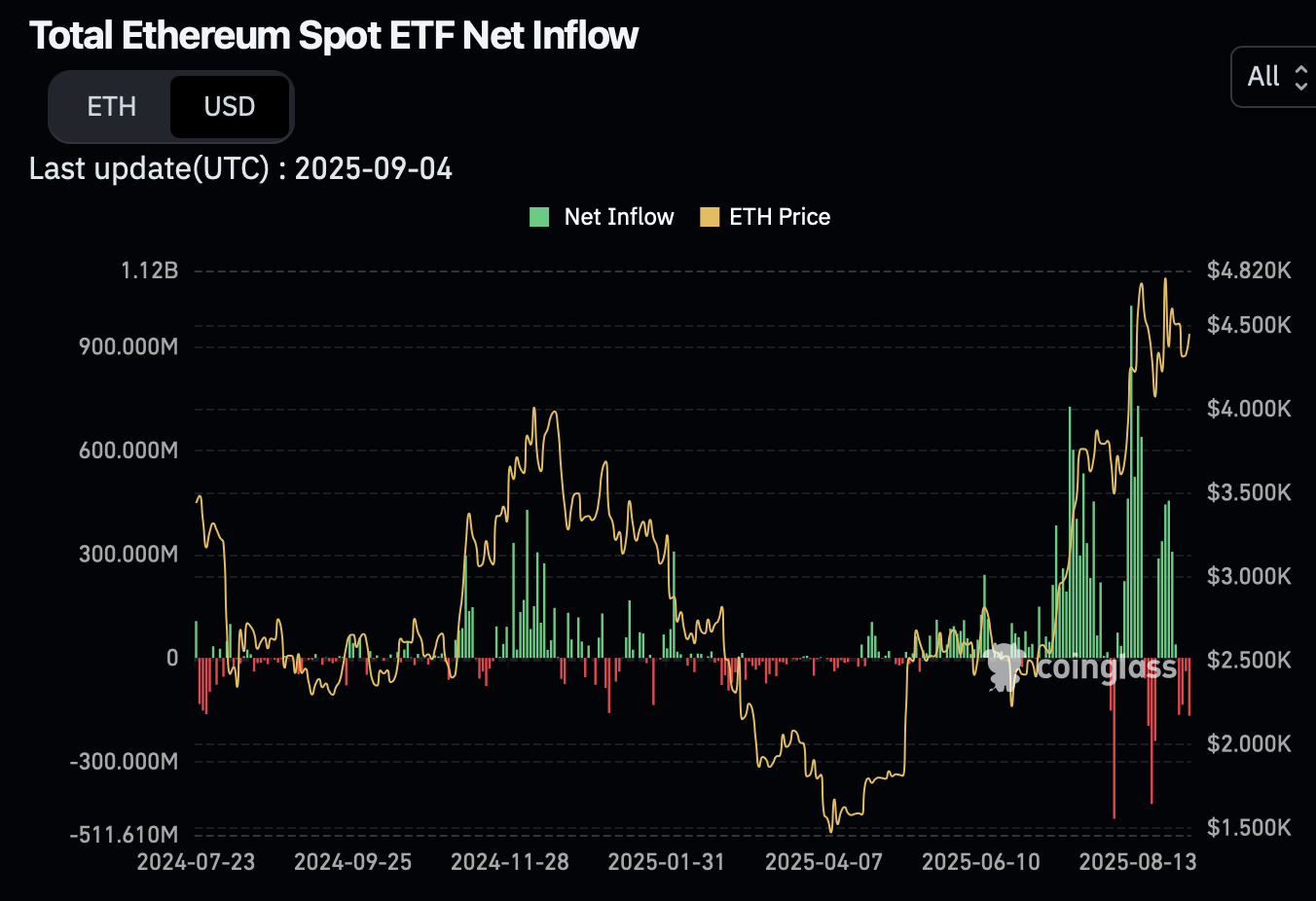

ETF inflows tell the tale too: Bitcoin’s Spot ETFs have been catching flies since mid-July 2025, while Ethereum’s ETFs broke records by guzzling over a billion dollars in fresh money on August 11 alone. Ah yes, liquidity and drama-best friends forever.

Hackers playing peek-a-boo with malicious code in Ethereum software

Just when you thought Ethereum was having too much fun, security researchers from Reversing Labs reported that hackers sneaked some nasty code into the Node Package Manager (NPM)-the tech equivalent of your grandma’s cookie recipe book but for developers running smart contracts on Ethereum and its pals.

Downloading these malicious “patches” might cause your smart contract to dial home to shady websites and execute Judas-like commands. Because who doesn’t want a botched contract calling unknown parties? 🙃

Not a unique problem: Solana (SOL) dApps got the same creepy treatment, with infected trading bot code repositories doing their unwelcome viral tour.

Crypto’s fast-rising prices seem to have also inflated hackers’ egos, with new breaches and attacks happening multiple times per week. Just in August 2025, losses topped a casual $168 million. Spare change, really, if you’re into that sort of thing.

WLFI drama: Justin Sun’s wallets iced-space cowboy grumbles

In other cryptocurrency soap opera news, the WLFI token release by World Liberty Financial ended in scandal: Justin Sun, Tron’s flamboyant founder and self-styled astronaut (yes, really), got his token allocation frozen by the distribution gatekeepers.

Accusations flew fast and furious that Justin might dump tokens like a hot potato and tank the price. The drama! 🎭

To the World Liberty Financials team and the global community,

As one of the early major investors in World Liberty Financials, I have contributed not only capital but also my trust and support for the future of this project. My goal has always been to grow alongside the team…

– H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 5, 2025

In a heartfelt response, Sun declared himself a loyal OG investor devoted to building a strong WLF ecosystem and demanded his tokens be unblocked post-haste.

Meanwhile, WLFI’s price took a dive to $0.19, down 19% since launch-which is steep, but hey, it still squeezes into the crypto top 30 by market cap, boasting a jaw-dropping fully diluted valuation of $19 billion. Because in crypto, it’s not about the price, it’s about the drama-and the math that makes zero sense. 💸

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Silver Rate Forecast

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- BTC AUD PREDICTION. BTC cryptocurrency

- Dogecoin’s $2B Volume Spree: Bearish Brouhaha or Bullish Blunder? 🐕💸

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

- Trump’s Crypto Invasion: Blockchain Meets Bollywood Drama! 🎭💰

2025-09-05 18:02