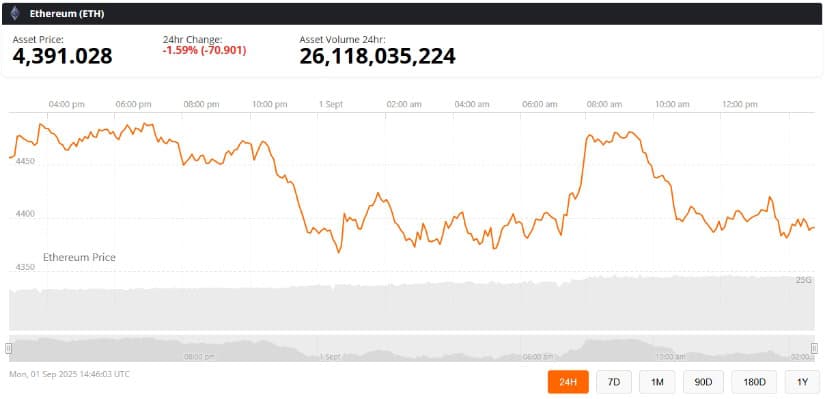

So, Ethereum had a little hiccup above $4,600-think of it as trying on that cute pair of shoes that are just a bit too tight. Analysts, however, are still crossing their fingers that a big, dramatic move could catapult ETH toward a jaw-dropping $7,000. 🤑

Market Overview: Ethereum Price Holds Key Channel Support

Daily charts tell a story that’s basically “ETH, you’ve got this!” since July, when it strutted from $3,200 upwards like a fashion icon on a runway. Right now, support is lounging at $4,380, while the 50-day EMA is patiently waiting at $4,004. Resistance? The notorious $4,600-$4,700 zone-ETH’s equivalent of that club you can never get into.

RSI is chilling at 53, meaning Ethereum is neither overexcited nor throwing a tantrum. Crypto Rover (yes, that guy on X) insists this pullback is totally normal, a bit like 2021’s awkward teenage phase-temporary and necessary before strutting into new highs. 😎

Institutional Flows and Supply Squeeze Boost Outlook

Apparently, big whales and institutions are hoarding ETH like it’s the last slice of pizza. CryptoQuant says 24.3 million ETH-18% of total supply-is safely tucked away in accumulation wallets. Long-term vibes only. 🐳

And then there’s Arthur Hayes, former BitMEX CEO, throwing out eye-popping projections of $10,000-$20,000. Yup, the dream numbers, fueled by supply squeeze and ETF inflows. Coinbase survey backs this up-institutions are ready to ramp up crypto allocations by nearly 60% over three years. 💸

Spot Outflows and Technical Resistance Pressure Momentum

But don’t get too comfy. Coinglass reports $38.1 million in net ETH outflows, hinting some big players are feeling a bit shaky. On the short-term charts, ETH is flirting below supertrend resistance at $4,590, flashing subtle “maybe not today” vibes. 😬

Parabolic SAR is hovering at $4,340, acting as the bouncer. Drop below this, and ETH could tumble toward $4,200-$4,000-cue dramatic music. 🎢

Layer 2 Ecosystem Adds to Ethereum’s Strength

Meanwhile, Layer 2 solutions like Arbitrum, Optimism, and zkSync are quietly growing, basically like supportive friends keeping ETH from tripping over high gas fees. Analysts say this could ease congestion and make adoption soar before the Pectra upgrade struts onto the stage. 💪

Contrasting Views: Bulls vs. Bears

The market is basically a soap opera.

- Bulls: “ETH’s channel structure + whale love = skyrocket to $5,000, then $7,000. No brainer.” 🐂

- Bears: “Spot outflows + resistance fails = watch your step. $4,380 break could mean a swift tumble.” 🐻

Wallet Investor dreams of $7,000 in five years, InvestingHaven says $7,500 by end of 2025, and Finder’s team is like, “let’s be conservative… $6,100 this year, $12,000 by 2030.” Classic crowd, right?

Ethereum Prediction: Breakout or Breakdown Ahead?

September is heating up, and ETH is facing its make-or-break moment. Hang onto $4,380 and the bullish parade toward $4,700 (and maybe $5,200) could continue. Fail, and brace for a slide toward $4,000. Drama, thy name is Ethereum. 🎭

Bottom line: institutional flows + whale hoarding could be enough to push ETH toward that dreamy $7,000, but, as always in crypto, volatility is the uninvited plus-one. Buckle up and enjoy the ride. 🚀

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- SUI ETF? Oh, the Drama! 🤑

- Brent Oil Forecast

- When Crypto Meets Caution: South Korea’s Stablecoin Dilemma 🤔💰

- USD MXN PREDICTION

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- SHIB PREDICTION. SHIB cryptocurrency

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

2025-09-01 23:57