What to know:

- Polygon’s native token, POL, surged 16% over the weekend, reaching $0.29 for the first time since March.

- The surge occurred despite the broader crypto market remaining steady, with bitcoin and ether showing only modest gains.

- Positive developments, such as the U.S. government’s blockchain initiative and a new integration with a Tether-focused protocol, may have supported POL’s performance.

In this article

BTCBTC$111,846.73◢1.95%

BTCBTC$111,846.73◢1.95% CD20CD20$-◢0.00%

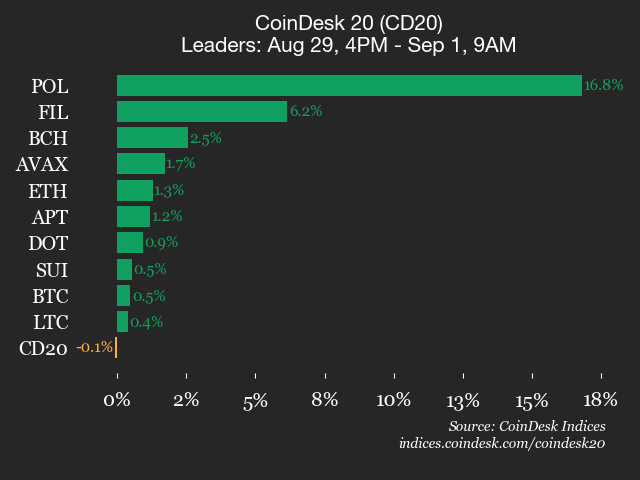

CD20CD20$-◢0.00%As a cryptocurrency analyst, I observed that over the weekend, the native token of Polygon (POL) registered significant gains within the broader cryptocurrency market, as indicated by the CoinDesk 29 Index.

On Friday through early Monday, the value of POL experienced a 16% increase, reaching $0.29 for the first time since early March, according to data from CoinDesk. However, it has since slightly retreated, falling below $0.28.

The situation didn’t see much variation as CD20 stayed relatively stable, while Bitcoin and Ethereum‘s ether (ETH) experienced minimal growth.

Although it isn’t evident what specifically triggered POL’s rise, several encouraging factors might have contributed to its improved performance.

Last week, it was announced that Polygon is among the blockchains being considered by the U.S. government for their project aimed at disseminating significant economic statistics, like the GDP, through blockchain infrastructure.

Last week, the network unveiled its integration with USDT0, a protocol designed for cross-chain stablecoins backed by Tether. This move could potentially strengthen the network’s status as a crucial center for stablecoin liquidity.

On the technical side, POL’s surge suggests a strong upward trend, as indicated by CoinDesk’s Research analysis. Although it has consolidated following its peak, the persistent buying interest in the $0.277-$0.278 range may signal ongoing support for additional growth, according to the model.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- SUI ETF? Oh, the Drama! 🤑

- Brent Oil Forecast

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- Bitcoin Apocalypse Imminent?! 😱

- This Trader Turned Pocket Change Into Millions With LAUNCHCOIN (And You Didn’t!)

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- USD MXN PREDICTION

2025-09-01 19:59