Once upon this cruel stage of digital alchemy, the Uniswap’s UNI token descended into the shadows, reaching its deepest nadir in nearly a month. Yet, almost humorously, the great whales-those colossal beasts of the blockchain sea-continued their solemn ritual of accumulation, while the network’s volume swelled to new heights, mocking the token’s despair.

Whales Feast as the Masses Panic

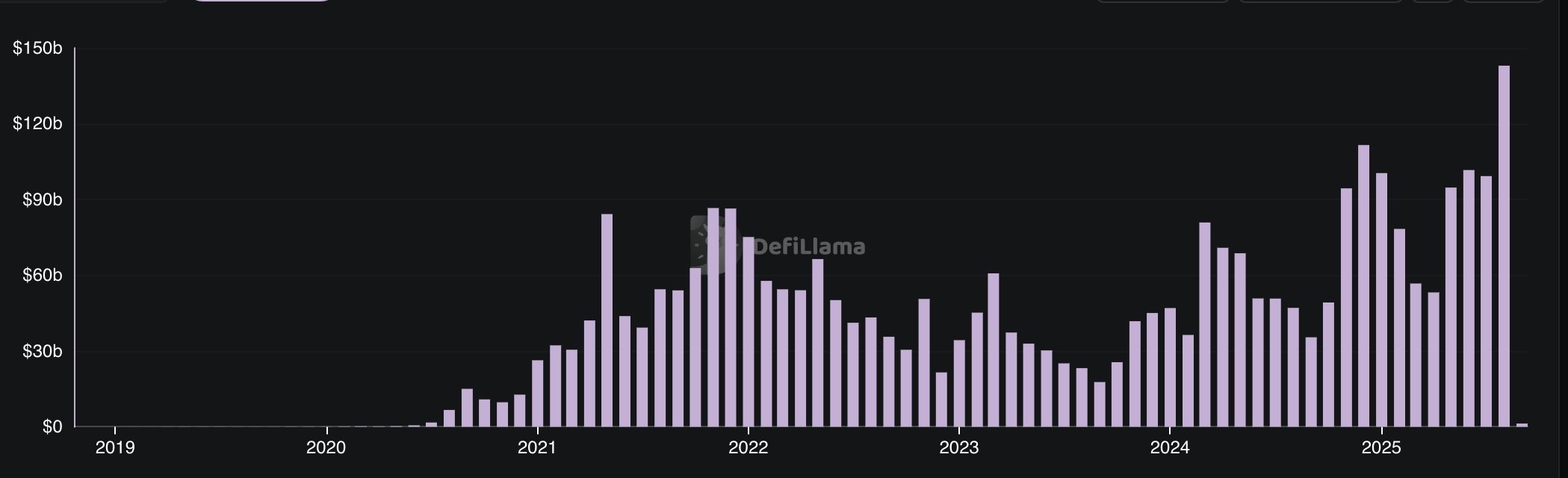

The DeFi Llama, ever the oracle of blockchain seas, reveals Uniswap’s transaction volume soared to a record $143 billion in August, mocking the previous measly $99 billion. It is as if the network, trembling yet defiant, has processed over $724 billion this year alone, staking its claim as emperor of decentralized exchanges.

Fees, the lifeblood flowing through this majestic beast, have climbed to $273.7 million this quarter-an increase that no doubt brings a sardonic smile to the keepers of Uniswap’s vaults. Compare this to the pittance of $115 million collected in the third quarter of the previous year, and one might chuckle at the wondrous progress born from chaos.

Meanwhile, Unichain-Uniswap’s layer-2 offspring birthed in March-proves no less industrious. August saw its dApps juggling over $12.54 billion, a slight stumble from July’s $13.5 billion, yet a testament to endurance. Since its birth, Unichain has shepherded over $53 billion, as if to say, “Watch me rise.”

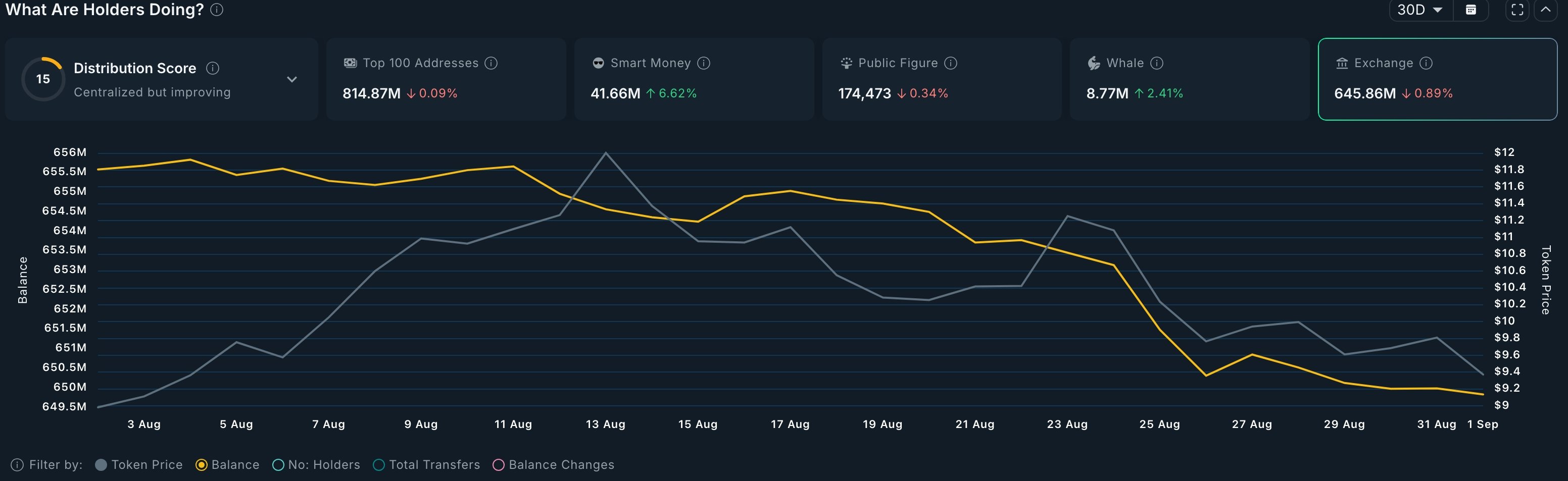

And who are these mysterious whales? These titans of smart money clutch over 8.77 million tokens, up from 8.26 million in August, as if collecting treasures in a cave of digital dragons. The smart money holds a staggering 41.6 million tokens, while the tokens resting on exchanges have receded slightly-from 655 million to 645 million-perhaps pondering their fate.

UNI Price Technical Analysis: The Dance of Hope and Despair

Observe the daily chart, a map of tragedy and hope intertwined. The UNI price has descended from its August zenith of $12.26 to a humbled $9.36, lingering on the shadowed lower edge of the ascending channel. It clings, like a weary prisoner, just above the 100-day exponential moving average and the stoic pivot point of Murrey Math Lines.

The story is clear: a bounce, a phoenix rising toward $12.26, about 30% above current depths, may still be possible. However, should UNI fall below its 100-day moving average, its fragile dream of a bullish rally would be cruelly shattered-an ignominious end to this chapter.

😂 Truly, in this game of whales, waves, and token tides, one must either laugh or weep. Or do both, because what else is there but to watch and wonder in this grand theater of blockchain absurdity?

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- SUI ETF? Oh, the Drama! 🤑

- Bitcoin’s on Fire! Institutions Hoarding Like It’s Toilet Paper 2020 🚀💰

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Bitcoin’s Wild Ride: Is It a Bull or Just a Bump? 🐂💰

- USD MXN PREDICTION

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

2025-09-01 19:33