In a tragic yet predictable episode, the magical mystery coin known as Bitcoin slipped down the rabbit hole to $108K right after the “de minimis” exemption waved goodbye on Friday and core inflation decided to puff up to 2.9%. 🪙💸

BTC Throws a Tantrum Between Inflation’s Hug and Trade Turf Wars

Friday was that sort of day when both crypto and stock markets decided to bleed like an overcooked dragon’s roast-gritty and messy-after core inflation sauntered in at an oh-so-precise 2.9%, and the “de minimis” exemption-an obscure clause letting cheap trinkets under $800 sneak into America duty-free-was sent packing earlier than anyone expected. Predictably, Bitcoin took the news about as well as a goblin in a china shop, plunging to its lowest depths since July.

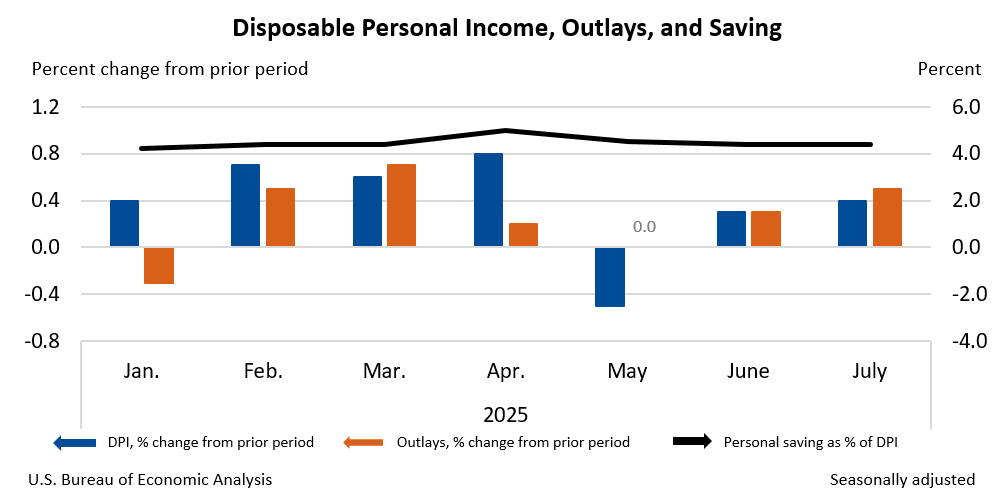

The U.S. Bureau of Economic Analysis (BEA), that kindly institution obsessed with numbers, published its monthly personal consumption expenditures (PCE) price index (yes, that’s a mouthful) which is the Federal Reserve’s favourite tea-leaf reading for inflation. July’s PCE clocked in at a polite 2.6% for all goods, but removing the volatile food and energy categories boosted the “core” rate to a sulky 2.9%. This particular figure was about as surprising as a wizard’s hat on a windy day, but it was still the highest inflation since February 2025. Welcome to the *fun* zone! 🎢

If that wasn’t enough to ruin your Friday, an obscure trade rule that allowed cheap goods under $800 to sneak into the U.S. duty-free suddenly decided to call it quits. Earlier this year, in an act of executive order wizardry, President Donald Trump accelerated the expiration date to August 29 instead of 2027. The result? American families might have to open their wallets $136 more wide than before, and low-income and minority households will be hit the hardest-because why not add insult to injury? According to two professorial sages who crunched the numbers, it’s not exactly a party. 🎉🤦♂️

Market Metrics in a Nitty-Gritty Nutshell

Bitcoin was lounging at $108,186.53 at press time, down a nifty 3.79% for the day and a slightly more sulky 7.38% for the week, according to Coinmarketcap. Over the last 24 hours, this digital sorcery pendulum swung between $108,098.62 and $112,619.05-proof Bitcoin really enjoys playing financial seesaw.

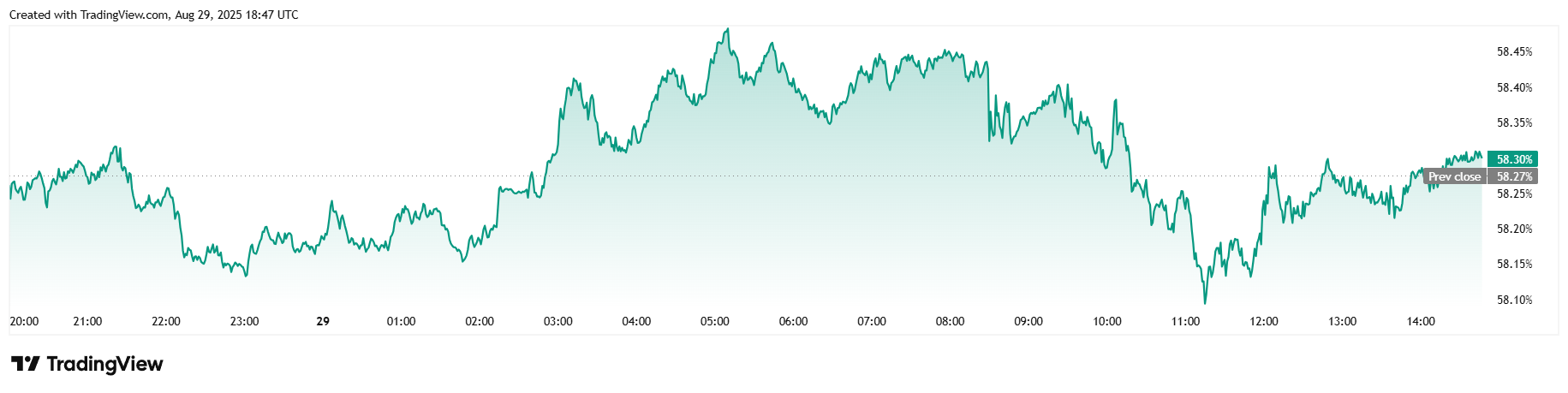

Trading volume danced up 15.84% to $72.77 billion in 24 hours-because chaos loves company-while market capitalization slipped 3.72% to $2.15 trillion, obediently mirroring the price dive. Yet, bitcoin dominance stubbornly crept up by a tiny 0.09% to 58.30%, like the annoying kid who still wants to be top of the class, according to Coinmarketcap.

The total bitcoin futures open interest slumped 1.17% to $80.28 billion over 24 hours-someone clearly forgot their crystals were fogged. Meanwhile, bitcoin liquidations on Coinglass shot up to a spicy $133.62 million in the same period. Of this magical pile, $121.61 million was long liquidations, proving that sometimes hoping for the sky is just asking for a bigger drop, while shorts accounted for a much smaller $12.01 million-probably just the sad souls left clutching their hats. 🎩💨

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- Brent Oil Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- USD TRY PREDICTION

- OMG: Altcoins Are Having a Meltdown-Is This the End or Just the Beginning? 😱💸

- Cardano’s ADA: $60M Whale Shopping Spree! Is $1 in Sight? 🐋💰

- SOL PREDICTION. SOL cryptocurrency

2025-08-29 22:58