So, here we are, folks! Ethereum’s market cap is like that awkward kid at the party, currently just a quarter of Bitcoin’s. But hold onto your hats, because new research suggests this altcoin might just sprint past BTC in the market cap race. Analysts are saying that treasury firms and ETFs are like the cool kids fueling a demand cycle that could catapult Ethereum to the top of the digital asset hierarchy in the next one to two market cycles. Who knew finance could be so dramatic? 🎭

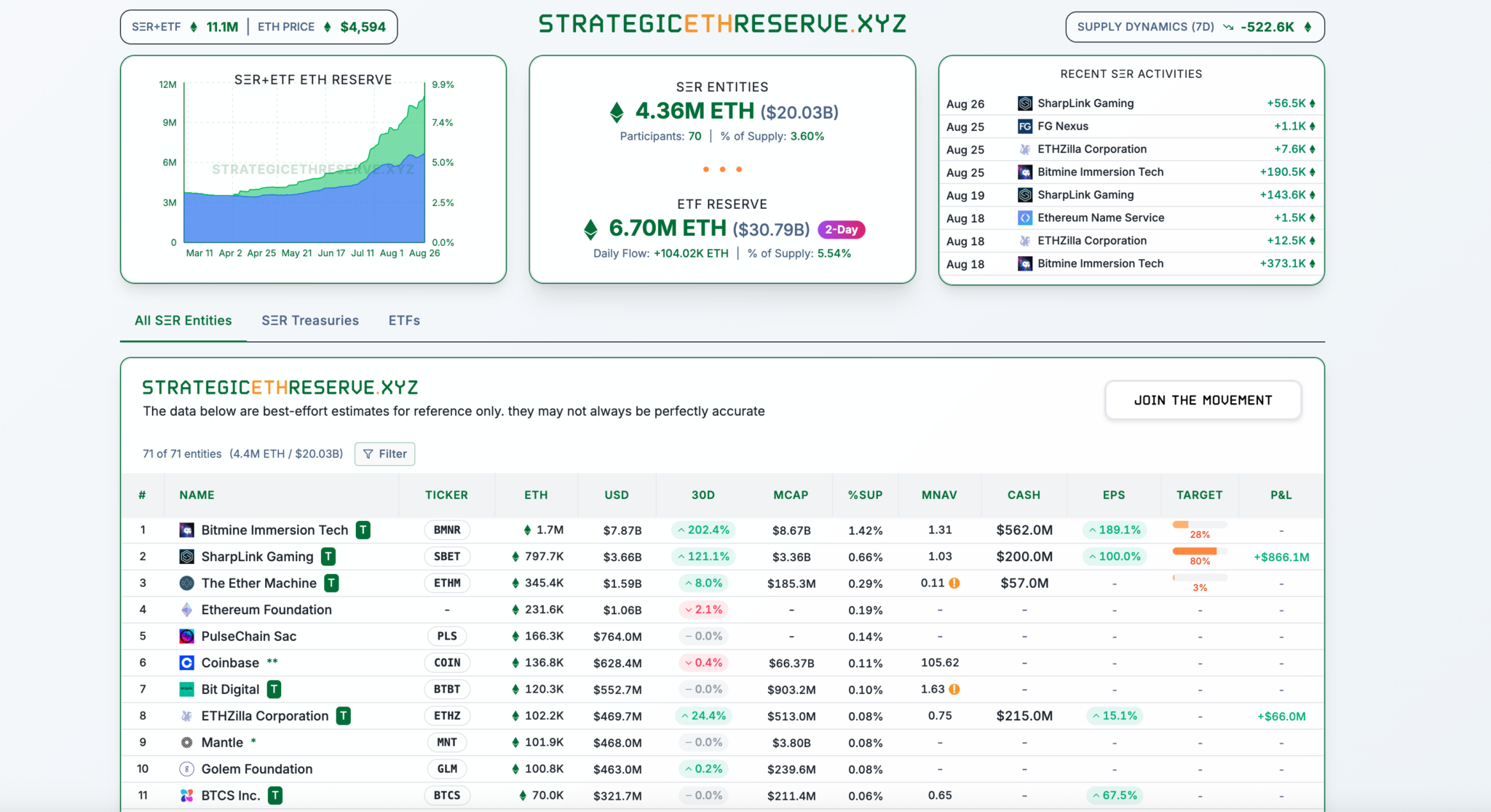

Trend Research, the brainy folks at LD Capital, estimate that treasury firms and ETFs are already hoarding nearly $20 billion worth of Ethereum-about 3.39% of the total supply. Unlike Bitcoin, which is like that one friend who never shares, Ethereum is being bought at scale and is also moonlighting as a yield-generating asset. Talk about a multi-talented crypto! 💪

Treasury Firms Push ETH Beyond Supply Dynamics

Now, the balance between staking supply and institutional demand is like the ultimate tug-of-war that defines Ethereum’s future. Since the Pectra upgrade in May 2025, the network has capped daily unstaking at 57,600 ETH. But guess what? Institutional inflows are already throwing a party that’s way bigger than that! 🎉

BitMine has been on a shopping spree, accumulating over 1.5 million ETH since July, splurging more than $5.6 billion. And SharpLink? Oh, they’ve added about 740,000 ETH since June. Both firms are like kids in a candy store, expanding their stash, with BitMine eyeing up to 5% of the supply. Trend Research says this buying frenzy is reshaping market dynamics, much like MicroStrategy did with Bitcoin. 🍭

Ethereum Yield and ETF Flows

Ethereum is flaunting some serious structural advantages. Unlike Bitcoin, ETH holdings are like that friend who always brings snacks to the party-they generate yield through staking and liquidity provision. Staking returns are averaging 1.5 to 2.15% annually. Not too shabby, right? 🍕

And if you’re into decentralized finance (DeFi), liquidity provision can crank those yields up to about 5%. This cash flow allows treasury firms to justify higher valuations through discounted cash flow models. Trend Research calls this a “cash flow premium.” Sounds fancy, doesn’t it? 💸

ETF flows are just icing on the cake. From mid-May to mid-August, Ethereum ETFs enjoyed 14 consecutive weeks of net inflows, adding a whopping $19.2 billion. BlackRock’s ETHA is leading the charge with 2.93% of the supply. But hold your horses-Ethereum ETFs are still trailing behind Bitcoin’s $179 billion scale, so there’s plenty of room for growth. 🚀

BeInCrypto reported that Fundstrat’s Tom Lee is feeling optimistic, expecting Ethereum to hit $5,500 soon and possibly climb to $10,000-$12,000 by year-end. He cites treasury accumulation and shrinking exchange balances as reasons for his sunny outlook, echoing Trend Research’s thesis that institutional demand is about to steamroll supply. 🌞

Trend Research also pointed out that institutional demand for Ethereum is now far exceeding unstaking supply, which could put Bitcoin’s position in a bit of a pickle. 🥒

Why Ethereum Could Surpass Bitcoin

Trend Research has a list of reasons why Ethereum might just leapfrog Bitcoin in the coming cycles. First up: supply and demand. Daily unstaking is capped at 57,600 ETH, while treasury firms and ETFs are buying way more, creating a net demand that Bitcoin simply can’t keep up with. Talk about a one-sided competition! 🏆

Treasuries, ETFs, and Whales

Secondly, treasury firms and funds are hoarding ETH like it’s the last slice of pizza at a party. Unlike Bitcoin, Ethereum generates yield through staking and DeFi liquidity, making it a cash flow asset rather than just a scarce commodity. 🍕

ETF flows are still favoring Ethereum. Those Ethereum ETFs have logged 14 straight weeks of inflows worth $19.2 billion, while Bitcoin ETFs are seeing outflows. BlackRock’s ETHA alone is holding nearly 3% of the supply. Talk about a power move! 💪

On-chain data shows whales are making the switch from BTC to ETH. Futures trading volume share for Ethereum jumped from 35% in May to 68% in August. Some big players even staked hundreds of thousands of ETH, surpassing the Ethereum Foundation’s balance. It’s like a game of musical chairs, and ETH is winning! 🎶

Technicals Signal a Short-Term Test

While the long-term case for ETH is looking stronger than my morning coffee, it’s not all sunshine and rainbows. ETH is facing some short-term volatility. Matrixport’s Markus Thielen expects ETH to trade between $4,355 and $4,958, warning that momentum has slowed since July’s rally. Yikes! 😬

Today’s #Matrixport Daily Chart – August 27, 2025

Respect the Technicals: Ethereum’s Next Big Test #Matrixport #Bitcoin #Ethereum #CryptoMarkets #CryptoETF #InstitutionalFlows #BTC #ETH #MarketStrategy #TechnicalAnalysis

– Matrixport Official (@Matrixport_EN) August 27, 2025

“Respecting the technicals could be the difference between making money and losing it,” Thielen said.

Charts show Ethereum recently bounced off its 21-day moving average, a level that attracted dip-buying in early and mid-August. But with fading momentum, there’s a risk of a retest below $4,355. Will the market direction depend on whether treasury firms and ETFs keep buying aggressively? Only time will tell! ⏳

BeInCrypto also reported that Ethereum recently had one of the largest exchange outflows since July, while the taker buy-sell ratio briefly exceeded 1. Institutions, including BlackRock, rotated nearly $892 million from Bitcoin into ETH, reinforcing the bullish setup. 💥

Futures trading volume share for Ethereum rose from 35% in May to 68% in August, while Bitcoin’s share took a nosedive. On-chain activity shows whales are selling Bitcoin and buying ETH. In one case, a large holder staked 269,485 ETH, surpassing the Ethereum Foundation’s holdings. Talk about a power move! 💪

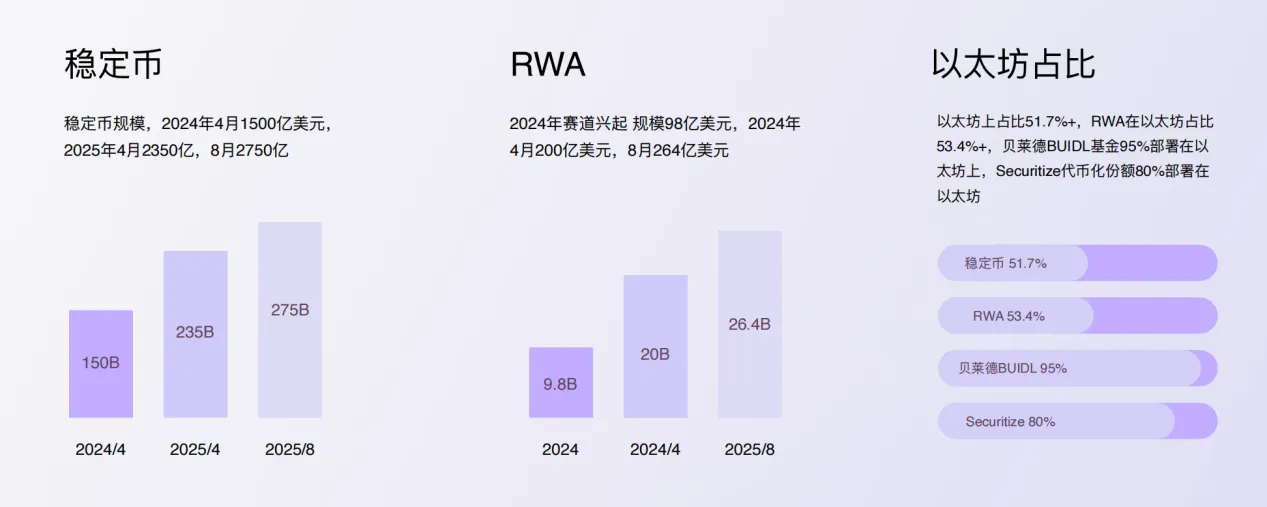

This rotation also shows changing investor psychology. Bitcoin is still the “digital gold,” but ETH is stepping up as the financial infrastructure for stablecoins, tokenized assets, and DeFi. The recent passage of the US GENIUS Stablecoin Act reflects this shift. With over half of stablecoin and real-world asset activity running on Ethereum, the asset is basking in policy and technological support. 🌐

Macroeconomic conditions are also giving Ethereum a boost. Federal Reserve Chair Jerome Powell hinted at rate cuts likely in September. History suggests that looser policy often favors Ethereum’s performance over Bitcoin. So, keep your eyes peeled! 👀

Trend Research estimates Ethereum’s market capitalization could exceed $3 trillion in optimistic scenarios, leaving Bitcoin’s current valuation in the dust. Buckle up, it’s going to be a wild ride! 🎢

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

- ZK Price: A Comedy of Errors 📉💰

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-08-27 22:35