Ah, the sweet smell of institutional validation. Metaplanet, once a humble hotel operator (yes, you read that right), has now been ushered into the hallowed halls of the FTSE Japan Index. And because life loves to hand out participation trophies, it’s also been added to the FTSE All-World Index. What does this mean for Bitcoin? Well, more exposure for traditional investors, naturally. Cue the confetti cannons and prepare for Bitcoin’s ascent to yet another all-time high-or so they say. 🎉

Bitcoin enthusiasts are already lighting up Twitter with their hot takes, claiming Metaplanet is now *the* big player in global markets. But fret not, ye procrastinators who haven’t bought $BTC yet-there’s still time to hop on this rollercoaster before it inevitably loops back around. Or crashes. Who can say? 😅

We’ll delve into how $HYPER plans to shake things up-but first, let’s take a closer look at Metaplanet’s grand ambitions for $BTC.

What Is Metaplanet?

Once upon a time, in 1999, Metaplanet was content running hotels. But like any good protagonist, it decided to pivot-to real estate, business advisory services, and eventually, Bitcoin. By 2024, it had morphed into a full-fledged $BTC treasury, acquiring a whopping 18,888 BTC. That’s more than Coinbase and Tesla combined! Move over, Elon; Metaplanet is here to steal your thunder. ⚡

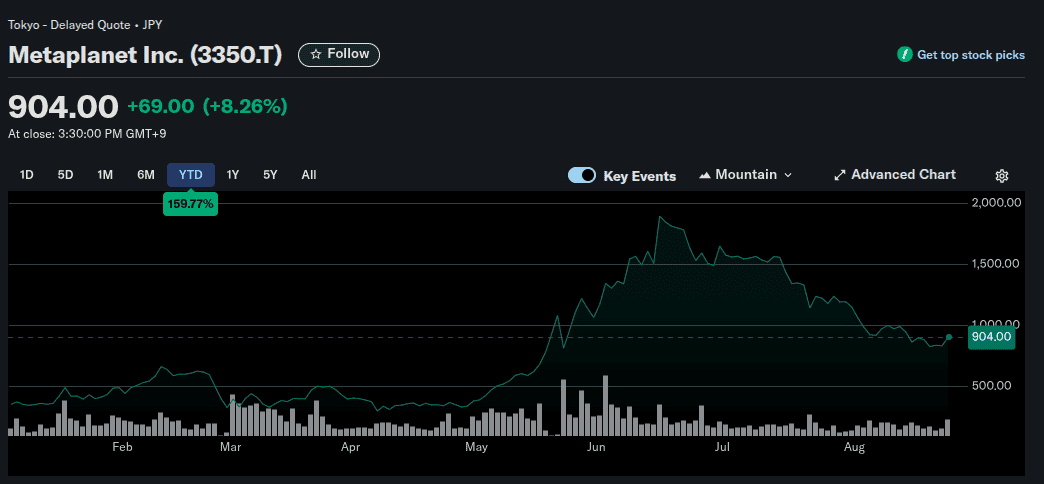

And the numbers don’t lie-or do they? Metaplanet’s stock performance has outshone the Tokyo Stock Price Index Core 30, which includes giants like Toyota, Nintendo, and Sony. While the TOPIX rose by a modest 7.2% year-to-date, Metaplanet posted gains of roughly 187%. Not bad for a former hotel chain, eh? 🏆

But Metaplanet isn’t stopping there. Oh no, it has its sights set on amassing 210,000 BTC by 2027, which would catapult it to second place among the world’s largest Bitcoin treasuries, trailing only MicroStrategy. Institutional money flooding into $BTC? Yes, please. Your Lambo awaits. 🚗💎

What About Bitcoin Hyper?

Bitcoin may reign supreme as a store-of-value coin, but let’s face it: trying to use it for daily transactions is about as efficient as mailing a letter via carrier pigeon. Slow transaction times and sky-high fees have long been Bitcoin’s Achilles’ heel. Enter Bitcoin Hyper, the knight in shining armor here to save the day. ✨

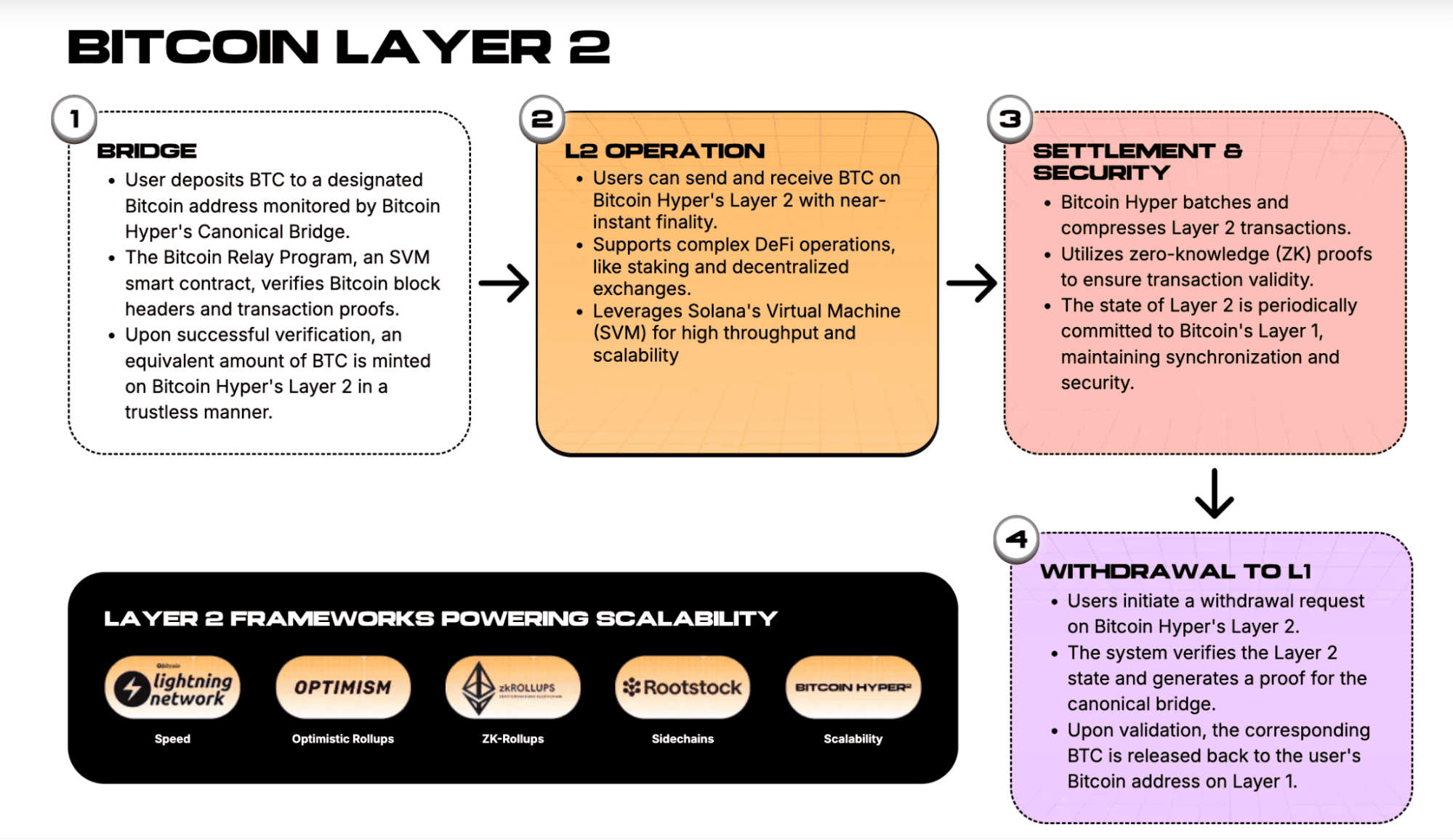

This Layer 2 solution leverages the Solana Virtual Machine to supercharge transaction speeds and slash fees, all while bringing smart contract capabilities to Bitcoin. How does it work? Simple. You send your $BTC to Bitcoin Hyper’s Canonical Bridge, which locks it up and mints an equivalent amount of wrapped Bitcoin ($wBTC) for you to play with. It’s like magic, but with fewer rabbits and more blockchain. 🐇🎩

Step-by-step flow of Bitcoin Hyper’s Layer 2, from deposit to withdrawal

With $wBTC in hand, you can dive headfirst into DeFi apps, trade NFTs, and swap tokens faster than you can say “decentralized finance.” And when you’re ready to cash out, a ZK-rollup ensures your original $BTC is safely returned to your wallet. Neat, huh? 🤑

What’s Next for Bitcoin?

As worldwide institutional adoption grows, Bitcoin’s notorious volatility may finally settle down, making it a safer bet for long-term investors. Metaplanet, for one, isn’t slowing down anytime soon-it aims to grow its Bitcoin stash even further by 2027, putting it in direct competition with heavyweights like Riot, Bullish, and Marathon. 💪

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- BTC Plummets: ETFs & Risk Aversion Send Crypto into Crisis 🚨

2025-08-25 17:23