In the grand theater of finance, where dreams clash and fortunes are made from whispers, our dear XRP investors peer intently towards Washington, their gazes as sharp as a hawk’s. A veritable parade of asset managers-Grayscale, Bitwise, and Canary Capital-have, in an act of both courage and desperation, cast amendments to their spot XRP ETF applications. A sight to behold, indeed! 🧐

These submissions arrive like a puppy chasing its tail, filled with growing optimism that perhaps, just perhaps, the U.S. regulators are loosening their iron grip, ready to let the doors swing wide for an exchange-traded fund directly tied to Ripple‘s beloved token. Isn’t it amusing to watch? 🤪

As the SEC drags its feet over rulings, the cryptocurrency sector finds itself teetering on the brink between despair and exuberance. Will the long wait lead to a breakthrough moment for XRP in the staid world of traditional finance? A mystery worthy of Shakespearean intrigue!

Asset Managers Revise Proposals in Push for SEC Approval

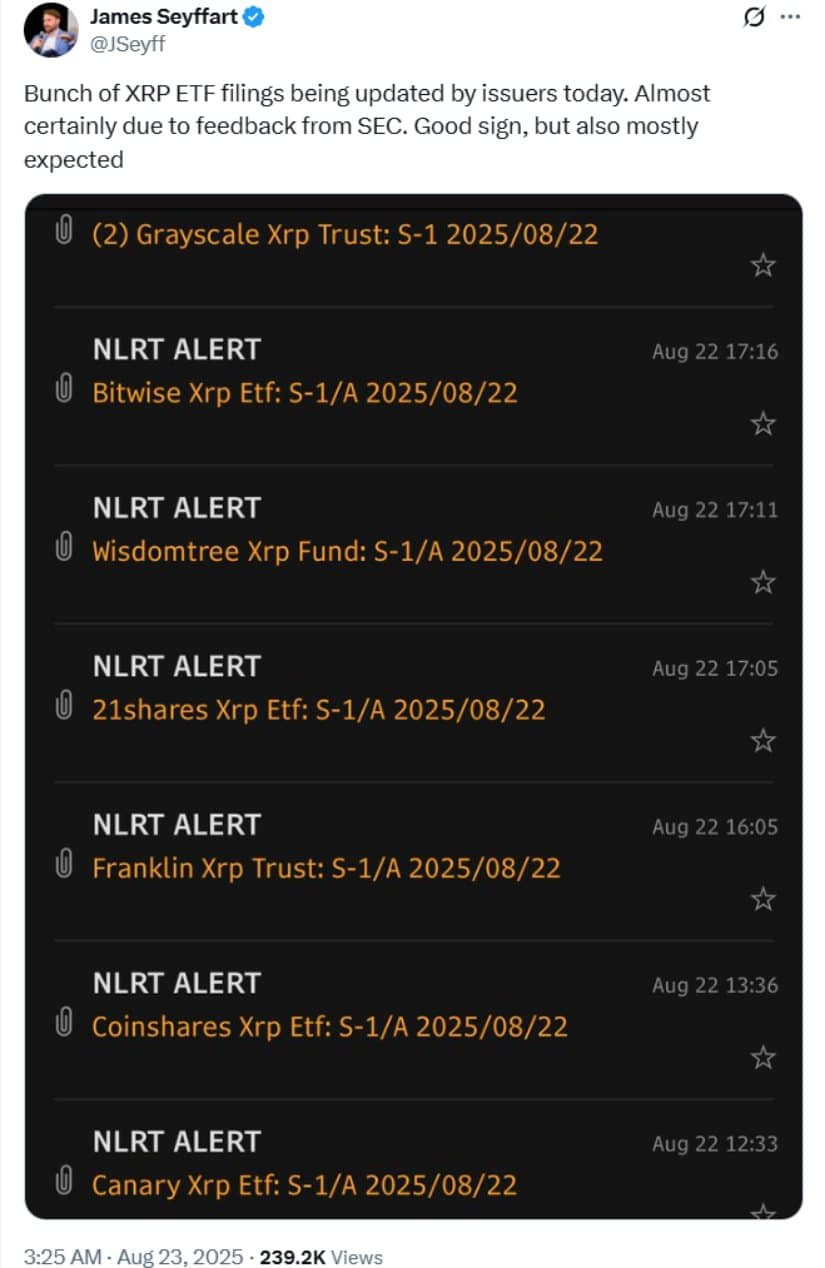

On a fine Friday, as many watched their coffees brew, Grayscale, Bitwise, and other notables stepped up to the plate, submitting amended S-1 registration statements like eager children at a spelling bee. Could it be that the swarm of filings reflects the almighty feedback from the SEC? James Seyffart, an ETF analyst, suggests these updates are “almost certainly” due to regulatory whispers-a move both expected and anticipated, like a plot twist in a Sunday matinée! 🎭

Nate Geraci, the wise President of ETF Store, echoed this sentiment, declaring this cluster of filings a “very good sign.” Is it optimism or just the high we find ourselves on during a good hair day? 🤔

With these amendments came adjustments to fund structures-allowing both cash and in-kind creations and redemptions. Flexibility, my friends, is the name of the game! Imagine a dance party among ETFs, where Bitcoin and Ethereum take the lead while XRP tries to catch up. 🕺

Canary Capital Highlights Path to Mainstream Adoption

And speaking of the dance floor, our brave friends at Canary Capital have also submitted their revised S-1 for the Canary XRP ETF, radiating confidence like a peacock in full plume, despite the shadows of regulatory hurdles. Their fund is set to list on the Cboe BZX Exchange; it’s like showing up to the prom without a date but still being the life of the party! 💃

Much like a magician revealing secrets, this trust intends to track the CoinDesk XRP Index Rate, with XRP held securely by a trust company-akin to safeguarding the crown jewels, if you will. 🏰

SEC Delays Raise Anticipation for October Decisions

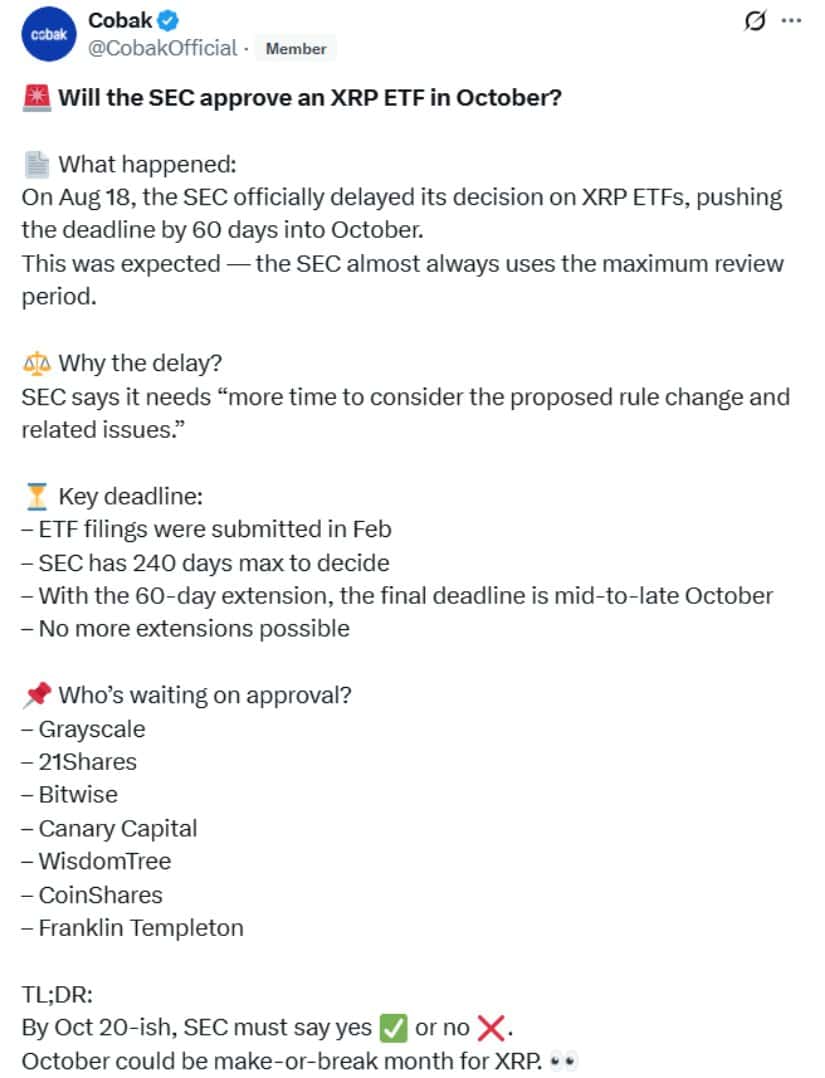

As the drama unfolds, we find that the SEC has chosen to postpone rulings on several XRP ETF applications, pushing deadlines into October. Ah, the suspense! Should regulators stick to their schedule, we might see decisions pouring in like confetti at a New Year’s bash-a ruling for Grayscale around October 18, followed swiftly by the likes of 21Shares, Bitwise, and others. 🎉

Nate Geraci argues that this delay is less a whirlwind of despair and more like a procedural waltz. “The floodgates for spot crypto ETFs appear set to open in the next two months,” he mused, as if predicting the arrival of the long-anticipated pizza delivery! 🍕

As the winds of U.S. financial policy shift, the Digital Asset Market Clarity Act looms large, suggesting that oversight may be split between the SEC and the CFTC. Will this bring forth the necessary regulatory certainty for XRP ETFs? Only time will tell, and I do feel a twinge of hope! 🌈

What an Approved XRP ETF Could Mean for Traders

Now, let us ponder: if an XRP ETF gains approval, what seismic shift might occur? Imagine investors buying XRP exposure through regulated brokerage accounts-like trading baseball cards but with more decimal points! 🧮

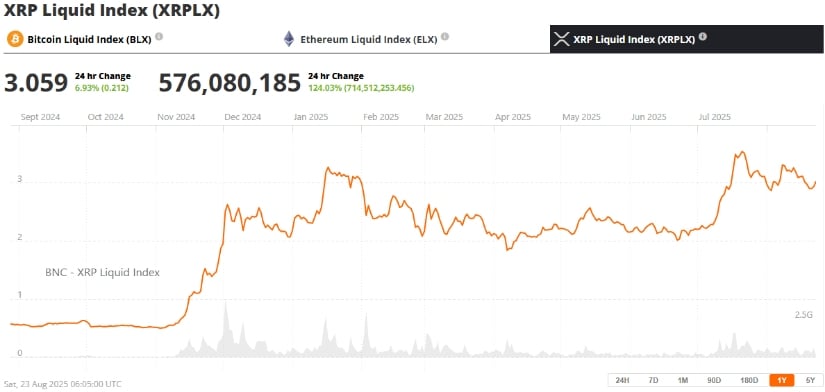

Analysts speculate that this new product could attract institutional inflows that improve liquidity and potentially send XRP skyward. Could we ride this rocket into Shopify stock territory or even beyond? 🚀

However, a word of caution: ETF holders wouldn’t enjoy the same warm comfort as mutual fund investors. Perils like exchange shutdowns or custody hiccups loom large, like ominous clouds on a sunny day-the ever-present reminder that nothing is guaranteed! ☁️

Outlook: Will XRP Go Up With an ETF Approval?

As we approach October, the crypto world buzzes in anticipation of a regulatory moment that could be as pivotal for Ripple as a bold actor’s debut in a Shakespearean play. A nod from the SEC wouldn’t just be a win for Ripple Labs-it’d be a fresh test of how digital assets join the grand tapestry of traditional finance! ⚖️

The ultimate question hangs in the air: will XRP rise if an ETF is approved? Waves of short-term volatility may grace us, but many wager the future holds growth, especially as institutional capital paddles its way into regulated products. 🌊

Whether this approval lands in October or drifts into the distance, the fervor around XRP ETF news embodies a broader push to legitimize and embrace digital assets in the good old U.S. financial system. And that, dear reader, is perhaps the funniest thing of all! 😂

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-08-23 15:41