Ah, Bitcoin! The digital currency that’s more temperamental than a cat on a hot tin roof. Last week, it soared to a dizzying height of $124,500, only to plummet faster than a lead balloon at a helium convention. Now, it’s flailing about, desperately searching for support like a toddler looking for their lost teddy bear. Traders are in a heated debate-are we witnessing the start of a catastrophic correction, or is this just a healthy little nap before the next big adventure? Some analysts are clutching their crystal balls and proclaiming this pullback as a necessary reset in an overheated market, while others are waving red flags and shouting about bearish signals like they’re at a particularly rowdy football match. ⚽️

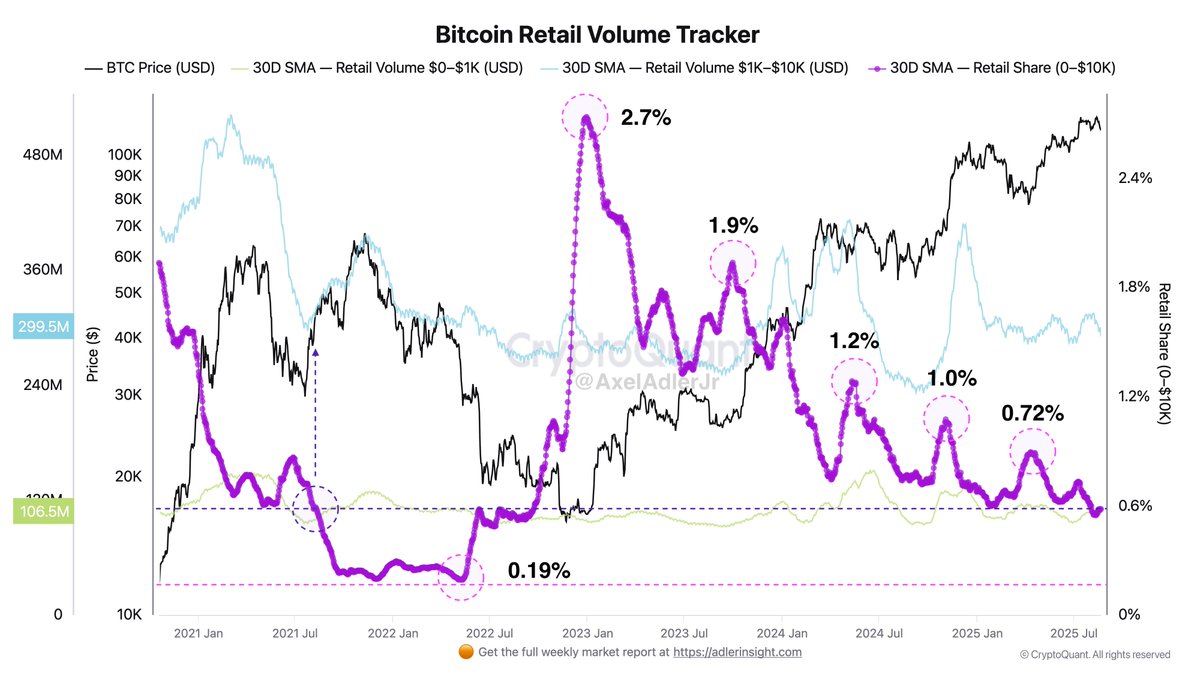

Now, enter stage left, CryptoQuant analyst Axel Adler, who’s been keeping an eye on retail participation. It seems that the share of retail transfers in the $0-$10K range has been on a steady decline, dropping from a peak of 2.7% to a mere 0.6%. It’s like watching a balloon slowly deflate at a birthday party-sad, but you can’t look away.

Historically, such declines in retail participation have been the harbingers of doom, coinciding with the later stages of bull cycles. This raises the question: is retail enthusiasm cooling off just when Bitcoin needs it most? It’s like a party where the guests start leaving just as the cake is being served. 🍰

Bitcoin Retail Activity Declines as Market Cools

According to our friend Axel, while retail activity in Bitcoin’s network has taken a nosedive, it’s still significant in absolute terms. Retail transfers in the $0-$10K range are still raking in over $400 million a day! But alas, this represents only 0.6% of total USD turnover. It’s a classic case of “look at all that money, but it’s not doing much.”

Adler points out that this cooling of retail demand was also observed back in the autumn of 2021, right at the peak of the previous cycle. At that time, retail participation plummeted to a historic low of just 0.19%, coinciding with market conditions that were hotter than a jalapeño in a sauna. The current decline mirrors that pattern, suggesting we might be heading toward a similar late-cycle environment. Buckle up, folks!

This is crucial because retail investors have traditionally been the life of the party during bull markets. With their influence waning, it seems institutional flows and long-term holders are now the ones calling the shots. The coming weeks will be pivotal as altcoins, led by Ethereum, start flexing their muscles. ETH is inching closer to its 2021 all-time high, and many analysts believe its performance could dictate the next move of the entire crypto circus. 🎪

If retail demand continues to fade while institutional accumulation grows, Bitcoin may just hunker down for a bit, while capital does a little cha-cha toward altcoins.

Bulls Defend Key Demand Level

Now, let’s take a gander at the 8-hour chart, where Bitcoin (BTC) is under pressure, trading near $113,400. It’s struggling to hold above its 200-day moving average (the red line), which is currently hanging around $113,416. This level has become a critical support zone after BTC failed to maintain momentum above the $123,217 resistance, which has been a clear rejection point more times than a bad date. 💔

Shorter-term moving averages are waving their bearish flags. The 50-day SMA (blue) at $117,017 and the 100-day SMA (green) at $117,087 are both trending above the current price, creating a resistance wall that would make even the most determined bull reconsider its life choices. The breakdown below these averages confirms a weakening trend, with BTC struggling to regain lost ground. Price action shows a sequence of lower highs and lower lows since the rejection at the $124K zone, reinforcing the bearish short-term sentiment. Yikes!

For the bulls, reclaiming the 100-day SMA near $117K would be key to reversing momentum and reattempting a push toward the $120K-$123K range. But if they fail to hold the 200-day SMA, we might just see a dramatic plunge toward $110K, a major psychological level that could send shivers down the spines of even the most hardened crypto enthusiasts.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Robinhood Wants Europeans to Trade US Stocks on Blockchain—What Could Possibly Go Wrong? 🤔

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

2025-08-21 23:18