So, here we are, folks, with another chapter in the Trump family saga, but this time it’s all about decentralized finance (DeFi). World Liberty Financial, the brainchild of the Trump clan, has just minted over $200 million in USD1 stablecoins. Can you even imagine? It’s like printing money, but in the digital age! 🤯

And just when you thought things couldn’t get more interesting, Fed Governor Christopher Waller decided to give stablecoins a thumbs up. 🙌 It’s like he read the script and knew exactly when to deliver his lines.

World Liberty announced on X (because who uses Twitter anymore?) that they’ve minted a whopping $205 million worth of their stablecoin, USD1, for treasury purposes. I mean, why not? When you can mint your own currency, why bother with the old-fashioned stuff? 💸

🚨 We just minted $205,000,000 of USD1 for the WLFI Treasury🚨

The fastest-growing stablecoin of all time continues to scale. Backed 1:1 by USD and U.S. Treasuries. Transparent. Reliable. Built for the future of global finance.

$USD1 ☝️| $WLFI 🦅

– WLFI (@worldlibertyfi) August 20, 2025

Launched in early April, this Trump-backed stablecoin has rocketed to become the world’s sixth-largest by market cap. It’s like the Trumps found a new way to stay relevant, and it involves a lot of zeros. 🚀

Tether still holds the crown with its USDT stablecoin, boasting a 60% market share and a $167 billion market cap. But hey, who doesn’t love a good underdog story? Maybe USD1 will give them a run for their money. 💪

Earlier this month, the Trump family DeFi project hinted at a new loyalty program for USD1 holders. Because, you know, why not throw in a few freebies while you’re at it? 🎁

WLFI Treasury Holdings Soar to New Heights

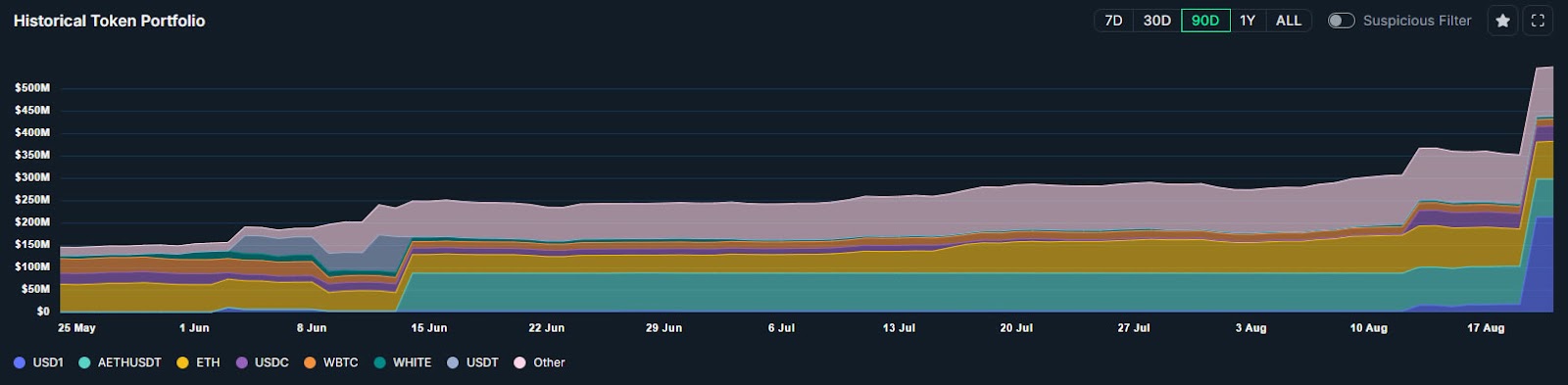

Data from Nansen shows that the latest USD1 mint has propelled World Liberty Financial’s treasury holdings to a record $548 million. That’s more money than most people will see in their lifetimes, all neatly tucked away in digital wallets. 🏦

World Liberty Financial’s treasury holdings reach a record $548M after USD1 stablecoin mint. | Source: Nansen

USD1 is now the firm’s largest crypto holding at $212 million, making up 39% of its total portfolio. Aave Ethereum USDT (AETHUSDT) follows with $85 million, alongside an equivalent value in Ether. The project holds 19,650 ETH, each worth about $4,283. It’s like a treasure trove of digital gold! 🏆

Reports suggest that World Liberty Financial is considering creating a publicly traded company to hold its WLFI tokens. They’re planning a $1.5 billion fundraising round, which, if successful, could propel the WLFI token into the top ten digital assets. Talk about ambition! 🌟

Regulators Get Bullish on Stablecoins

The USD1 mint happened just hours after Federal Reserve Governor Waller delivered a pro-crypto speech at a blockchain conference in Wyoming. He said:

“I believe that stablecoins have the potential to maintain and extend the role of the dollar internationally. Stablecoins also have the potential to improve retail and cross-border payments.”

Waller added that the GENIUS Act, signed into law last month, is a significant step for the payment stablecoin market. It seems the regulators are finally catching up with the crypto wave. 🌊

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Brent Oil Forecast

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

2025-08-21 16:58