In the grand theater of finance, where numbers pirouette like drunken fireflies, Ethereum-oh, that smug virtuoso-commanded a $3.75 billion waltz last week, a sum so vast it could drown a small island nation in liquidity. Solana and XRP, those eager understudies, joined the cacophony with inflows so robust they might have made a Victorian poet weep into his tea. CoinShares, that diligent scribe of digital gold, chronicled this financial farce with the solemnity of a funeral director.

Ethereum’s Record-Breaking Numbers

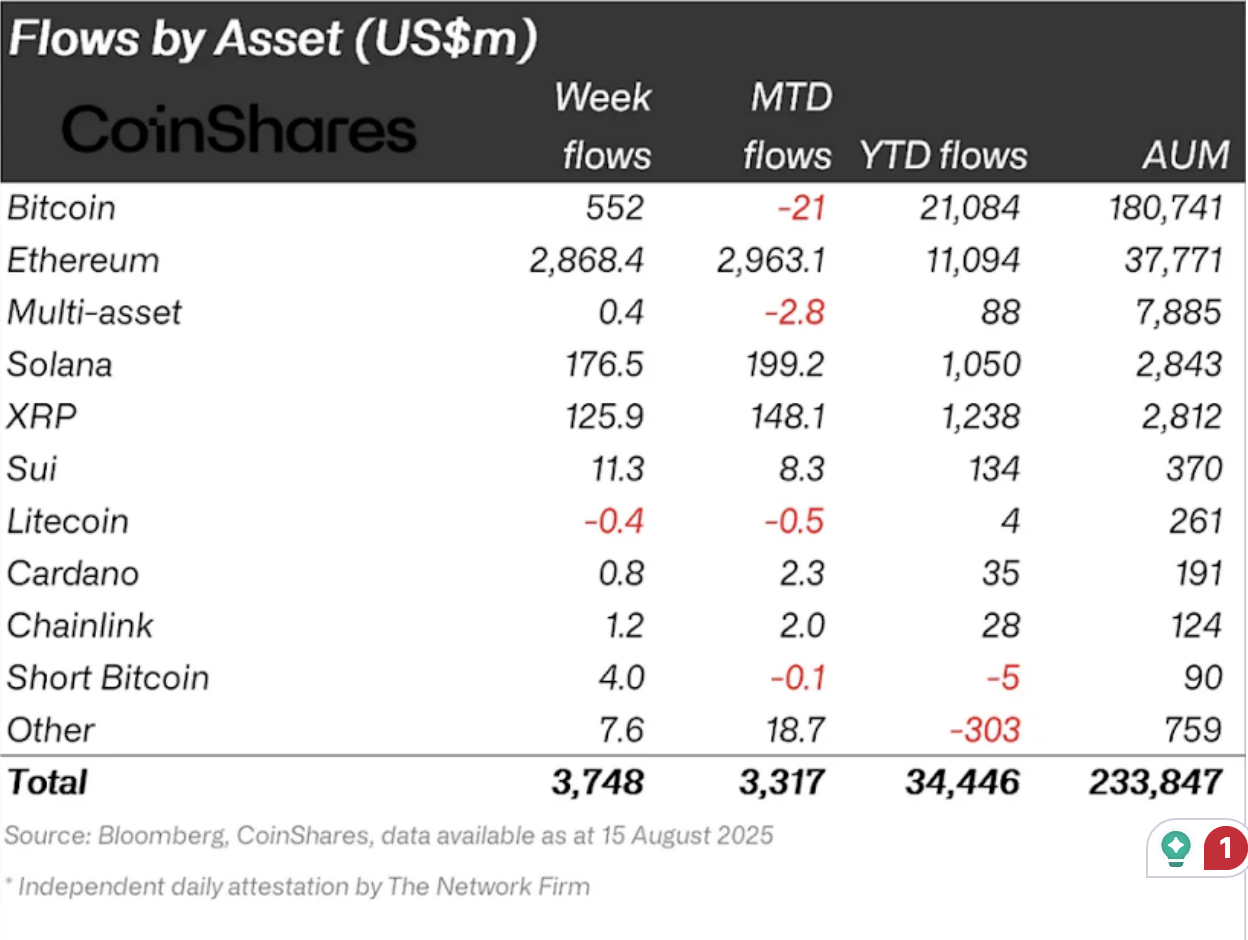

Ethereum, that ever-glamorous hostess at the blockchain ball, once again stole the spotlight, her $2.87 billion inflows eclipsing Bitcoin’s feeble attempts to maintain dignity. The figure, a gaudy 77% of the week’s total, left the market reeling like a lovesick teenager clutching a wilted rose. Her year-to-date tally now stands at $11.094 billion, a sum that would make a pharaoh blush-though perhaps not as much as Ethereum’s price surge to $4,776, a peak so lofty it could only be reached by levitating on a cloud of institutional greed.

The United States, that gluttonous gourmand of crypto, devoured $3.725 billion in inflows, a feast funded by iShares ETFs and served with the subtlety of a cannonball into a kiddie pool. Canada, Hong Kong, and Australia offered polite but minuscule contributions, while Brazil and Sweden, in a fit of pique, cashed out like disgruntled dinner guests. Bitcoin, meanwhile, limped to an all-time high of $124,128, a triumph tarnished by its meager $552 million inflows. One wonders if it forgot to wear its crown.

XRP And Solana Join The Party

Solana, that sprightly upstart, swanned in with $176.5 million in inflows, a performance so dazzling it could rival a disco ball at a vampire rave. XRP, ever the enigmatic flapper, added $125.9 million to the chaos, its inflows a sly wink at the absence of US spot ETFs. Together, they proved that even in crypto’s twilight zone, altcoins could charm investors with the same reckless abandon as a toddler with a credit card.

Sui, Cardano, Chainlink, and Short Bitcoin products-those minor players in this operatic debacle-collected paltry sums, while Litecoin, the party pooper, suffered $400,000 in outflows. A tragedy, one might say, though perhaps not as tragic as a man who buys a house with crypto in 2025.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

2025-08-19 18:06